stdClass Object

(

[agents_bottom_line] =>

We’re in a strong sellers’ market, and that means you have the leverage to sell your house on your terms. Let’s connect today to determine if renovating is really the best way to spend your time and money before you sell.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 6

[name] => For Sellers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => sellers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los vendedores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

[1] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 9

[name] => Home Prices

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => home-prices

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Precios

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => When thinking about selling, homeowners often feel they need to get their house ready with some remodeling to make it more appealing to buyers. However, with so many buyers competing for available homes right now, renovations may not be as vital as they would be in a more normal market. Here are two things to keep in mind if you’re thinking of selling this season.

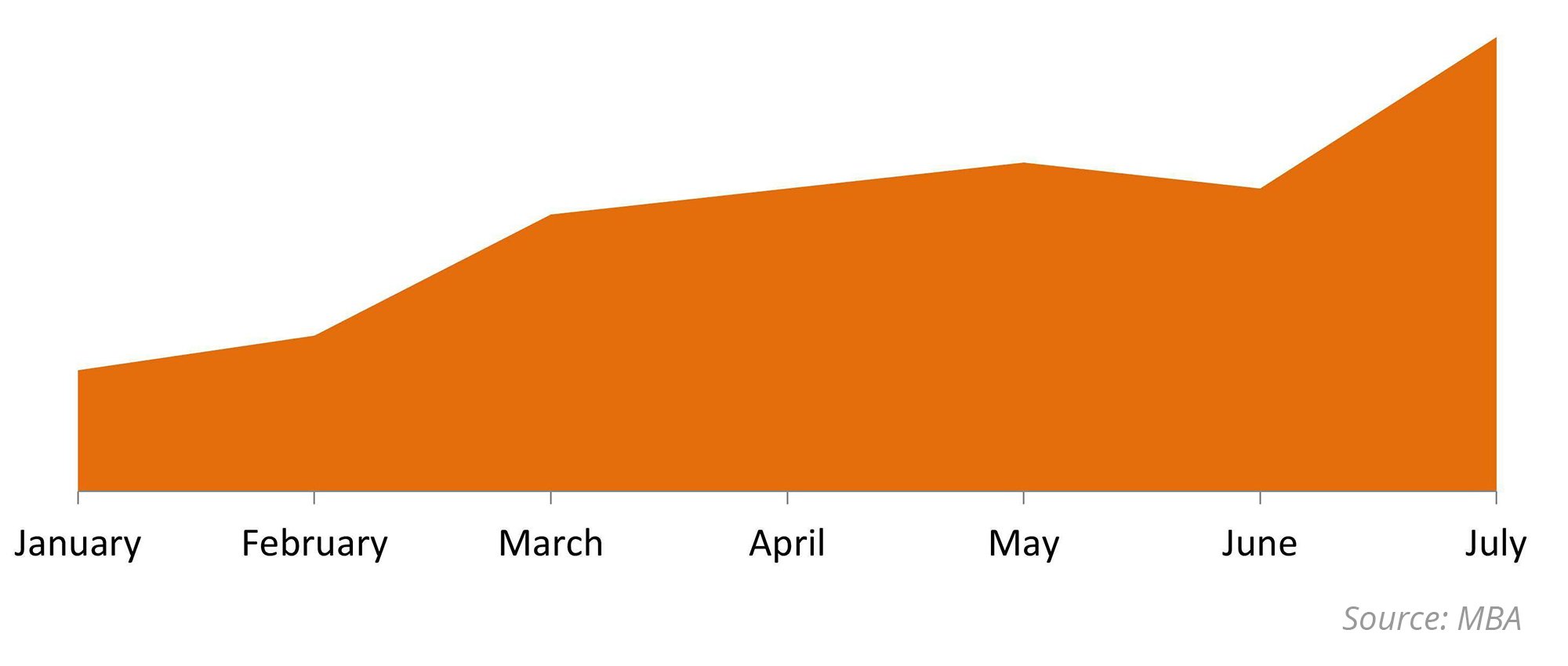

1. There aren’t enough homes for sale right now.

A normal market has a 6-month supply of houses for sale, but today’s housing inventory sits far below that benchmark. According to the National Association of Realtors (NAR), there’s only a 1.9-month supply of homes available today. As a result, buyer competition is high and homes are only on the market for about 21 days, during which time many receive multiple offers from hopeful buyers.

In a competitive market that’s moving so quickly, it makes sense to sell your house when buyers are scooping homes up as fast as they’re being listed. Spending costly time and money on renovations before you sell might just mean you’ll miss your key window of opportunity. While certain repairs on your house may be important, your best move right now is to work with a real estate advisor to determine which improvements are truly necessary, and which ones are not likely to be deal-breakers for buyers.

Today, many buyers are more willing to take on home improvement projects themselves in order to get the home they’re after, even if it means putting in a little extra work. Home Advisor explains:

“When it comes to the number of home improvement projects completed, Gen Z homeowners are leading the pack, completing an average of 3.5 projects. Millennials closely follow Gen Z, taking on an average of 3.3 projects, followed by Gen X at 2.8 projects. Boomers completed an average of 2 projects, and the Silent Generation completed the fewest projects, on average, at 1.8 per household. Compared to 2019, millennials are spending 60% more on home improvement and doing on average 30% more projects.”

In this market, it may be wise to let future homeowners remodel the bathroom or the kitchen to make design decisions that are best for their specific taste and lifestyle. As a seller, your dollars and time might be better spent working on small cosmetic updates, like refreshing some paint and power washing the exterior. Instead of over-investing in your home with upgrades that the buyers may change anyway, work with a real estate professional to determine the key projects that will maximize your listing, without overdoing it.

2. Focus on getting a good return on your investment.

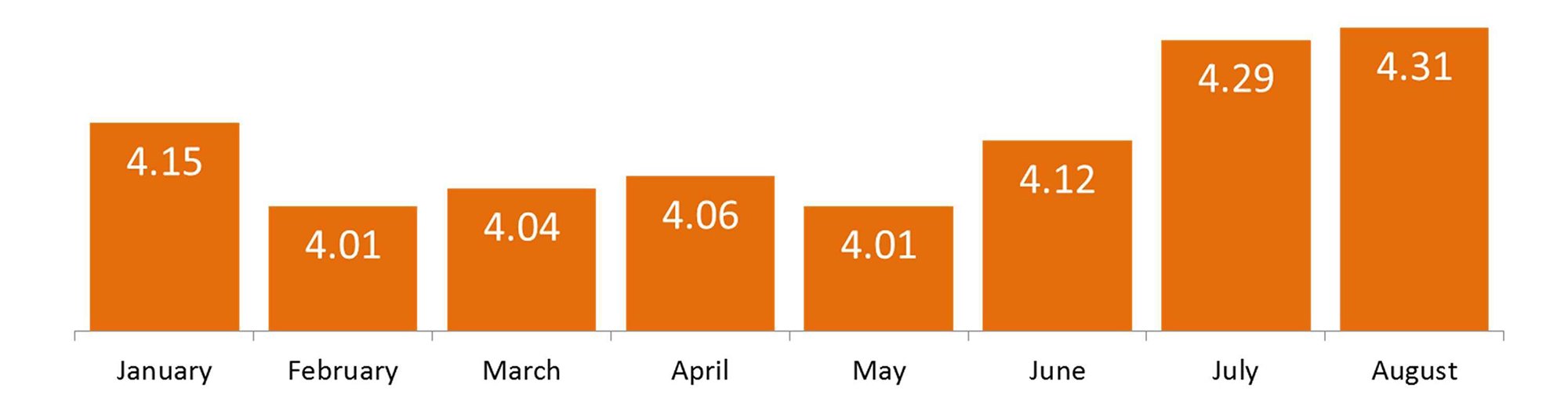

When planning any bigger projects to tackle, you and your real estate agent will want to discuss the potential return on your investment and if those projects are worth the cost. Some homes do need a kitchen or bathroom renovation, roof repairs, or other major work, but definitely not all of them. You might be surprised by how well your house could fair in today’s sellers’ market. Hanley Wood states:

“The 2020 Cost vs. Value report shows a predictable increase in costs for all 22 remodeling projects but a consistent dip in the perceived value of those projects at the time of home sale, as estimated by real-estate professionals in more than 100 metro areas across the U.S. This results in a slight downturn on the return on investment for nearly all projects relative to the trends we saw in last year’s report.”

Ideally, homeowners getting ready to move should try to avoid over-investing in big renovations if they won’t make that money back when they sell their house. According to the 2020 State of Home Spending report from Home Advisor:

“The average household spending on home services rose to $13,138, an increase over last year’s survey results, where homeowners who did projects spent $9,081 on average in 2019.”

Before you renovate, contact a local real estate professional to see if it’s the best course of action. You may find out that putting your house on the market as-is will help you sell quickly, and it may result in the best return on your investment. Every home is different, but a conversation with your agent is mission-critical to make sure you make the right moves when selling this season.

Bottom Line

We’re in a strong sellers’ market, and that means you have the leverage to sell your house on your terms. Let’s connect today to determine if renovating is really the best way to spend your time and money before you sell.

[created_at] => 2021-03-18T06:00:33Z

[description] => When thinking about selling, homeowners often feel they need to get their house ready with some remodeling to make it more appealing to buyers. However, with so many buyers competing for available homes right now, renovations may not be as vital as they would be in a more normal market. Here are two things to keep in mind if you’re thinking of selling this season.

[expired_at] =>

[featured_image] => https://files.simplifyingthemarket.com/wp-content/uploads/2021/03/17155905/20210318-KCM-Share.jpg

[id] => 1843

[kcm_ig_caption] => When thinking about selling, homeowners often feel they need to get their house ready with some remodeling to make it more appealing to buyers. However, with so many buyers competing for available homes right now, renovations may not be as vital as they would be in a more normal market. Here are two things to keep in mind if you’re thinking of selling this season.

>>There aren’t enough homes for sale right now.

In a competitive market that’s moving so quickly, it makes sense to sell your house when buyers are scooping homes up as fast as they’re being listed. Today, many buyers are more willing to take on home improvement projects themselves in order to get the home they’re after, even if it means putting in a little extra work. Instead of over-investing in your home with upgrades the buyers may change anyway, work with a real estate professional to determine the key projects that will maximize your listing, without overdoing it.

>>Focus on getting a good return on your investment.

When planning any bigger projects to tackle, you and your real estate agent will want to discuss the potential return on your investment and if those projects are worth the cost. Ideally, homeowners getting ready to move should try to avoid over-investing on big renovations if they won’t make that money back when they sell their house.

Before you renovate, DM me to see if it’s the best course of action. You may find out that putting your house on the market as-is will help you sell quickly, and it may result in the best return on your investment.

[kcm_ig_hashtags] => expertanswers,stayinformed,staycurrent,powerfuldecisions,confidentdecisions,realestate,homevalues,homeownership,homebuying,realestategoals,realestatetips,realestatelife,realestatenews,realestateagent,realestateexpert,realestateagency,realestateadvice,realestateblog,realestatemarket,realestateexperts,instarealestate,instarealtor,realestatetipsoftheday,realestatetipsandadvice,keepingcurrentmatters

[kcm_ig_quote] => To Renovate or Not To Renovate Before You Sell

[published_at] => 2021-03-18T10:00:33Z

[related] => Array

(

)

[slug] => to-renovate-or-not-to-renovate-before-you-sell

[status] => published

[tags] => Array

(

)

[title] => To Renovate or Not To Renovate Before You Sell

[updated_at] => 2021-03-18T14:48:47Z

[url] => /2021/03/18/to-renovate-or-not-to-renovate-before-you-sell/

)

To Renovate or Not To Renovate Before You Sell

When thinking about selling, homeowners often feel they need to get their house ready with some remodeling to make it more appealing to buyers. However, with so many buyers competing for available homes right now, renovations may not be as vital as they would be in a more normal market. Here are two things to keep in mind if you’re thinking of selling this season.

![It’s a Sellers’ Market [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2021/02/20210226-MEM.png)

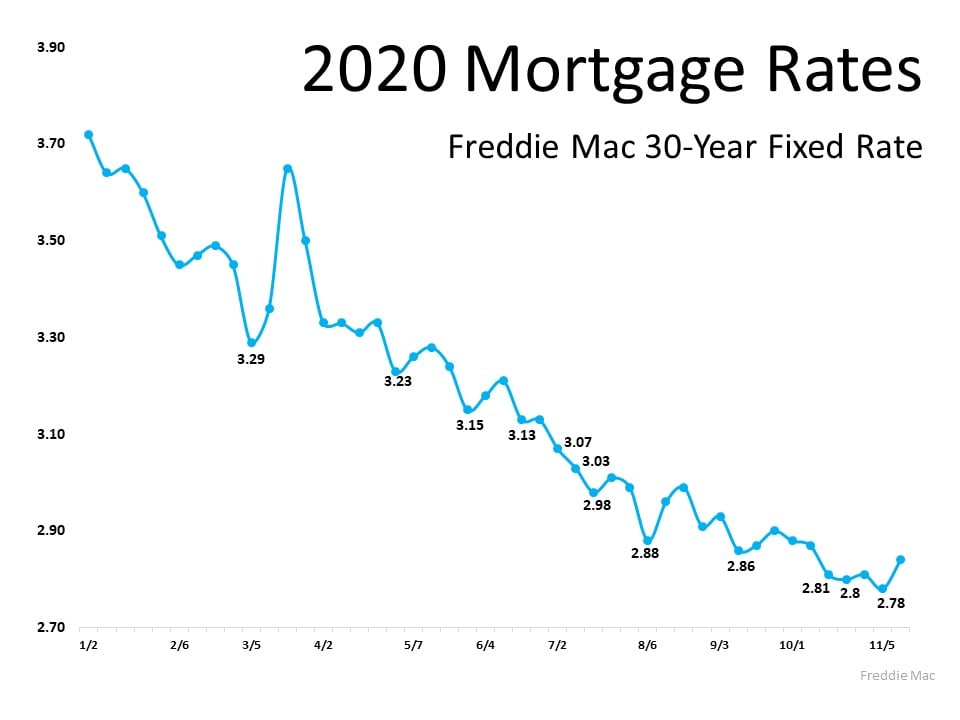

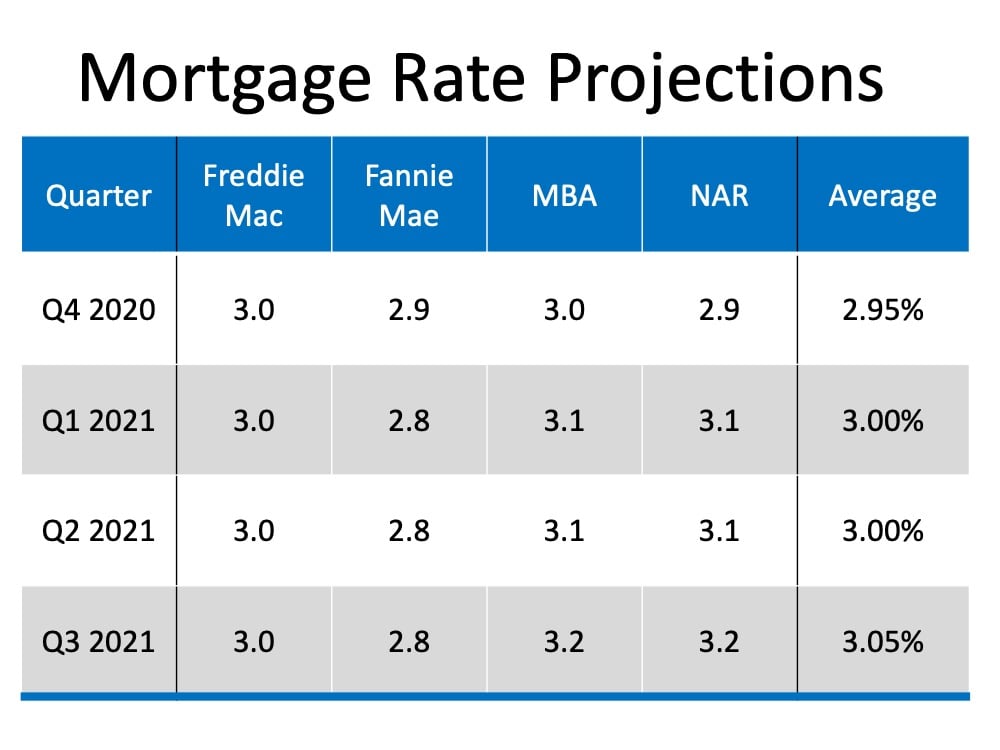

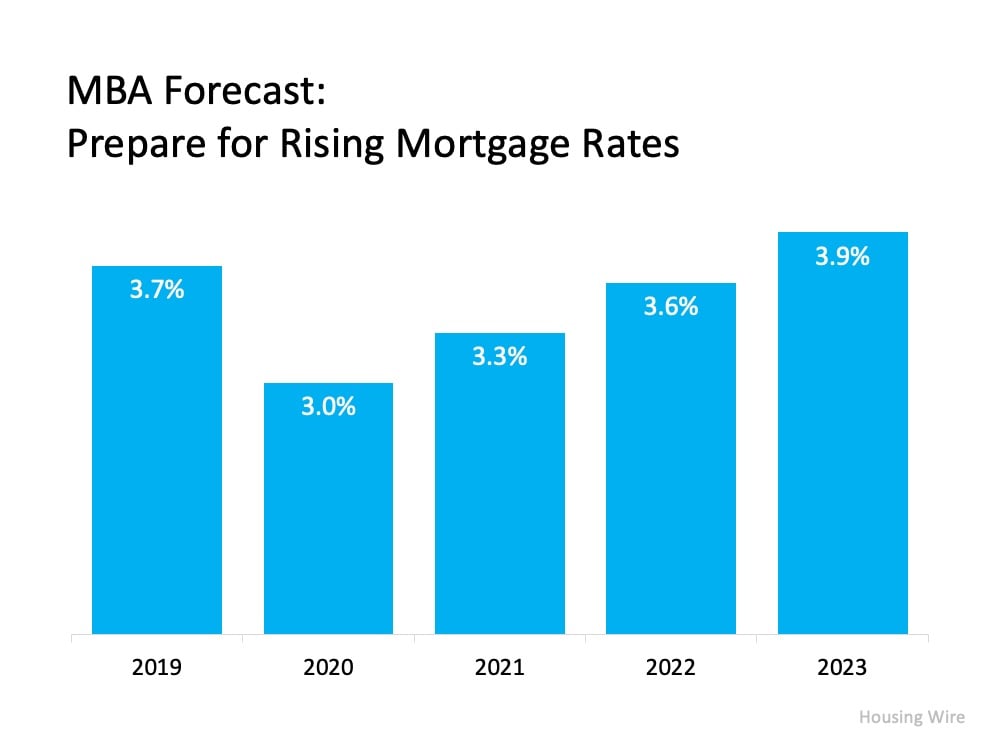

When you continually hear how rates are hitting record lows, you may be wondering: Are they going to keep falling? Should I wait until they get even lower?

When you continually hear how rates are hitting record lows, you may be wondering: Are they going to keep falling? Should I wait until they get even lower?

A recent Bloomberg Business article

A recent Bloomberg Business article