stdClass Object

(

[agents_bottom_line] => In today's competitive market, let’s work together to find you a home you love and craft a strong offer that stands out.

[assets] => Array

(

)

[banner_image] => https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20240328/STM-Banner-GettyImages-876245614.jpg

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => For Buyers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los compradores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

[1] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 11

[name] => First-Time Buyers

[parent] =>

[parent_id] =>

[published_at] => 2024-04-10T15:59:33Z

[slug] => first-time-buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Compradores de vivienda por primera vez

)

)

[updated_at] => 2024-04-10T15:59:33Z

)

[2] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2024-04-10T16:19:38Z

[id] => 323

[name] => Buying Tips

[parent] =>

[parent_id] =>

[published_at] => 2024-04-10T16:19:44Z

[slug] => buying-tips

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Consejos de compra

)

)

[updated_at] => 2024-04-10T16:19:44Z

)

)

[content_type] => blog

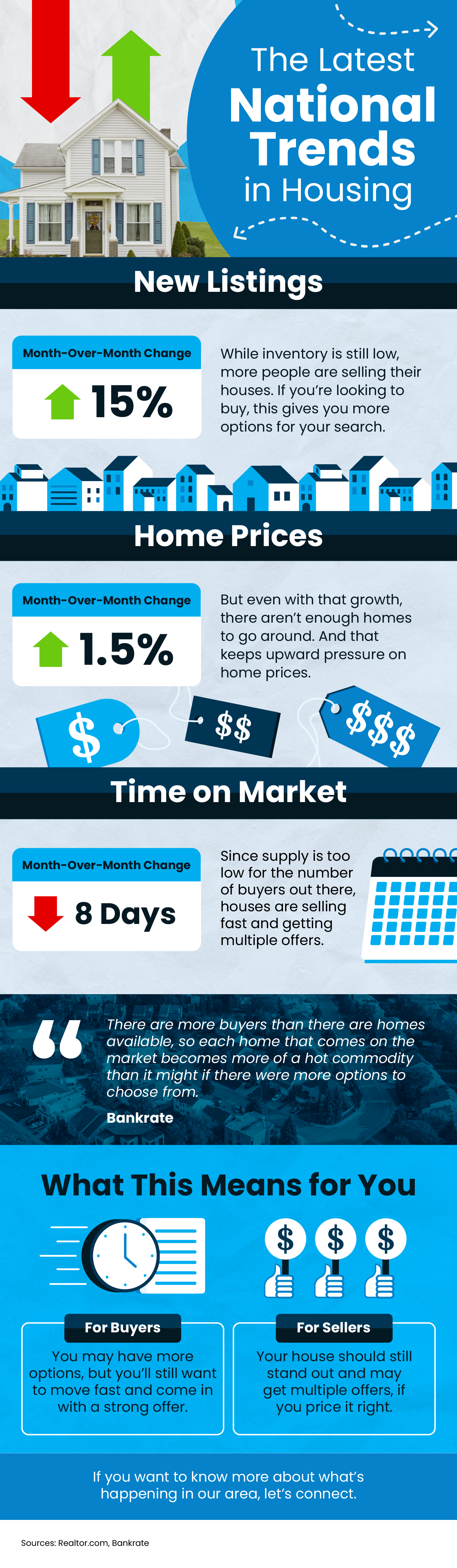

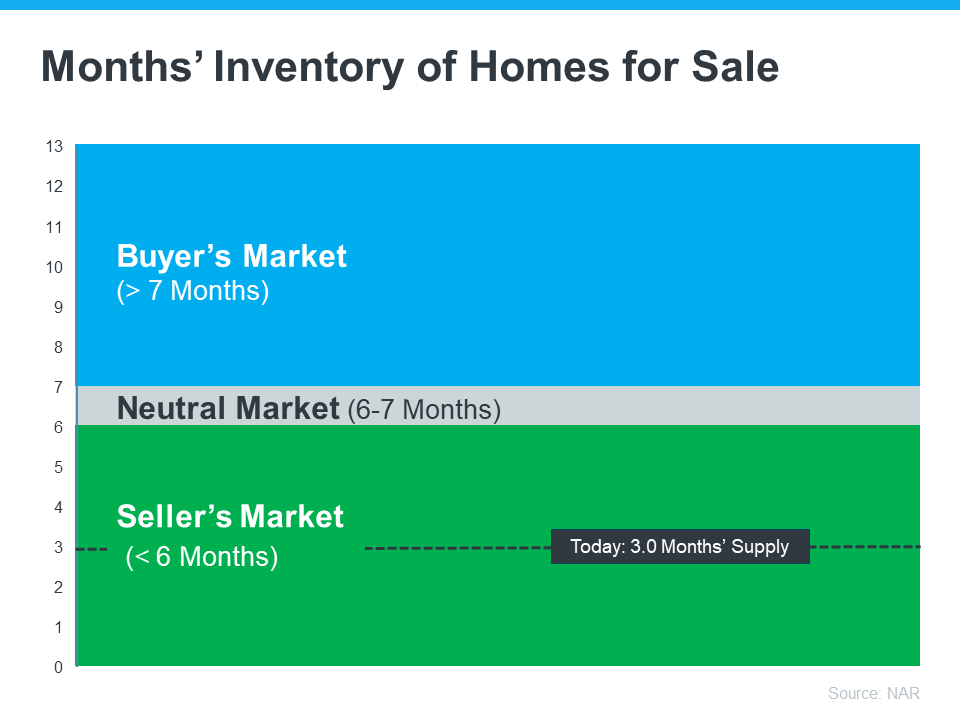

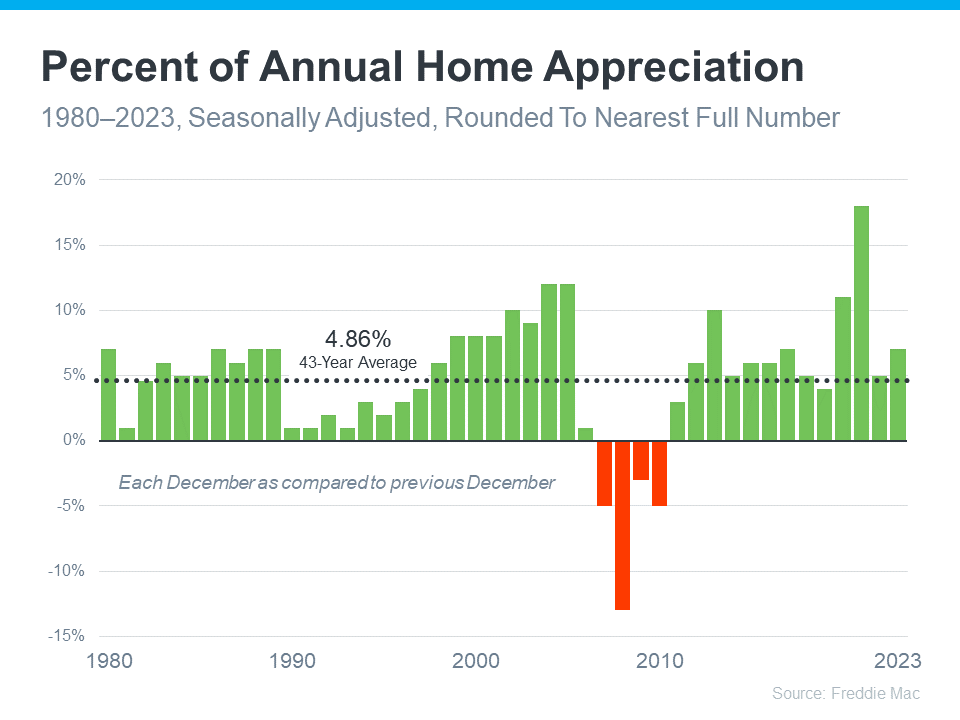

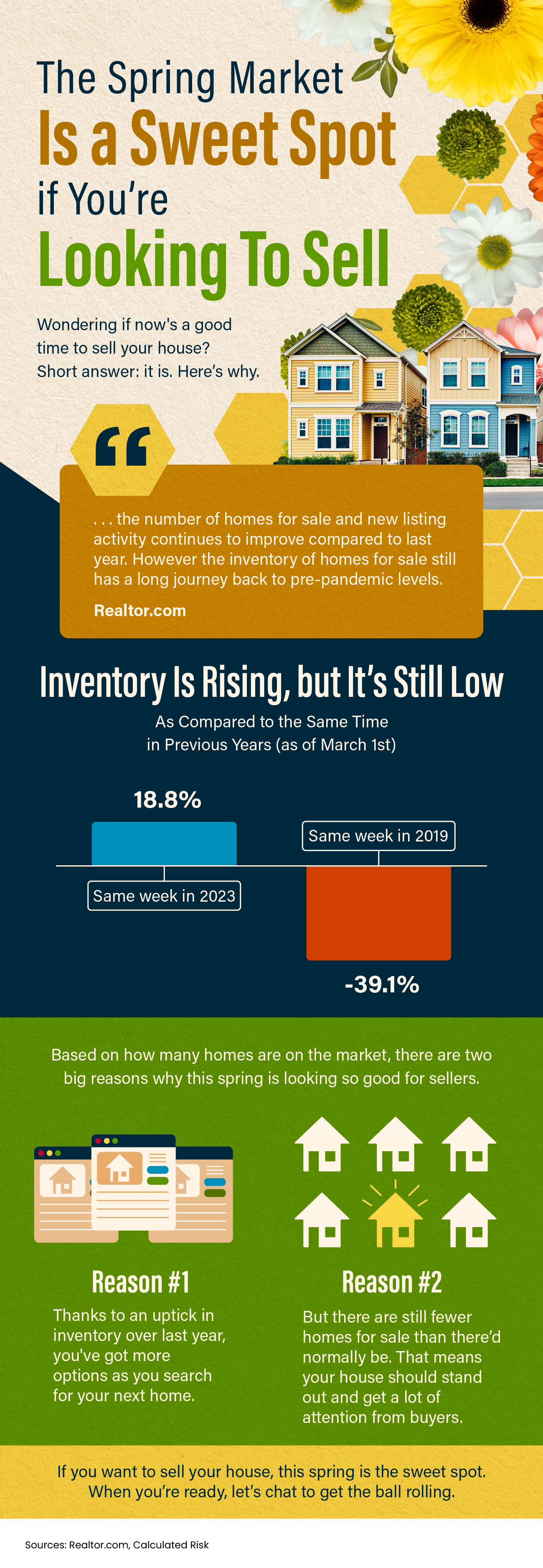

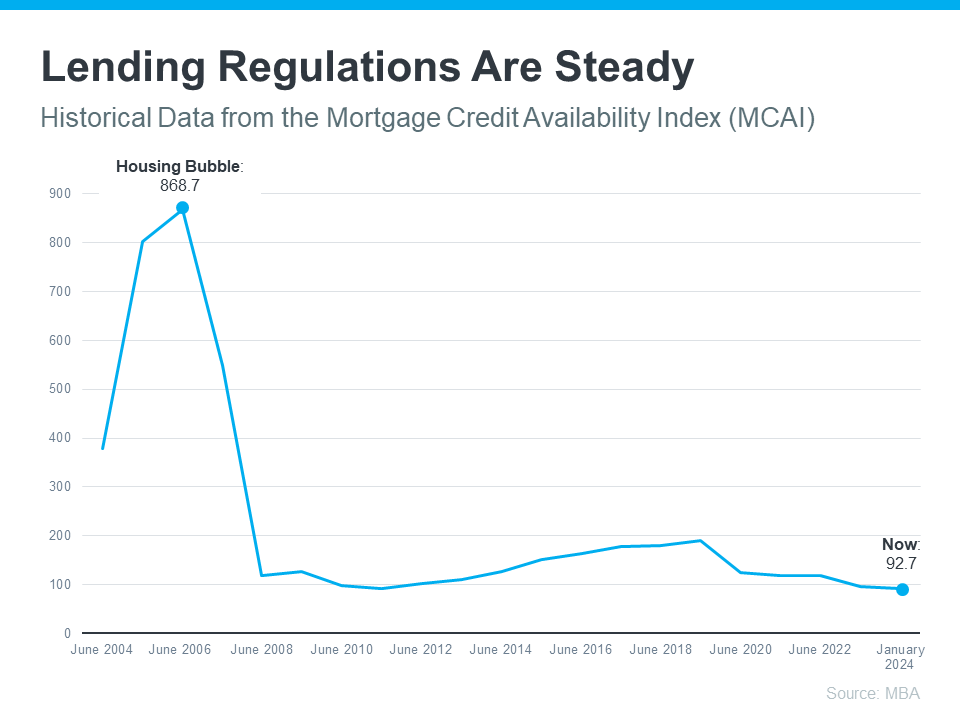

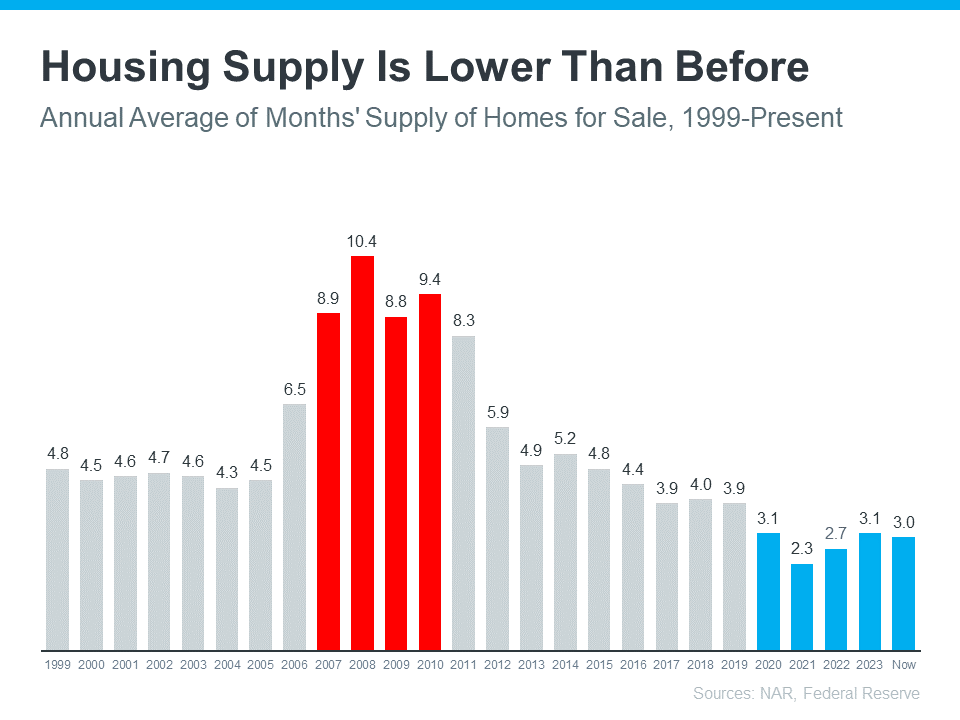

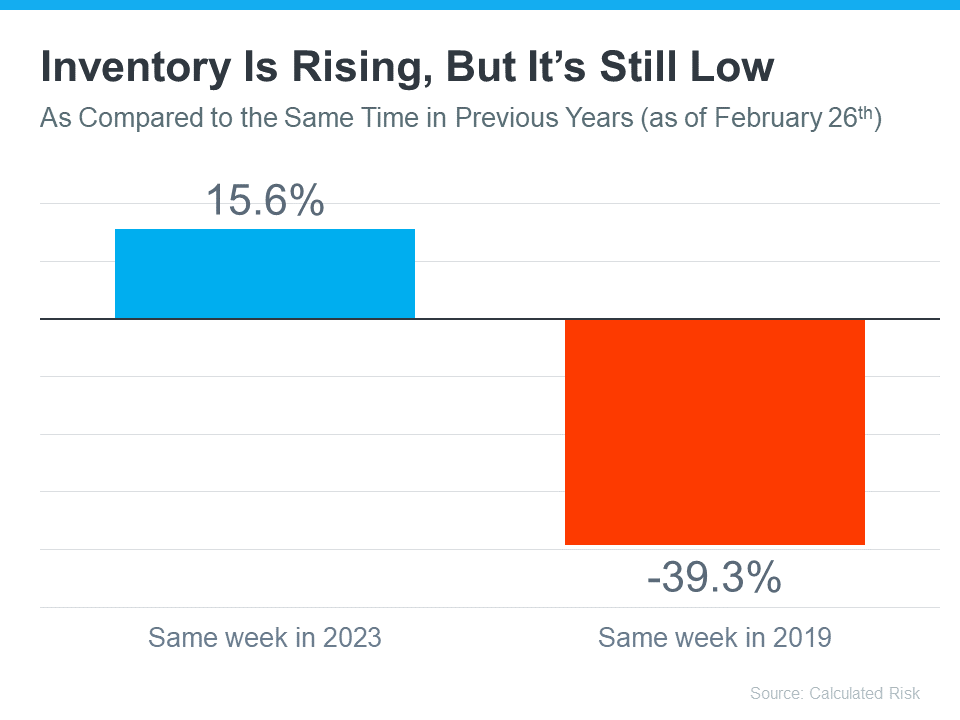

[contents] => Are you thinking about buying a home soon? If so, you should know today’s market is competitive in many areas because the number of homes for sale is still low – and that’s leading to multiple-offer scenarios. And moving into the peak homebuying season this spring, this is only expected to ramp up more.

Remember these four tips to make your best offer.

1. Partner with a Real Estate Agent

Rely on a real estate agent who can support your goals. As PODS notes:

“Making an offer on a home without an agent is certainly possible, but having a pro by your side gives you a massive advantage in figuring out what to offer on a house.”

Agents are local market experts. They know what’s worked for other buyers in your area and what sellers may be looking for. That advice can be game changing when you’re deciding what offer to bring to the table.

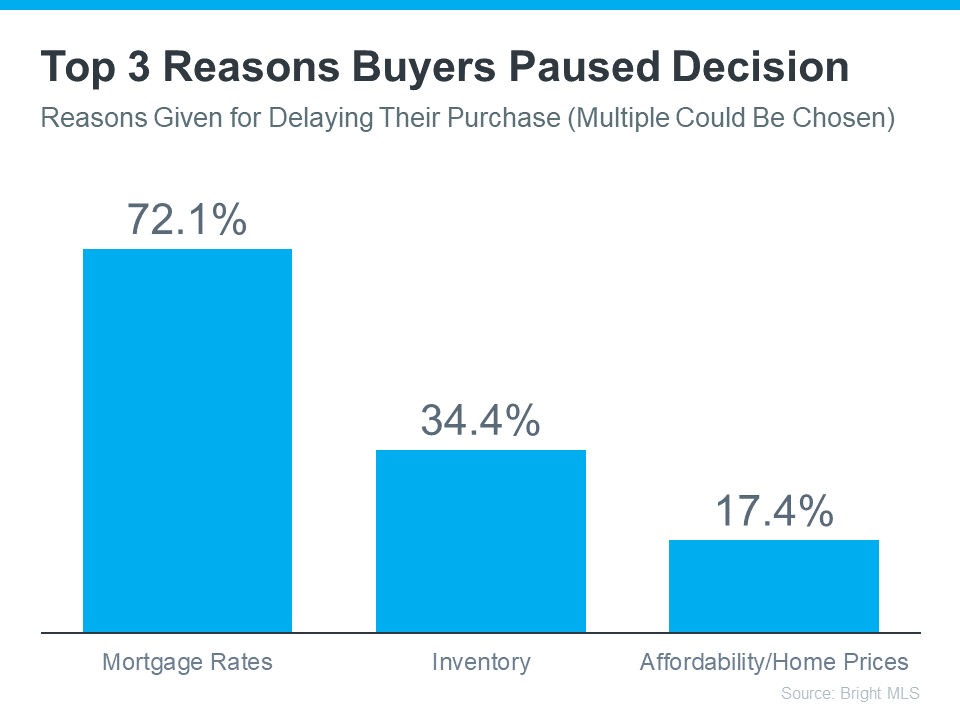

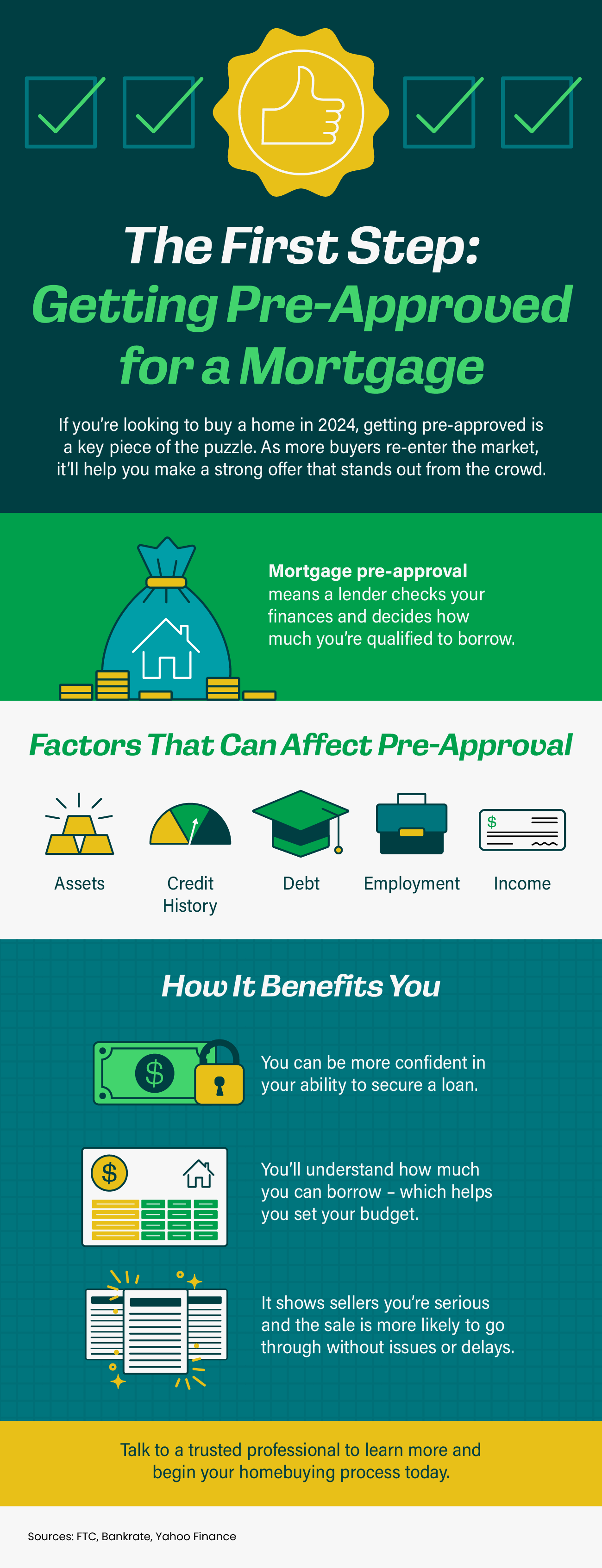

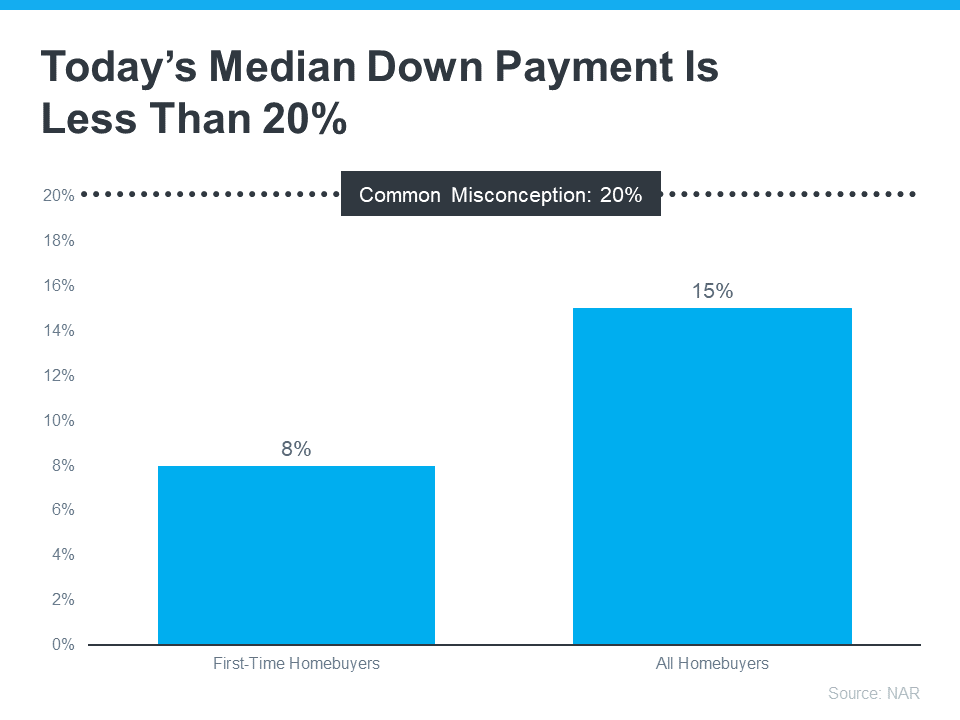

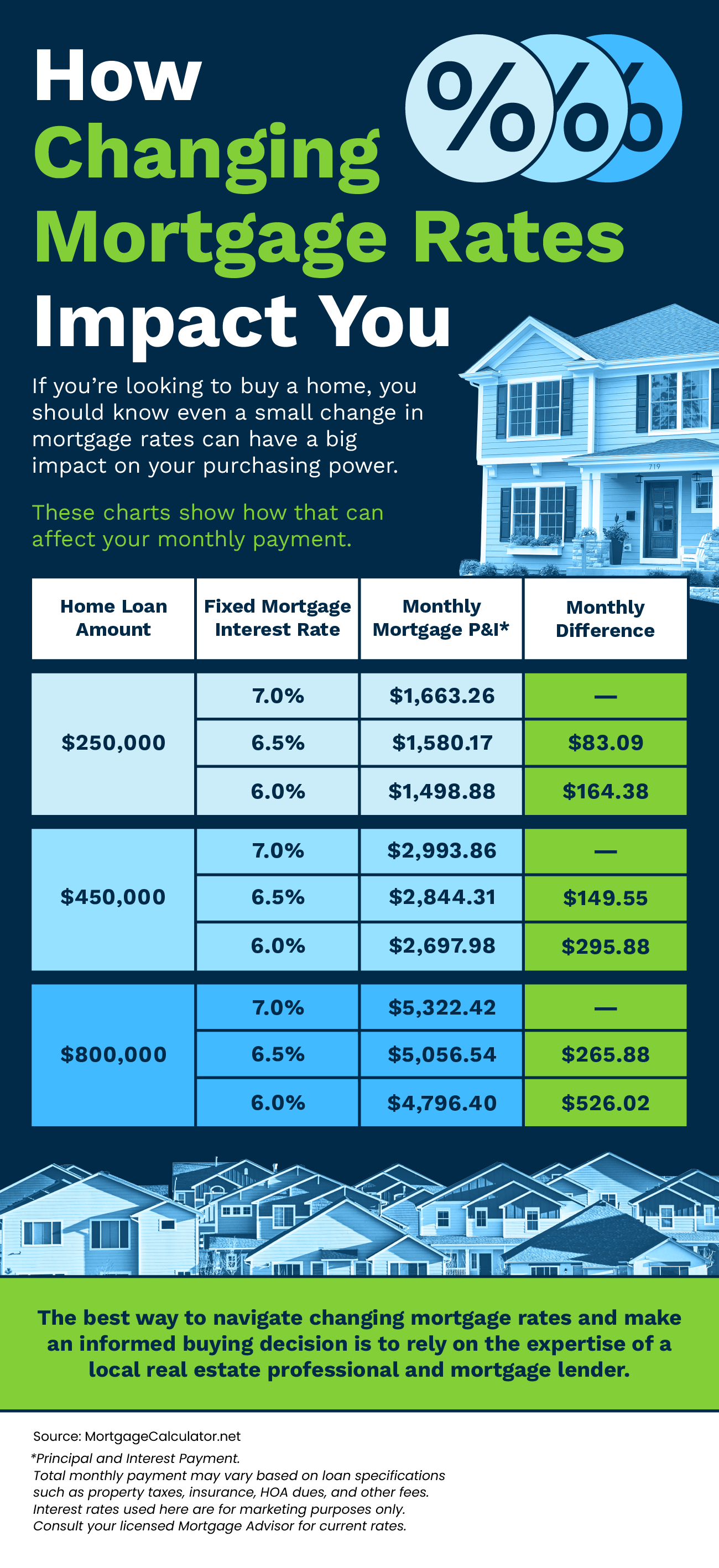

2. Understand Your Budget

Knowing your numbers is even more important right now. The best way to understand your budget is to work with a lender so you can get pre-approved for a home loan. Doing so helps you be more financially confident and shows sellers you’re serious. That gives you a competitive edge. As Investopedia says:

“. . . sellers have an advantage because of intense buyer demand and a limited number of homes for sale; they may be less likely to consider offers without pre-approval letters.”

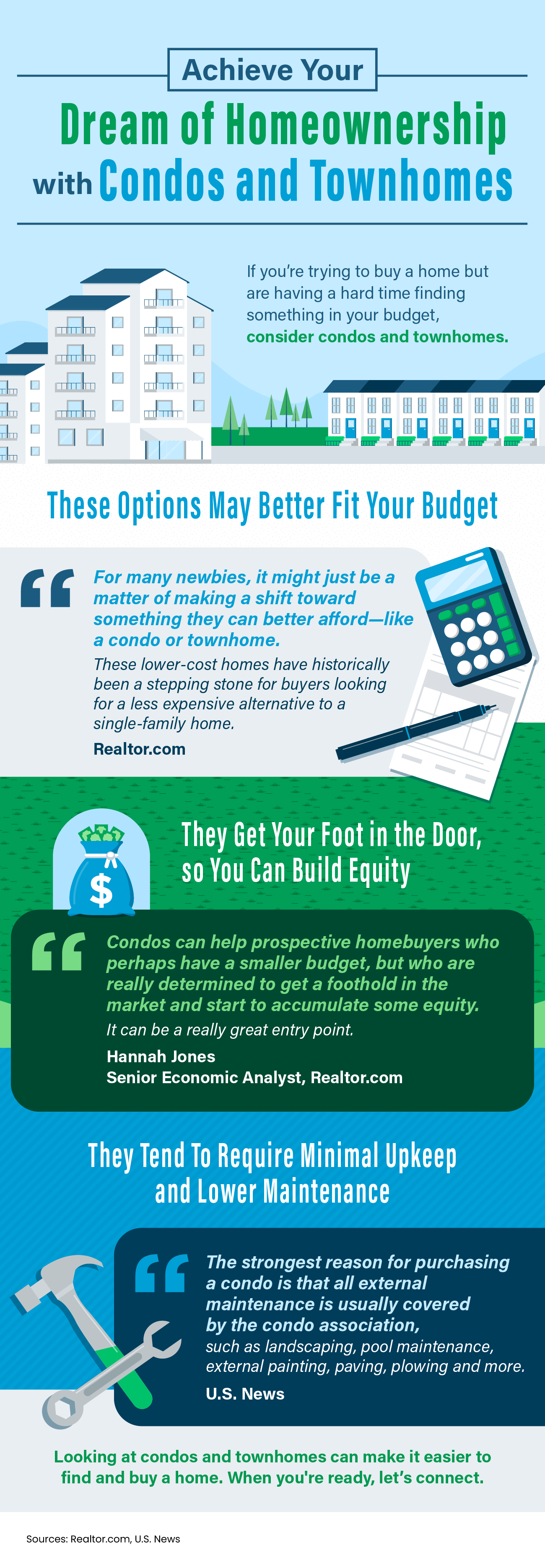

3. Make a Strong, but Fair Offer

It’s only natural to want the best deal you can get on a home, especially when affordability is tight. However, submitting an offer that’s too low does have some risks. You don’t want to make an offer that’ll be tossed out as soon as it’s received just to see if it sticks. As Realtor.com explains:

“. . . an offer price that’s significantly lower than the listing price, is often rejected by sellers who feel insulted . . . Most listing agents try to get their sellers to at least enter negotiations with buyers, to counteroffer with a number a little closer to the list price. However, if a seller is offended by a buyer or isn’t taking the buyer seriously, there’s not much you, or the real estate agent, can do.”

The expertise your agent brings to this part of the process will help you stay competitive and find a price that’s fair to you and the seller.

4. Trust Your Agent During Negotiations

After you submit your offer, the seller may decide to counter it. When negotiating, it's smart to understand what matters to the seller. Once you do, being as flexible as you can on things like moving dates or the condition of the house can make your offer more attractive.

Your real estate agent is your partner in navigating these details. Trust them to lead you through negotiations and help you figure out the best plan. As an article from the National Association of Realtors (NAR) explains:

“There are many factors up for discussion in any real estate transaction—from price to repairs to possession date. A real estate professional who’s representing you will look at the transaction from your perspective, helping you negotiate a purchase agreement that meets your needs . . .”

[created_at] => 2024-03-14T20:37:47Z

[description] => Are you thinking about buying a home soon?

[expired_at] =>

[featured_image] => https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20240314/20240318-Four-tips-to-make-your-strongest-offer-on-a-home.png

[id] => 46566

[kcm_ig_caption] => Are you thinking about buying a home soon? Remember these four tips to make your best offer.

1. Partner with a Real Estate Agent

Rely on a real estate agent who can support your goals. Agents are local market experts. They know what’s worked for other buyers in your area and what sellers may be looking for. That advice can be game changing when you’re deciding what offer to bring to the table.

2. Understand Your Budget

Knowing your numbers is even more important right now. The best way to understand your budget is to work with a lender so you can get pre-approved for a home loan. Doing so helps you be more financially confident and shows sellers you’re serious. That gives you a competitive edge.

3. Make a Strong, but Fair Offer

It’s only natural to want the best deal you can get on a home, especially when affordability is tight. However, submitting an offer that’s too low does have some risks. You don’t want to make an offer that’ll be tossed out as soon as it’s received just to see if it sticks.

4. Trust Your Agent During Negotiations

After you submit your offer, the seller may decide to counter it. When negotiating, it's smart to understand what matters to the seller. Once you do, being as flexible as you can on things like moving dates or the condition of the house can make your offer more attractive.

Your real estate agent is your partner in navigating these details. Trust them to lead you through negotiations and help you figure out the best plan.

In today's competitive market, let’s work together to find you a home you love and craft a strong offer that stands out.

[kcm_ig_hashtags] => firsttimehomebuyer,opportunity,housingmarket,househunting,makememove,homegoals,houseshopping,housegoals,investmentproperty,emptynest,downsizing,locationlocationlocation,newlisting,homeforsale,renovated,starterhome,dreamhome,curbappeal,keepingcurrentmatters

[kcm_ig_quote] => Four tips to make your strongest offer on a home.

[public_bottom_line] => In today's competitive market, be sure to work with a local real estate agent to find you a home you love and craft a strong offer that stands out.

[published_at] => 2024-03-18T10:30:00Z

[related] => Array

(

)

[slug] => 4-tips-to-make-your-strongest-offer-on-a-home

[status] => published

[tags] => Array

(

[0] => content-hub

)

[title] => 4 Tips To Make Your Strongest Offer on a Home

[updated_at] => 2024-04-29T14:48:03Z

[url] => /2024/03/18/4-tips-to-make-your-strongest-offer-on-a-home/

)

4 Tips To Make Your Strongest Offer on a Home

Are you thinking about buying a home soon?