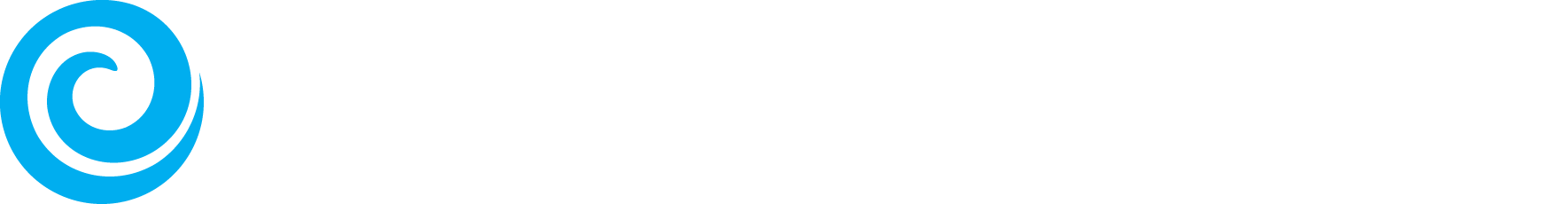

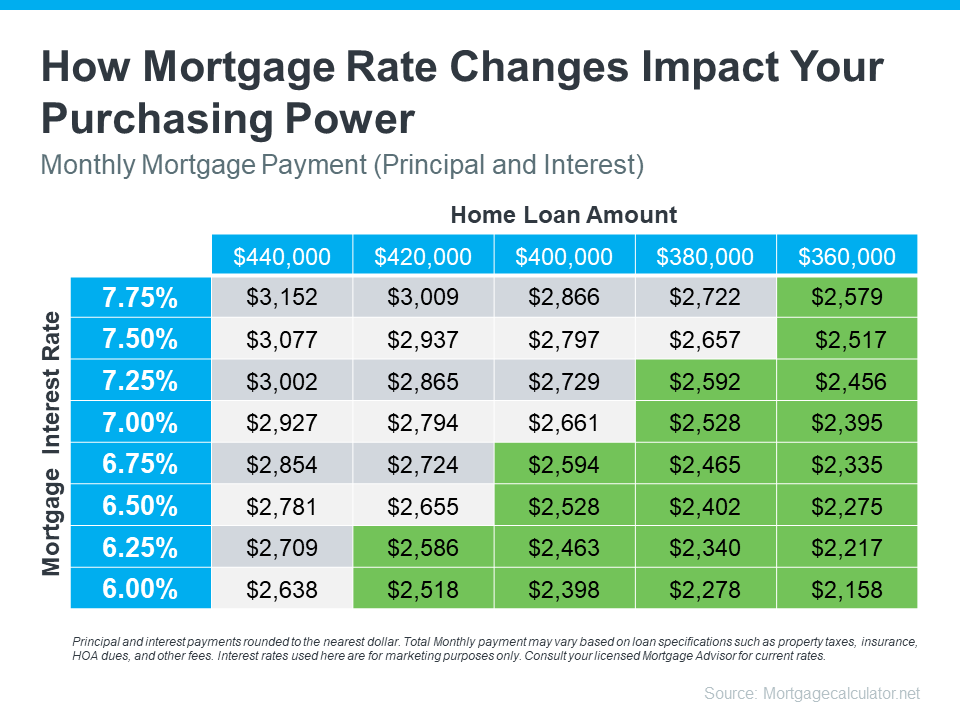

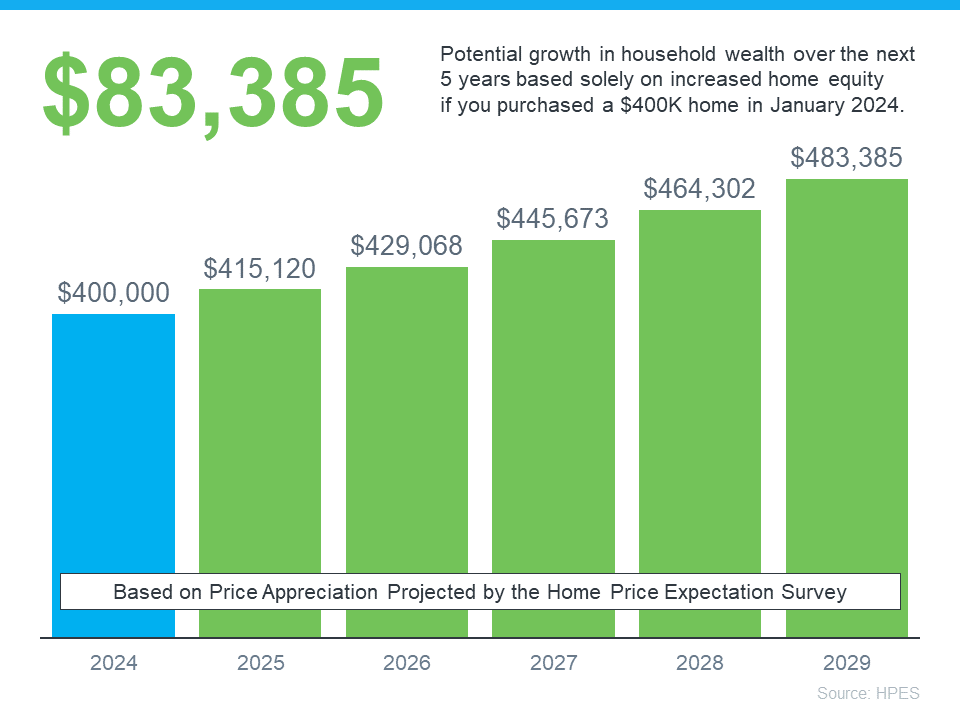

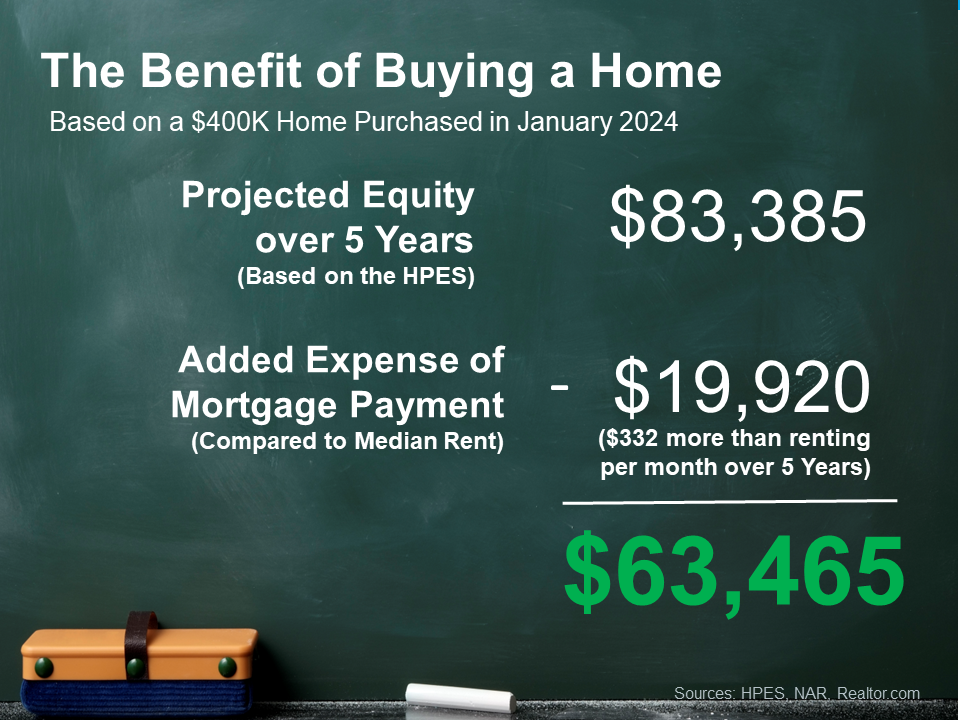

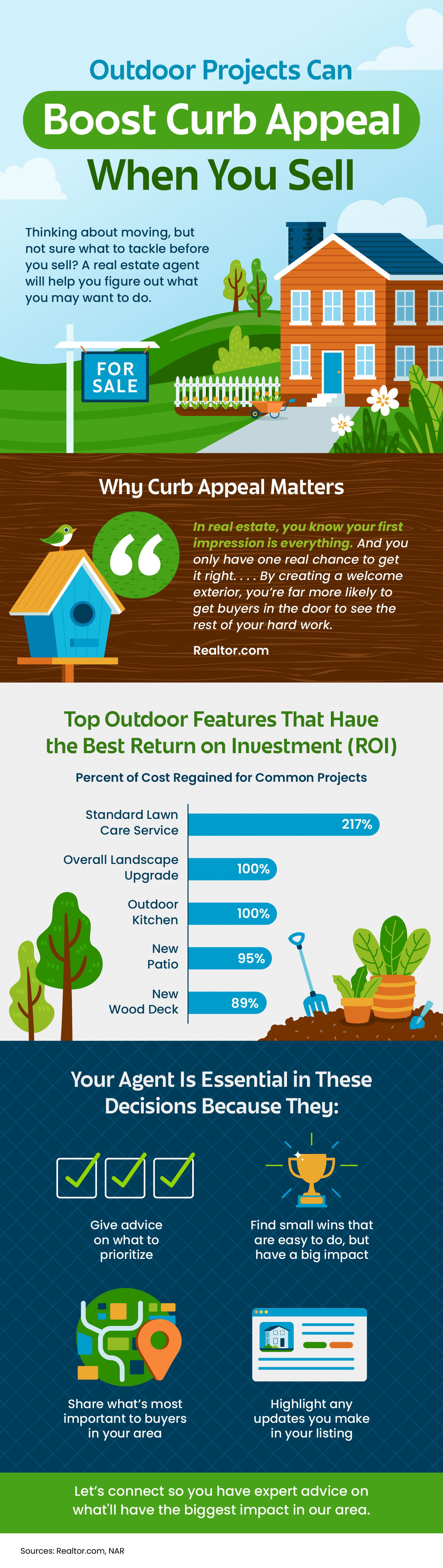

- Did you know the equity you have in your current house can help make your move possible?

- Once you sell, you can use it for a larger down payment on your next home, so you’re borrowing less. Or, you may even have enough to be an all-cash buyer.

- The typical homeowner has $298,000 in equity. If you want to find out how much you have, let’s connect for a Professional Equity Assessment Report.

Did you know the equity you have in your current house can help make your move possible?

[exclusive_id] => [expired_at] => [featured_image] => https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20240424/Equity-Can-Make-Your-Move-Possible-When-Affordability-Is-Tight-KCM-Share.png [id] => 50320 [kcm_ig_caption] => Did you know the equity you have in your current house can help make your move possible? Once you sell, you can use it for a larger down payment on your next home, so you’re borrowing less. Or, you may even have enough to be an all-cash buyer. The typical homeowner has $298,000 in equity. If you want to find out how much you have, let’s connect for a Professional Equity Assessment Report. [kcm_ig_hashtags] => houseshopping,housegoals,keepingcurrentmatters [kcm_ig_quote] => Equity can make your move possible when affordability is tight. [public_bottom_line] =>- Did you know the equity you have in your current house can help make your move possible?

- Once you sell, you can use it for a larger down payment on your next home, so you’re borrowing less. Or, you may even have enough to be an all-cash buyer.

- The typical homeowner has $298,000 in equity. If you want to find out how much you have, connect with a local real estate agent for a Professional Equity Assessment Report.

Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC]

Did you know the equity you have in your current house can help make your move possible?