stdClass Object

(

[agents_bottom_line] =>

If you’re unsure whether to continue renting or to buy a home, let’s connect to help you make the best decision.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => For Buyers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los compradores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

[1] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 11

[name] => First-Time Buyers

[parent] =>

[parent_id] =>

[published_at] => 2024-04-10T15:59:33Z

[slug] => first-time-buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Compradores de vivienda por primera vez

)

)

[updated_at] => 2024-04-10T15:59:33Z

)

[2] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 38

[name] => Move-Up

[parent] =>

[parent_id] =>

[published_at] => 2024-04-10T16:00:35Z

[slug] => move-up

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Compradores de casa mas grande

)

)

[updated_at] => 2024-04-10T16:00:35Z

)

)

[content_type] => blog

[contents] => You may have seen reports in the news recently saying it’s better to rent right now than it is to own your home. But before you let that impact your decisions, you should understand what these claims are based on.

A lot of the time, these reports are assuming things that aren’t realistic for the average household. For example, the methodology behind one of those reports says that renting is the smarter financial option because of the opportunity to invest money elsewhere. It assumes renters take the money they’d spend on costs tied to buying a home and put it in an investment portfolio.

But here’s the thing – most people who rent aren’t making those investments. Ken Johnson, Co-Author of the BH&J National Price-to-Rent Index, explains:

“One of the difficulties with the rent and reinvest model is many people . . . simply rent and spend the difference. . . . That’s wealth destroying.”

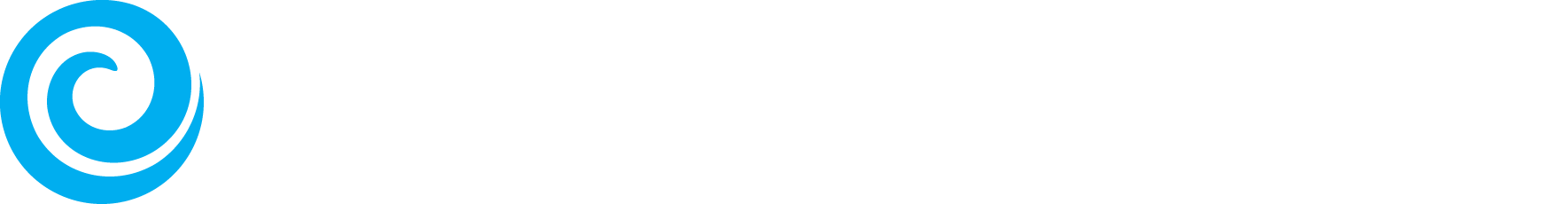

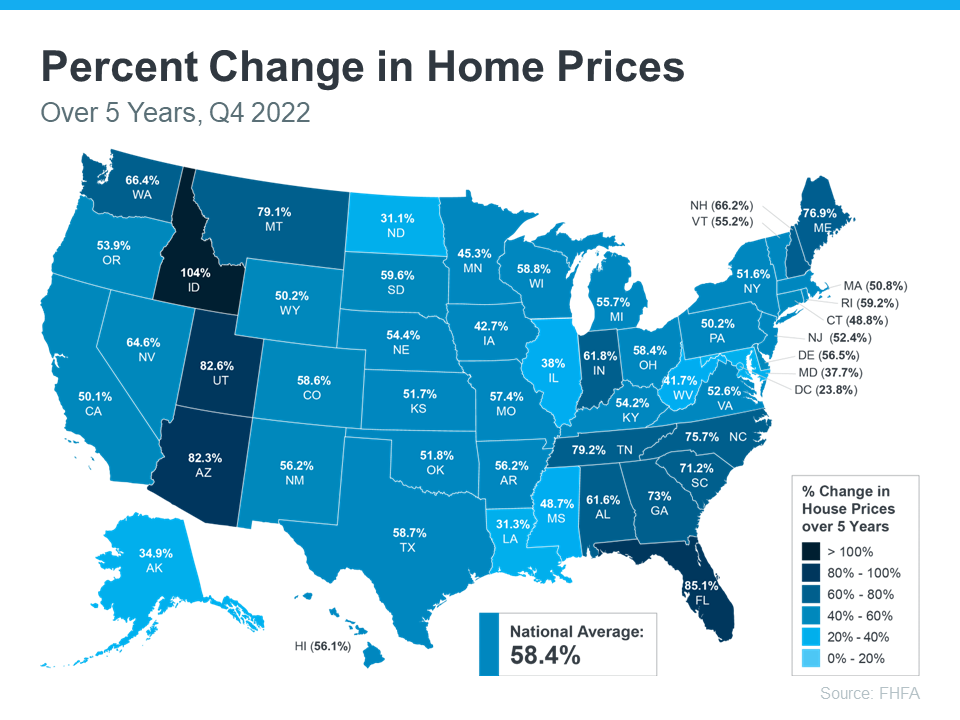

The reason homeownership is one of the best investments you can make is the wealth it helps you build. That’s why there’s a significant difference between the net worth of the average homeowner and the average renter (see graph below):

So, before you renew your rental agreement, think about the opportunity to build wealth that homeownership provides.

Bottom Line

If you’re unsure whether to continue renting or to buy a home, let’s connect to help you make the best decision.

[created_at] => 2023-03-03T15:54:40Z

[description] => You may have seen reports in the news recently saying it’s better to rent right now than it is to own your home. But before you let that impact your decisions, you should understand what these claims are based on.

[exclusive_id] =>

[expired_at] =>

[featured_image] => https://files.keepingcurrentmatters.com/wp-content/uploads/2023/03/03105503/is-it-really-better-to-rent-than-to-own-KCM.jpg

[id] => 4655

[kcm_ig_caption] => You may have seen reports in the news recently saying it’s better to rent right now than it is to own your home. But before you let that impact your decisions, you should understand what these claims are based on.

A lot of the time, these reports are assuming things that aren’t realistic for the average household. For example, the methodology behind one of those reports says that renting is the smarter financial option because of the opportunity to invest money elsewhere. It assumes renters take the money they’d spend on costs tied to buying a home and put it in an investment portfolio.

But here’s the thing – most people who rent aren’t making those investments. Ken Johnson, Co-Author of the BH&J National Price-to-Rent Index, explains:

“One of the difficulties with the rent and reinvest model is many people . . . simply rent and spend the difference. . . . That’s wealth destroying.”

The reason homeownership is one of the best investments you can make is the wealth it helps you build. That’s why there’s a significant difference between the net worth of the average homeowner and the average renter.

So, before you renew your rental agreement, think about the opportunity to build wealth that homeownership provides.

If you’re unsure whether to continue renting or to buy a home, DM me and let’s connect to help you make the best decision.

[kcm_ig_hashtags] => realestate,homeownership,homebuying,realestategoals,realestatetips,realestatelife,realestatenews,realestateagent,realestateexpert,realestateagency,realestateadvice,realestateblog,realestatemarket,realestateexperts,realestateagents,instarealestate,instarealtor,realestatetipsoftheday,realestatetipsandadvice,keepingcurrentmatters

[kcm_ig_quote] => Is it really better to rent than to own a home right now?

[public_bottom_line] => If you’re unsure whether to continue renting or to buy a home, work with a real estate advisor who can help you make the best decision.

[published_at] => 2023-03-06T11:30:31Z

[related] => Array

(

)

[slug] => is-it-really-better-to-rent-than-to-own-a-home-right-now

[status] => published

[tags] => Array

(

[0] => content-hub

)

[title] => Is It Really Better To Rent Than To Own a Home Right Now?

[updated_at] => 2023-03-29T18:42:38Z

[url] => /2023/03/06/is-it-really-better-to-rent-than-to-own-a-home-right-now/

)

New Search

If you are not happy with the results below please do another search

2326 search results for: 1 reason to sell now

- If you’re thinking of selling your house, be sure to explore all the options you have for your next home.

- Both newly built homes and existing homes offer plenty of unique benefits.

- If you have questions about the options in our area, let’s discuss what’s available and what’s right for you.

Some Highlights

- If you’re thinking of selling your house, be sure to explore all the options you have for your next home.

- Both newly built homes and existing homes offer plenty of unique benefits.

- If you have questions about the options in our area, let’s discuss what’s available and what’s right for you.

Some Highlights

- If you’re thinking of selling your house, be sure to explore all the options you have for your next home.

- Both newly built homes and existing homes offer plenty of unique benefits.

- If you’re thinking of selling your house, be sure to explore all the options you have for your next home.

- Both newly built homes and existing homes offer plenty of unique benefits.

- If you have questions about the options in your area, meet with a local real estate professional to discuss what’s available and what’s right for you.

Where Will You Go After You Sell Your House? [INFOGRAPHIC]

Some Highlights

- If you’re thinking of selling your house, be sure to explore all the options you have for your next home.

- Both newly built homes and existing homes offer plenty of unique benefits.

Equity Gains for Today’s Homeowners

- The buyer, who wants the best deal possible

- The buyer’s agent, who will use their expertise to advocate for the buyer

- The inspection company, which works for the buyer and will almost always find concerns with the house

- The appraiser, who assesses the property’s value to protect the lender

Instead of going toe-to-toe with these parties alone, lean on an expert. They’ll know what levers to pull, how to address everyone’s concerns, and when you may want to get a second opinion.

Bottom Line

Don’t go at it alone. If you’re planning to sell your house this spring, let’s connect so you have an expert by your side to guide you in today’s market.

[created_at] => 2023-02-27T17:46:44Z [description] => If you’re thinking of selling your house, it’s important to work with someone who understands how the market is changing and what it means for you. Here are five reasons working with a professional can ensure you’ll get the most out of your sale. [exclusive_id] => [expired_at] => [featured_image] => https://files.simplifyingthemarket.com/wp-content/uploads/2023/02/27123813/an-expert-makes-all-the-difference-when-you-sell-your-house-KCM.jpg [id] => 4637 [kcm_ig_caption] => If you’re thinking of selling your house, it’s important to work with someone who understands how the market is changing and what it means for you. >>1. They’re Experts on Market Trends An expert real estate advisor knows about national trends and your local area too. More importantly, they’ll give insight to what all of this means for you, so they’ll be able to help you make a decision based on trustworthy, data-bound information. >>2. A Local Professional Knows How To Set the Right Price for Your Home Real estate professionals look at a variety of factors, like the condition of your home and any upgrades you’ve made, with an unbiased eye. They compare your house to recently sold homes in your area to find the best price for today’s market so your house sells quickly. >>3. A Real Estate Advisor Helps Maximize Your Pool of Buyers Real estate professionals have a wide range of tools at their disposal, such as social media followers, agency resources, and the Multiple Listing Service (MLS), to ensure your house gets in front of people looking to make a purchase. >>4. A Real Estate Expert Will Read – and Understand – the Fine Print Today, more disclosures and regulations are mandatory when selling a house. That means the number of legal documents you’ll need to juggle is growing. >>5. A Local Professional Is a Skilled Negotiator In today’s market, buyers are regaining some negotiation power. If you sell without an expert, you’ll be responsible for any back-and-forth. Instead of going toe-to-toe with these parties alone, lean on an expert. If you’re planning to sell your house this spring, DM me so you have an expert by your side to guide you in today’s market. [kcm_ig_hashtags] => Sellyourhouse,moveuphome,dreamhome,realestate,homeownership,realestategoals,realestatetips,realestatelife,realestatenews,realestateagent,realestateexpert,realestateagency,realestateadvice,realestateblog,realestatemarket,realestateexperts,instarealestate,instarealtor,realestatetipsoftheday,realestatetipsandadvice,justsold,keepingcurrentmatters [kcm_ig_quote] => An expert makes all the difference when you sell your house. [public_bottom_line] => Don’t go at it alone. If you’re planning to sell your house this spring, work with a real estate professional so you have an expert by your side to guide you in today’s market. [published_at] => 2023-03-01T11:30:38Z [related] => Array ( ) [slug] => an-expert-makes-all-the-difference-when-you-sell-your-house [status] => published [tags] => Array ( ) [title] => An Expert Makes All the Difference When You Sell Your House [updated_at] => 2023-03-02T09:30:02Z [url] => /2023/03/01/an-expert-makes-all-the-difference-when-you-sell-your-house/ )An Expert Makes All the Difference When You Sell Your House

What You Should Know About Rising Mortgage Rates

One Major Benefit of Investing in a Home

- As you get ready to sell your house, there are specific things you can add to your to-do list.

- These include decluttering, taking down personal photos and items, and power washing outdoor surfaces.

- Let’s connect so you have advice on what you may want to do to get your house ready to sell this season.

Some Highlights

- As you get ready to sell your house, there are specific things you can add to your to-do list.

- These include decluttering, taking down personal photos and items, and power washing outdoor surfaces.

- Let’s connect so you have advice on what you may want to do to get your house ready to sell this season.

Some Highlights

- As you get ready to sell your house, there are specific things you can add to your to-do list.

- These include decluttering, taking down personal photos and items, and power washing outdoor surfaces.

- As you get ready to sell your house, there are specific things you can add to your to-do list.

- These include decluttering, taking down personal photos and items, and power washing outdoor surfaces.

- Connect with a trusted real estate professional for advice on what you may want to do to get your house ready to sell this season.

Checklist for Selling Your House This Spring [INFOGRAPHIC]

Some Highlights

- As you get ready to sell your house, there are specific things you can add to your to-do list.

- These include decluttering, taking down personal photos and items, and power washing outdoor surfaces.

- 34% answered, “I don’t have enough saved for a down payment”

- 30% answered, “My credit score”

If you’re aiming to buy a home, here’s what you need to know to accomplish that goal.

Save for Your Down Payment

Your down payment is a big chunk of what you pay up front for your home. For most home purchases, buyers put down some amount of cash up front (a down payment) and then take out a loan (a mortgage) to pay for the rest.

It’s a longstanding myth that you need to pay 20% of the purchase price for your down payment. In reality, 20% down isn’t always required. In fact, according to the National Association of Realtors (NAR), today’s median down payment is 14% for the average buyer and just 6% for a first-time buyer.

Regardless of how much money you can save for your down payment, know there’s help available. A local lender can show you options to help you get closer to your down payment goal. Plus, there are even loan types, like FHA loans, with down payments as low as 3.5% for some buyers, as well as options like VA loans and USDA loans with no down payment requirements for qualified applicants.

Beyond assistance programs and different loan types, here are a few other tips to help you as you save for your down payment:

- Remember to factor in closing costs. In addition to your down payment, closing costs are usually 2-5% of the home's purchase price.

- Maintain your savings. Your down payment shouldn’t deplete all your savings. It’s important to still have some money set aside for homeownership expenses after you move in.

- Explore your options and lean on your trusted advisor for expert guidance. Do your research, ask questions, and look into the resources available for buyers like you.

Improve Your Credit Score

Your credit score is a number that indicates how financially reliable you are to lenders. A higher credit score usually means you’ll be able to borrow more money at a better interest rate. If your credit score is preventing you from getting an affordable mortgage, there are steps you can take to improve it. Here are two:

- Pay your bills on time. When you pay your bills on time, your credit score improves. When you’re late, it takes a hit. One way to make paying your bills on time easier? Set up automatic payments when and where you can.

- Mix it up. From auto loans, to credit cards, to mortgages – there are several different types of credit. And having a mix of them improves your credit score.

Bottom Line

If you want to purchase a home this year, let’s connect so we can start preparing.

[created_at] => 2023-02-22T18:18:38Z [description] => According to a recent Harris Poll survey, 8 in 10 Americans say buying a home is a priority, and 28 million Americans actually plan to buy within the next 12 months. Homeownership provides many financial and nonfinancial benefits, so that interest is understandable. [exclusive_id] => [expired_at] => [featured_image] => https://files.simplifyingthemarket.com/wp-content/uploads/2023/02/22130933/how-to-make-your-dream-of-homeownership-a-reality-KCM.jpg [id] => 4619 [kcm_ig_caption] => According to a recent Harris Poll survey, 8 in 10 Americans say buying a home is a priority, and 28 million Americans actually plan to buy within the next 12 months. Homeownership provides many financial and nonfinancial benefits, so that interest is understandable. If you’re aiming to buy a home, here’s what you need to know to accomplish that goal. >>Save for Your Down Payment Your down payment is a big chunk of what you pay up front for your home. For most home purchases, buyers put down some amount of cash up front and then take out a loan to pay for the rest. It’s a longstanding myth that you need to pay 20% of the purchase price for your down payment. In reality, 20% down isn’t always required. Regardless of how much money you can save for your down payment, know there’s help available. A local lender can show you options to help you get closer to your down payment goal. Beyond assistance programs and different loan types, here are a few other tips to help you as you save for your down payment: • Remember to factor in closing costs. • Maintain your savings. • Explore your options and lean on your trusted advisor for expert guidance. >>Improve Your Credit Score Your credit score is a number that indicates how financially reliable you are to lenders. If your credit score is preventing you from getting an affordable mortgage, there are steps you can take to improve it: • Pay your bills on time. • Mix it up. From auto loans, to credit cards, to mortgages – there are several different types of credit. And having a mix of them improves your credit score. If you want to purchase a home this year, DM me so you can to build your team of professionals and start preparing. [kcm_ig_hashtags] => firsttimehomebuyer,opportunity,housingmarket,househunting,makememove,homegoals,houseshopping,housegoals,investmentproperty,emptynest,downsizing,locationlocationlocation,newlisting,homeforsale,renovated,starterhome,dreamhome,curbappeal,keepingcurrentmatters [kcm_ig_quote] => Here’s how to make your dream of homeownership a reality. [public_bottom_line] => If you want to purchase a home this year, contact a trusted real estate advisor so you can to build your team of professionals and start preparing. [published_at] => 2023-02-23T11:30:26Z [related] => Array ( ) [slug] => how-to-make-your-dream-of-homeownership-a-reality [status] => published [tags] => Array ( ) [title] => How To Make Your Dream of Homeownership a Reality [updated_at] => 2023-02-24T09:30:02Z [url] => /2023/02/23/how-to-make-your-dream-of-homeownership-a-reality/ )How To Make Your Dream of Homeownership a Reality

A Smaller Home Could Be Your Best Option

The Two Big Issues the Housing Market’s Facing Right Now

Spring into Action: Boost Your Home’s Curb Appeal with Expert Guidance

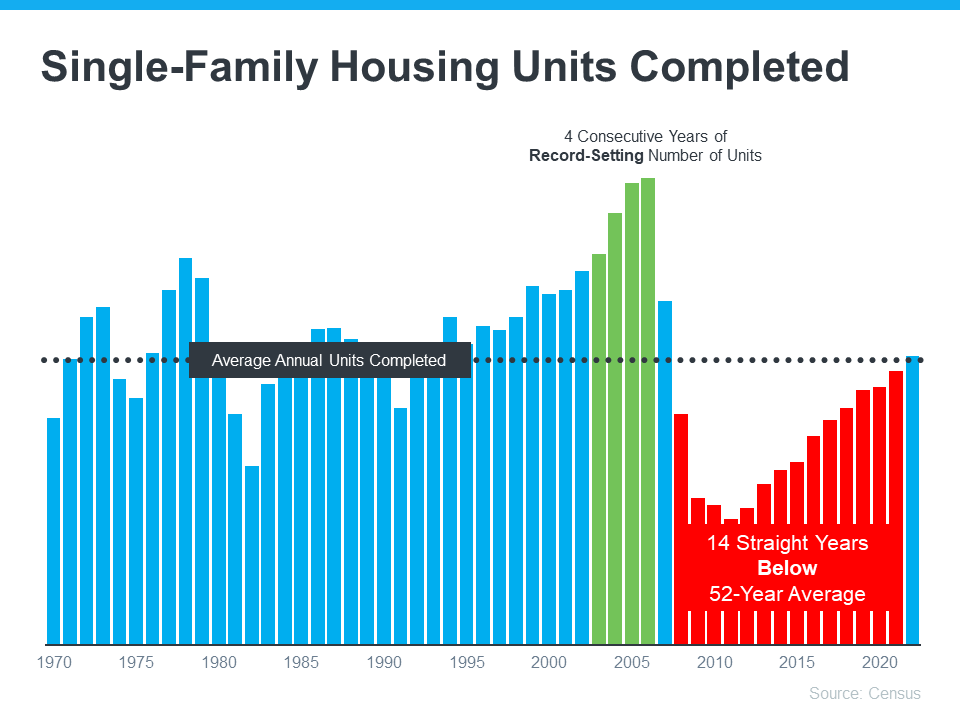

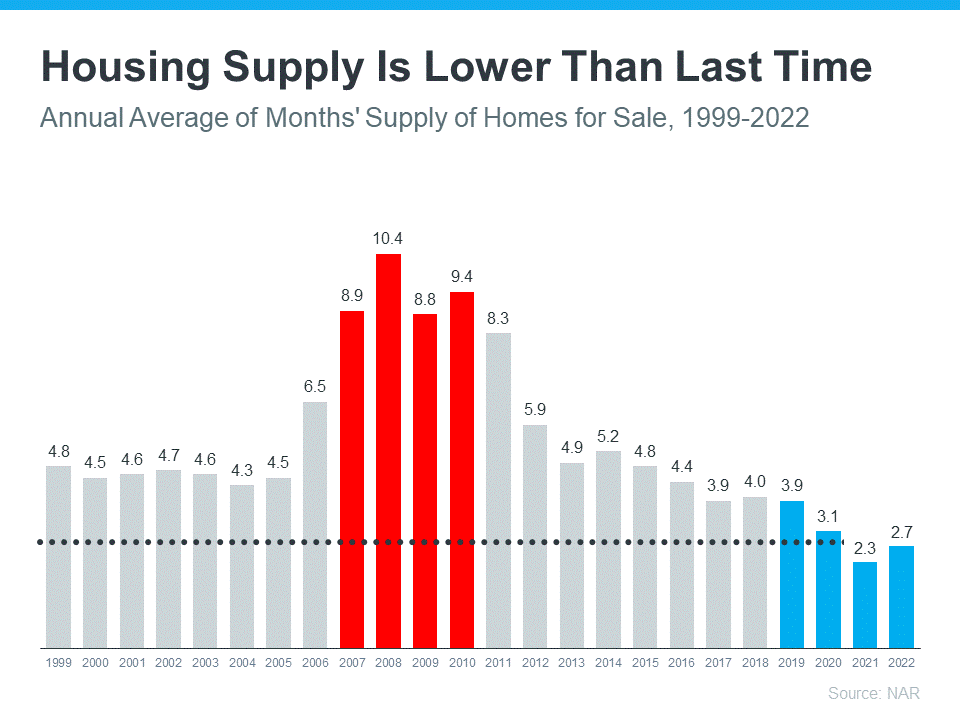

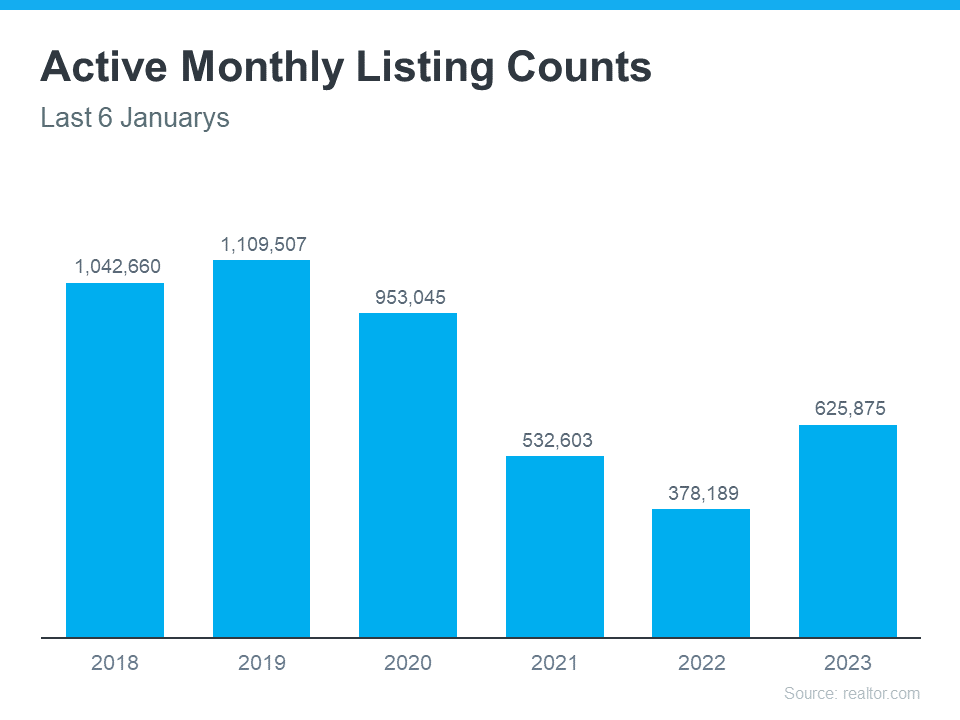

- The biggest challenge in the housing market is how few houses there are for sale compared to the number of people who want to buy.

- The number of homes for sale is up from last year but below pre-pandemic numbers, and that means we’re still in a sellers’ market.

- The housing market needs more homes for sale to meet the demand of today’s buyers. If you’ve thought about selling, let’s connect today.

Some Highlights

- The biggest challenge in the housing market is how few houses there are for sale compared to the number of people who want to buy.

- The number of homes for sale is up from last year but below pre-pandemic numbers, and that means we’re still in a sellers’ market.

- The housing market needs more homes for sale to meet the demand of today’s buyers. If you’ve thought about selling, let’s connect today.

Some Highlights

- The biggest challenge in the housing market is how few houses there are for sale compared to the number of people who want to buy.

- The number of homes for sale is up from last year but below pre-pandemic numbers, and that means we’re still in a sellers’ market.

- The biggest challenge in the housing market is how few houses there are for sale compared to the number of people who want to buy.

- The number of homes for sale is up from last year but below pre-pandemic numbers, and that means we’re still in a sellers’ market.

- The housing market needs more homes for sale to meet the demand of today’s buyers. If you’ve thought about selling, now’s the time to connect with a local expert.

The Spring Housing Market Could Be a Sweet Spot for Sellers [INFOGRAPHIC]

Some Highlights

- The biggest challenge in the housing market is how few houses there are for sale compared to the number of people who want to buy.

- The number of homes for sale is up from last year but below pre-pandemic numbers, and that means we’re still in a sellers’ market.

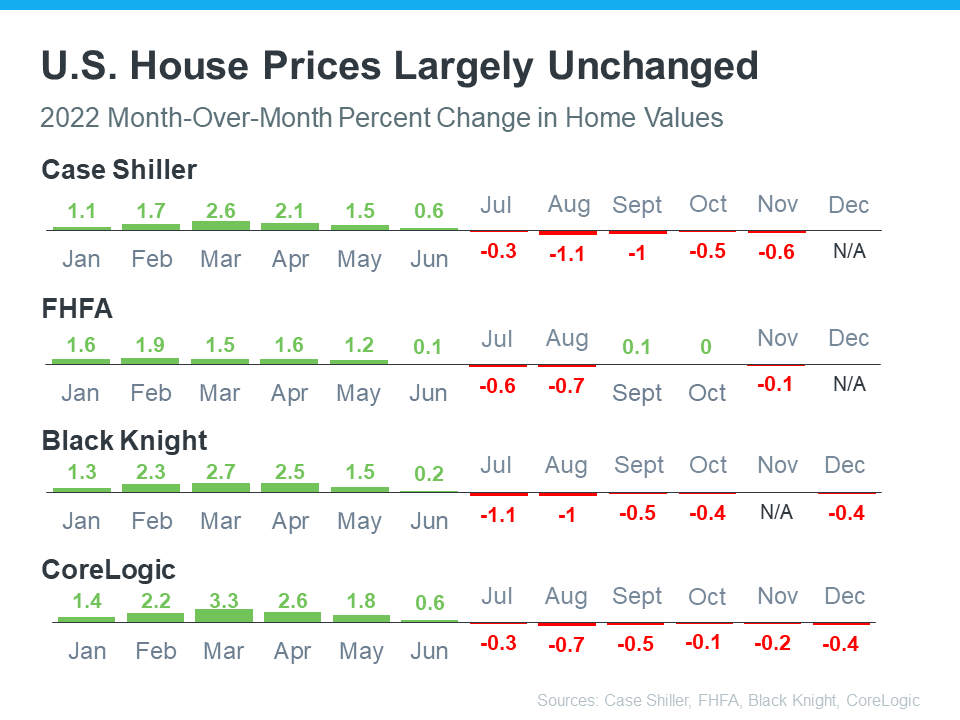

Wondering What’s Going on with Home Prices?

Should You Consider Buying a Newly Built Home?

- 91% of homeowners say they feel secure, stable, or successful owning a home

- 64% of American homeowners say living through a pandemic has made their home more important to them than ever

It’s no surprise this study also reveals that homeowners now love their homes even more as our attachments to them have grown:

The National Association of Realtors (NAR) also explains:

“In addition to tangible financial benefits, homeownership brings substantial social benefits for [households], communities, and the country as a whole.”

In other words, not only does owning a home build your net worth over time, but it also gives you and your loved ones a place to thrive. And by living near people with shared experiences, homeownership helps you connect with your community and contribute meaningfully.

Bottom Line

Whether you’re thinking of buying your first home, moving up to your dream home, or downsizing to something that better fits your changing lifestyle, let me be the key to unlocking a home you can truly fall in love with.

[created_at] => 2023-02-09T15:26:39Z [description] =>No matter how the housing market changes, there are some things about owning a home that never change—like the personal benefits it can provide. When you own your home, you likely feel a sense of attachment because of the comfort it gives and also because it’s a space that’s truly yours.

[email_copy] => [exclusive_id] => [expired_at] => [featured_image] => https://files.keepingcurrentmatters.com/wp-content/uploads/2023/02/13104549/why-its-easy-to-fall-in-love-with-homeownership-KCM.jpg [gif] => https://videos.mykcm.com/videos/gifs/WhyItsEasyToFallinLovewithHomeownership.gif [hashtags] => valentinesday,homeownership,dreamhome [id] => 4582 [kcm_ig_caption] => No matter how the housing market changes, there are some things about owning a home that never change—like the personal benefits it can provide. When you own your home, you likely feel a sense of attachment because of the comfort it gives and also because it’s a space that’s truly yours. Over the last few years, we’ve fully embraced the meaning of our homes as we spent more time than ever in them. As a result, the emotional benefits our homes provide have become even more important to us. As the most recent State of the American Homeowner from Unison puts it: “. . . one thing has stayed the same: the home continues to be of the utmost importance and a place of security and comfort.” The same study from Unison notes: • 91% of homeowners say they feel secure, stable, or successful owning a home • 64% of American homeowners say living through a pandemic has made their home more important to them than ever The National Association of Realtors (NAR) also explains: “In addition to tangible financial benefits, homeownership brings substantial social benefits for [households], communities, and the country as a whole.” In other words, not only does owning a home build your net worth over time, but it also gives you and your loved ones a place to thrive. And by living near people with shared experiences, homeownership helps you connect with your community and contribute meaningfully. Whether you’re thinking of buying your first home, moving up to your dream home, or downsizing to something that better fits your changing lifestyle, let me be the key to unlocking a home you can truly fall in love with. DM me today. [kcm_ig_hashtags] => firsttimehomebuyer,opportunity,housingmarket,househunting,makememove,homegoals,houseshopping,housegoals,investmentproperty,emptynest,downsizing,locationlocationlocation,newlisting,homeforsale,renovated,starterhome,dreamhome,curbappeal,keepingcurrentmatters [kcm_ig_quote] => Here’s why it’s easy to fall in love with homeownership. [public_bottom_line] => Whether you’re thinking of buying your first home, moving up to your dream home, or downsizing to something that better fits your changing lifestyle, a local market expert is the key to unlocking a home you can truly fall in love with. [published_at] => 2023-02-14T11:30:53Z [related] => Array ( ) [slug] => why-its-easy-to-fall-in-love-with-homeownership-1 [sources] => [status] => published [tags] => Array ( ) [thumbnail_timestamp] => [title] => Why It’s Easy To Fall in Love with Homeownership [type] => blog [updated_at] => 2023-02-14T17:54:29Z [url] => /2023/02/14/why-its-easy-to-fall-in-love-with-homeownership-1/ )Why It’s Easy To Fall in Love with Homeownership

No matter how the housing market changes, there are some things about owning a home that never change—like the personal benefits it can provide. When you own your home, you likely feel a sense of attachment because of the comfort it gives and also because it’s a space that’s truly yours.

- In today’s housing market, you can still be the champion if you have the right team and strategy.

- To win as a buyer, you need to build your team, make strategic plays, consider what’s in and out of bounds, and stand out from the crowd.

- Let’s connect today to make your game-winning play.

Some Highlights

- In today’s housing market, you can still be the champion if you have the right team and strategy.

- To win as a buyer, you need to build your team, make strategic plays, consider what’s in and out of bounds, and stand out from the crowd.

- Let’s connect today to make your game-winning play.

Some Highlights

- In today’s housing market, you can still be the champion if you have the right team and strategy.

- To win as a buyer, you need to build your team, make strategic plays, consider what’s in and out of bounds, and stand out from the crowd.

- In today’s housing market, you can still be the champion if you have the right team and strategy.

- To win as a buyer, you need to build your team, make strategic plays, consider what’s in and out of bounds, and stand out from the crowd.

- Connect with a real estate professional today to make your game-winning play.

How To Win as a Buyer in Today’s Housing Market [INFOGRAPHIC]

Some Highlights

- In today’s housing market, you can still be the champion if you have the right team and strategy.

- To win as a buyer, you need to build your team, make strategic plays, consider what’s in and out of bounds, and stand out from the crowd.

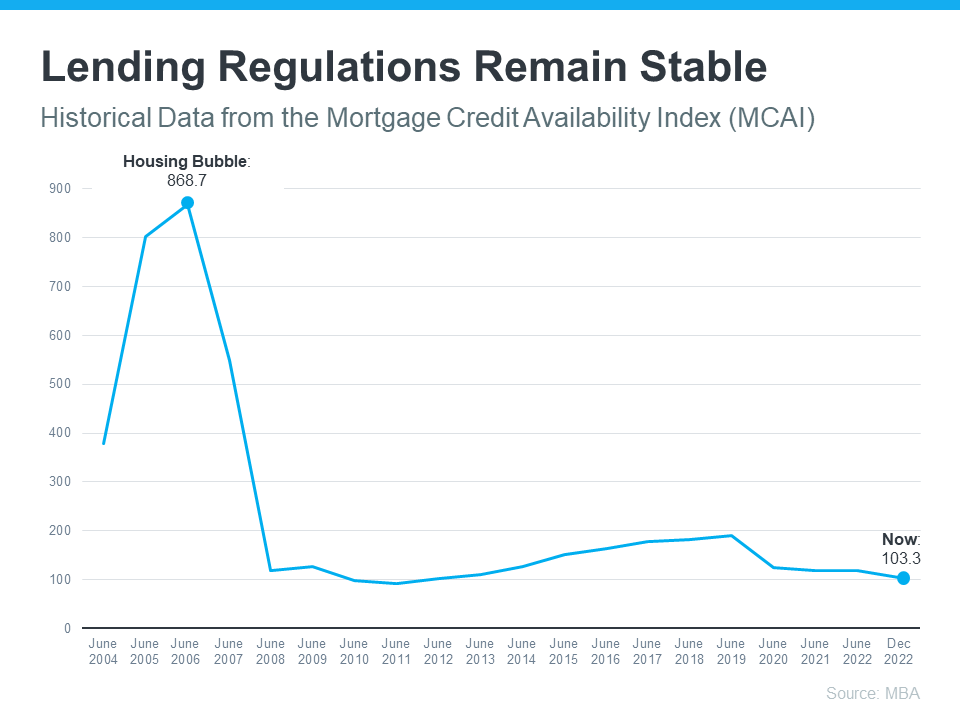

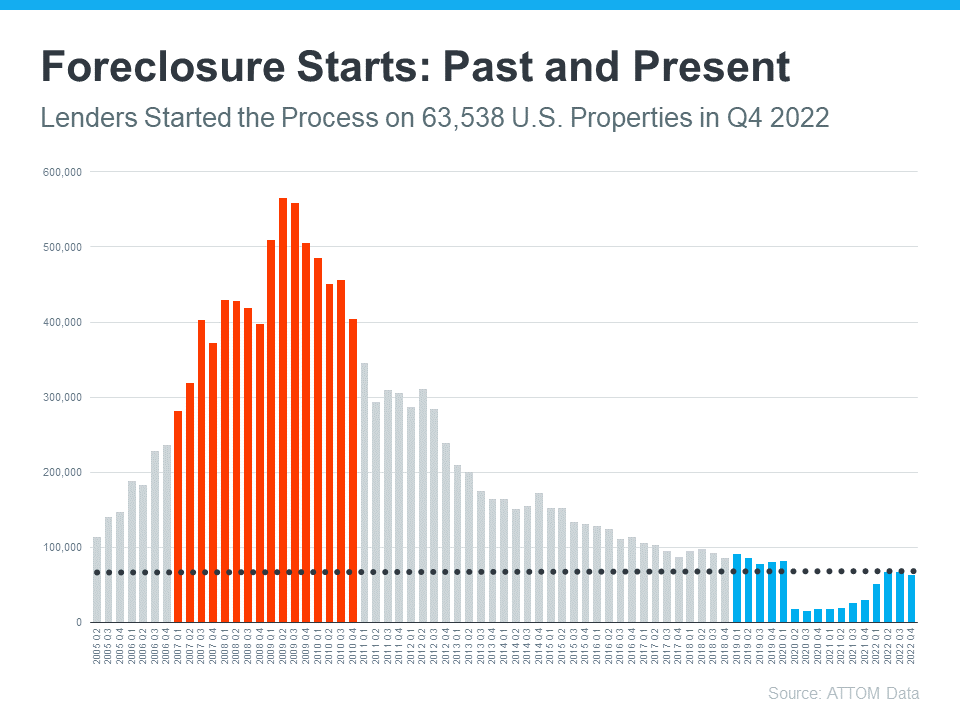

Why Today’s Housing Market Isn’t Headed for a Crash

Number of Homes for Sale Up from Last Year, but Below Pre-Pandemic Years

The Top Reasons for Selling Your House

- Many people believe you need to put down 20% of the purchase price when you buy a home. But recent homebuyers actually put down far less on their purchase.

- And with programs like FHA loans, VA loans, and USDA loans, some qualified buyers are able to put down as little as 0-3.5%.

- Let’s connect to make sure you have a trusted lender and can find out if you’re ready to buy a home sooner rather than later.

Some Highlights

- Many people believe you need to put down 20% of the purchase price when you buy a home. But recent homebuyers actually put down far less on their purchase.

- And with programs like FHA loans, VA loans, and USDA loans, some qualified buyers are able to put down as little as 0-3.5%.

- Let’s connect to make sure you have a trusted lender and can find out if you’re ready to buy a home sooner rather than later.

Some Highlights

- Many people believe you need to put down 20% of the purchase price when you buy a home. But recent homebuyers actually put down far less on their purchase.

- And with programs like FHA loans, VA loans, and USDA loans, some qualified buyers are able to put down as little as 0-3.5%.

- Many people believe you need to put down 20% of the purchase price when you buy a home. But recent homebuyers actually put down far less on their purchase.

- And with programs like FHA loans, VA loans, and USDA loans, some qualified buyers are able to put down as little as 0-3.5%.

- Connect with a real estate professional and find out if you’re ready to buy a home sooner rather than later.

You May Not Need as Much as You Think for Your Down Payment [INFOGRAPHIC]

Some Highlights

- Many people believe you need to put down 20% of the purchase price when you buy a home. But recent homebuyers actually put down far less on their purchase.

- And with programs like FHA loans, VA loans, and USDA loans, some qualified buyers are able to put down as little as 0-3.5%.

Experts Forecast a Turnaround in the Housing Market in 2023

Should You Rent Your House or Sell It?

Lower Mortgage Rates Are Bringing Buyers Back to the Market

Where Will You Go If You Sell? You Have Options.

- If you’re thinking of buying a home this year, be sure to factor in the long-term benefits of homeownership.

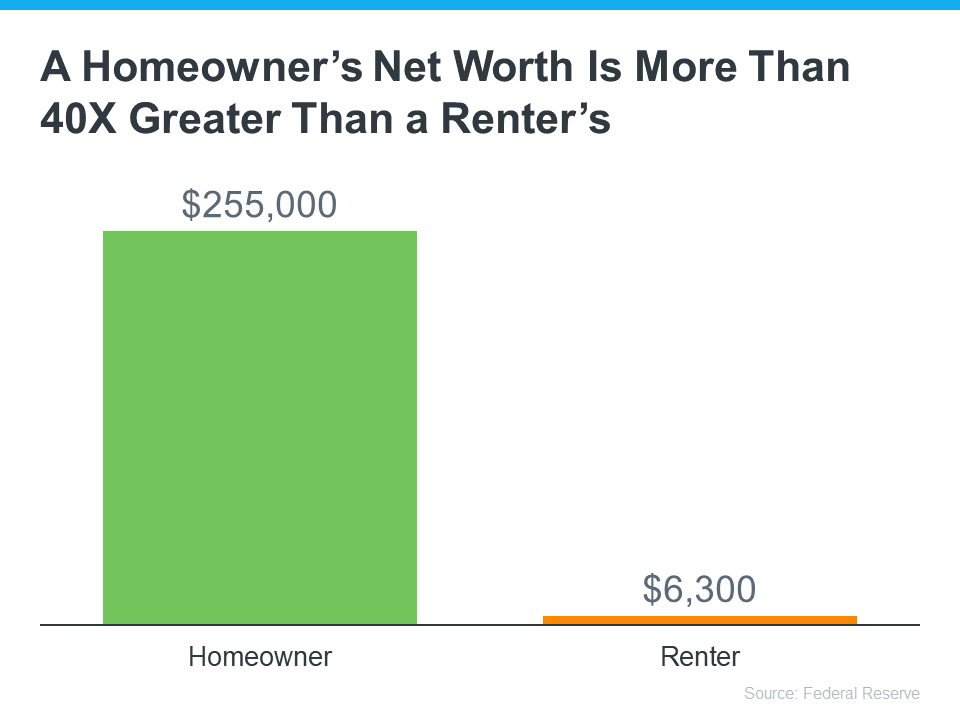

- On average, nationwide, home prices appreciated by 288.7% over the last 32 years. That means homeowners grow their net worth significantly in the long term.

- Homeownership wins over time. Let’s connect so you can start your homebuying journey today.

Some Highlights

- If you’re thinking of buying a home this year, be sure to factor in the long-term benefits of homeownership.

- On average, nationwide, home prices appreciated by 288.7% over the last 32 years. That means homeowners grow their net worth significantly in the long term.

- Homeownership wins over time. Let’s connect so you can start your homebuying journey today.

Some Highlights

- If you’re thinking of buying a home this year, be sure to factor in the long-term benefits of homeownership.

- On average, nationwide, home prices appreciated by 288.7% over the last 32 years. That means homeowners grow their net worth significantly in the long term.

- If you’re thinking of buying a home this year, be sure to factor in the long-term benefits of homeownership.

- On average, nationwide home prices appreciated by 288.7% over the last 32 years. That means homeowners grow their net worth significantly in the long term.

- Homeownership wins over time. Reach out to a real estate professional so you can start your homebuying journey today.

Homeownership Builds Your Wealth over Time [INFOGRAPHIC]

Some Highlights

- If you’re thinking of buying a home this year, be sure to factor in the long-term benefits of homeownership.

- On average, nationwide, home prices appreciated by 288.7% over the last 32 years. That means homeowners grow their net worth significantly in the long term.

![Where Will You Go After You Sell Your House? [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2023/03/02130847/Where-Will-You-Go-After-You-Sell-Your-House-MEM.png)

![Checklist for Selling Your House This Spring [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2023/02/22133439/Checklist-For-Selling-This-Spring-MEM.png)

![The Spring Housing Market Could Be a Sweet Spot for Sellers [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2023/02/16105224/The-Spring-Housing-Market-Could-Be-A-Sweet-Spot-For-Sellers-MEM.png)

![How To Win as a Buyer in Today’s Housing Market [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2023/02/10132046/Resize-UPDATED-MEM_Homeownership-Builds-Your-Wealth-In-The-Over-Time-MEM.png)

![You May Not Need as Much as You Think for Your Down Payment [INFOGRAPHIC] | Simplifying The Market](https://api.simplifyingthemarket.com/wp-content/uploads/2023/02/You-May-Not-Need-As-Much-As-You-Think-For-Your-Down-Payment-MEM.png)

![Homeownership Builds Your Wealth over Time [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2023/01/26130049/Homeownership-Builds-Your-Wealth-In-The-Over-Time-MEM.png)