3 Graphs That Prove We’re Not Headed for a Foreclosure Crisis

We all know the saying about assumptions.

And if you don’t, well…just Google it.

With the massive surge of unemployment that happened this year, it’s natural to assume that a massive surge of foreclosures will follow.

However, history is not expected to repeat itself this time.

Here are 3 simple graphs that prove why we’re not headed for another foreclosure crisis.

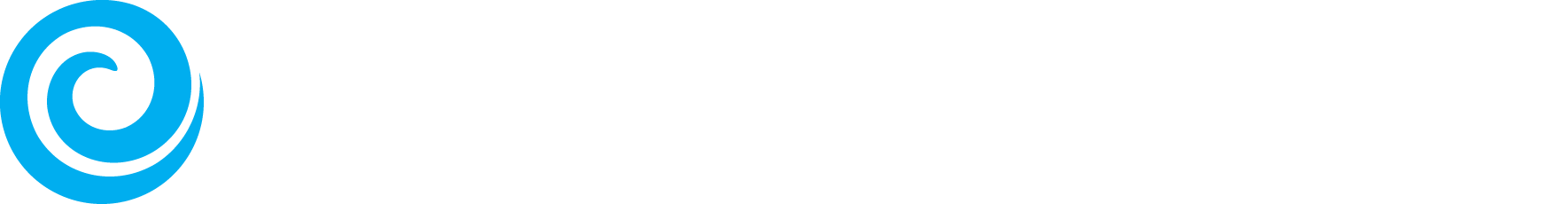

The unique conditions that led to the 2008 market collapse and foreclosure crisis were in big part due to cashed-out equity. With many borrowers owing more than they could afford on their homes, mass foreclosures followed.

Today’s market, however, looks a lot different. Instead, homeowners have an abundance of equity, and lending standards are much stricter. This means that instead of foreclosing and walking away, many homeowners are in a good position to protect their investment.

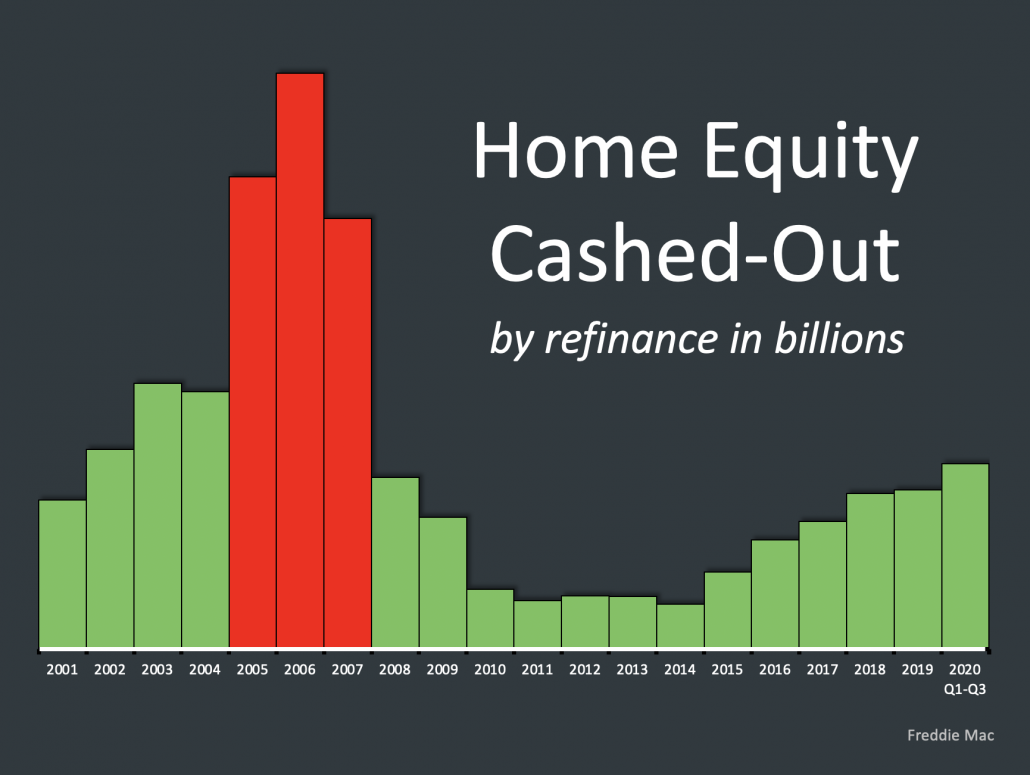

Looking at this graph, we can see that of those who requested forbearance, nearly 44% have either paid off their mortgage or opted out. It also shows that of all the homeowners in forbearance, only 80,000 are at risk of moving into foreclosures.

To drive this point home, Mike Fratantoni, Senior Vice President and Chief Economist at the Mortgage Bankers Association (MBA), said:

“Nearly two-thirds of borrowers who exited forbearance remained current on their payments, repaid their forborne payments, or moved into a payment deferral plan. All of these borrowers have been able to resume – or continue – their pre-pandemic monthly payments.”

After the 2008 financial collapse, we saw the worst foreclosure crises in history. The market was flooded with homes that had defaulted on their mortgage payments, spiking all the way up to over 500,000 at the peak in 2009.

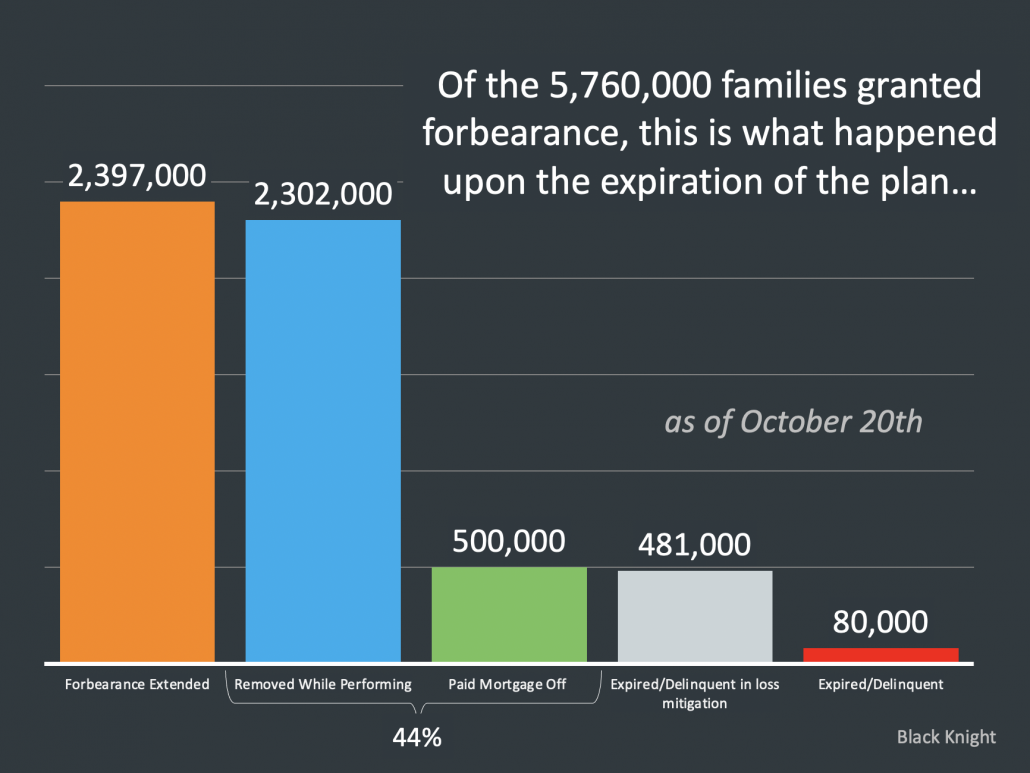

Today, we are looking at a much different story. According to Black Knight, 91% of homeowners in forbearance have 11% equity in their homes. While that may not seem like a big number, that much equity means rather than foreclose, those homeowners can not only sell their homes but walk away with gains from it.

According to Odeta Kushi, economist for First American:

“Economic distress and a lack of equity are the two triggers of a foreclosure. Each trigger by itself is necessary, but not sufficient for foreclosure. The percentage of economically distressed homeowner households is highest in COVID-19 hotspots… However, the equity built up since the Great Recession can provide an important buffer for distressed homeowners.”

The big question is: what happens when forbearance inevitably expires? Many lenders are offering to help homeowners create a plan for the deferred payments. There are multiple options that homeowners can pursue at this point, and with the right planning and communication with their lender, they may be able to avoid foreclosure, especially if they have equity in their homes.

Bottom Line

The reality of the situation is this: through all of the hardship Americans have faced this year, people are going to fall into foreclosure.

However, the last thing anyone wants right now is another foreclosure crisis like 2008, and there are many factors that suggest it’s not going to be like last time.

By educating your clients with data and insights from market experts, you can help them make smart and calculated real estate decisions instead of those based on scary headlines or hearsay.

Anyone can drive a car really fast in a straight line. It’s those that can navigate the twists and turns that cross the finish line first.

That’s why we’ve put together the How to Succeed in a Changing Market eGuide. This free resource tells you everything you need to know about navigating a changing market so you can be the real estate agent your clients trust-especially when times are tough.