stdClass Object

(

[agents_bottom_line] =>

If you’re planning to buy a home this year, there are incredible benefits waiting for you at the end of your journey, including the ability to customize your home, the sense of achievement homeownership brings, and a greater connection to your community. Let’s connect to discuss everything homeownership has to offer.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => For Buyers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los compradores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

[1] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 11

[name] => First-Time Buyers

[parent] =>

[parent_id] =>

[published_at] => 2024-04-10T15:59:33Z

[slug] => first-time-buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Compradores de vivienda por primera vez

)

)

[updated_at] => 2024-04-10T15:59:33Z

)

[2] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 38

[name] => Move-Up

[parent] =>

[parent_id] =>

[published_at] => 2024-04-10T16:00:35Z

[slug] => move-up

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Compradores de casa mas grande

)

)

[updated_at] => 2024-04-10T16:00:35Z

)

[3] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 53

[name] => Rent vs. Buy

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => rent-vs-buy

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Alquilar Vs. Comprar

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

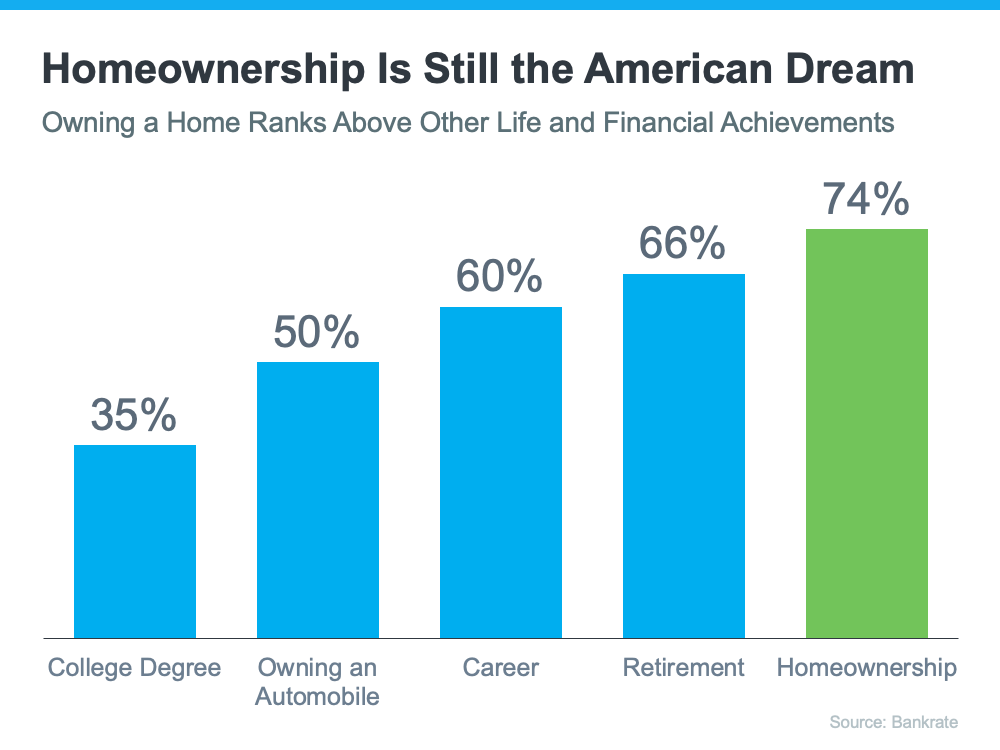

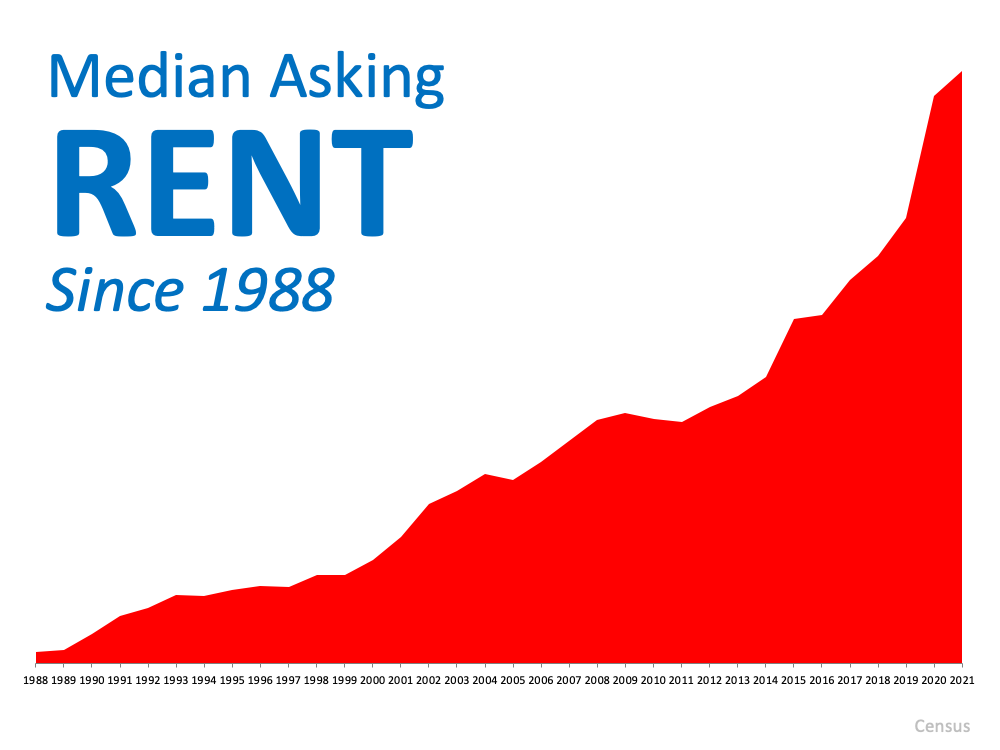

[contents] => With higher mortgage rates, you might be wondering if now's the best time to buy a home. While the financial aspects are important to consider, there are also powerful non-financial reasons it may make sense to make a move. Here are just a few of the benefits that come with homeownership.

Homeowners Can Make Their Home Truly Their Own

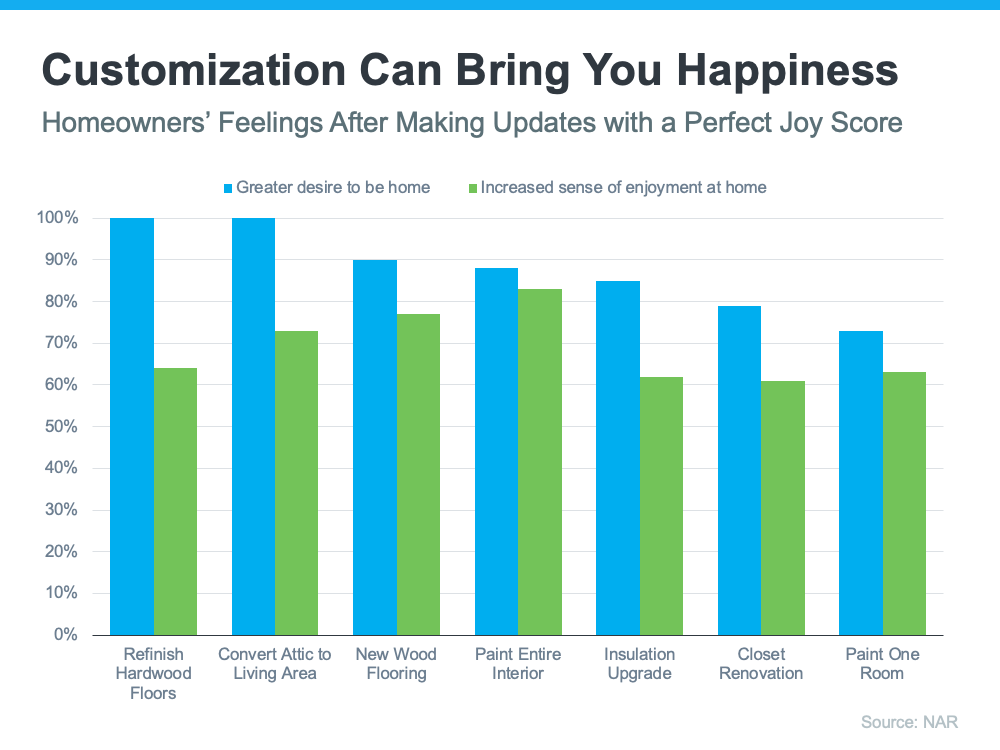

Owning your home gives you a significant sense of accomplishment because it’s a space you can customize to your heart’s desire. That can bring you added happiness.

In fact, a report from the National Association of Realtors (NAR) shows making updates or remodeling your home can help you feel more at ease and comfortable in your living space. NAR measures this with a Joy Score that indicates how much happiness specific home upgrades bring. According to NAR:

“There were numerous interior projects that received a perfect Joy Score of 10: paint entire interior of home, paint one room of home, add a new home office, hardwood flooring refinish, new wood flooring, closet renovation, insulation upgrade, and attic conversion to living area.”

And as a homeowner, unless there are specific homeowner’s association requirements, you typically won’t have to worry about the changes you can and can’t make.

If you rent, you may not have the same freedom. And if you do make changes as a renter, there’s a good chance you’ll need to revert them back at the end of your lease based on your rental agreement. That can add additional costs when you move out.

The Responsibilities of Homeownership Give You a Greater Sense of Achievement

There’s no denying taking care of your home is a large responsibility, but it’s one you’ll take pride in as a homeowner. Freddie Mac explains:

“As the homeowner, you have the freedom to adopt a pet, paint the walls any color you choose, renovate your kitchen, and more. . . . Of course, along with the freedoms of homeownership come responsibilities, such as making your monthly mortgage payments on time and maintaining your home. But as the property owner, you'll be caring for your own investment.”

You’re not taking care of a living space that belongs to someone else. The space is yours. As an added benefit, you may get a return on investment for any upgrades or repairs you make.

Homeownership Can Lead to Greater Community Engagement

That sense of ownership and your feelings of responsibility can even extend beyond the walls of your home. Your home also gives you a stake in your community. Because the average homeowner stays in their home for longer than just a few years, that can lead to having a stronger connection to your local area. NAR notes how that can benefit you:

“Living in one place for a longer amount of time creates an obvious sense of community pride, which may lead to more investment in said community.”

If you’re looking to put down roots, homeownership can help fuel a sense of connection to the area and those around you.

Bottom Line

If you’re planning to buy a home this year, there are incredible benefits waiting for you at the end of your journey, including the ability to customize your home, the sense of achievement homeownership brings, and a greater connection to your community. Let’s connect to discuss everything homeownership has to offer.

[created_at] => 2022-10-14T14:46:20Z

[description] => With higher mortgage rates, you might be wondering if now's the best time to buy a home. While the financial aspects are important to consider, there are also powerful non-financial reasons it may make sense to make a move. Here are just a few of the benefits that come with homeownership.

[expired_at] =>

[featured_image] => https://files.simplifyingthemarket.com/wp-content/uploads/2022/10/14103720/20221017-KCM-Share.jpg

[id] => 4341

[kcm_ig_caption] => With higher mortgage rates, you might be wondering if now's the best time to buy a home. While the financial aspects are important to consider, there are also powerful non-financial reasons it may make sense to make a move. Here are just a few of the benefits that come with homeownership.

>>Homeowners Can Make Their Home Truly Their Own

Owning your home gives you a significant sense of accomplishment because it’s a space you can customize to your heart’s desire. That can bring you added happiness.

And as a homeowner, unless there are specific homeowner’s association requirements, you typically won’t have to worry about the changes you can and can’t make. If you rent, you may not have the same freedom.

>>The Responsibilities of Homeownership Give You a Greater Sense of Achievement

There’s no denying taking care of your home is a large responsibility, but it’s one you’ll take pride in as a homeowner.

You’re not taking care of a living space that belongs to someone else. The space is yours. As an added benefit, you may get a return on investment for any upgrades or repairs you make.

>>Homeownership Can Lead to Greater Community Engagement

That sense of ownership and your feelings of responsibility can even extend beyond the walls of your home. Your home also gives you a stake in your community. Because the average homeowner stays in their home for longer than just a few years, that can lead to having a stronger connection to your local area.

If you’re looking to put down roots, homeownership can help fuel a sense of connection to the area and those around you. DM me to discuss everything homeownership has to offer.

[kcm_ig_hashtags] => realestate,homeownership,homebuying,realestategoals,realestatetips,realestatelife,realestatenews,realestateagent,realestateexpert,realestateagency,realestateadvice,realestateblog,realestatemarket,realestateexperts,realestateagents,instarealestate,instarealtor,realestatetipsoftheday,realestatetipsandadvice,keepingcurrentmatters

[kcm_ig_quote] => The emotional and non-financial benefits of homeownership are powerful.

[public_bottom_line] =>

If you’re planning to buy a home this year, there are incredible benefits waiting for you at the end of your journey, including the ability to customize your home, the sense of achievement homeownership brings, and a greater connection to your community. Connect with a local real estate professional to discuss everything homeownership has to offer.

[published_at] => 2022-10-17T10:00:02Z

[related] => Array

(

)

[slug] => the-emotional-and-non-financial-benefits-of-homeownership

[status] => published

[tags] => Array

(

)

[title] => The Emotional and Non-financial Benefits of Homeownership

[updated_at] => 2023-02-03T15:33:45Z

[url] => /2022/10/17/the-emotional-and-non-financial-benefits-of-homeownership/

)

The Emotional and Non-financial Benefits of Homeownership

With higher mortgage rates, you might be wondering if now's the best time to buy a home. While the financial aspects are important to consider, there are also powerful non-financial reasons it may make sense to make a move. Here are just a few of the benefits that come with homeownership.