stdClass Object

(

[agents_bottom_line] =>  La gente en todo el país está empezando a pensar en cómo será su vida el próximo año. Sucede cada otoño, reflexionamos si deberíamos reubicarnos en una parte diferente del país para encontrar un clima mejor durante todo el año o tal vez mudarnos a través del estado para encontrar mejores oportunidades de trabajo. Los propietarios de casa en esta situación deben considerar si ellos deben vender su casa o esperar. Si usted es uno de estos vendedores potenciales, aquí hay cinco razones importantes para hacerlo ahora en lugar de en pleno invierno.

La gente en todo el país está empezando a pensar en cómo será su vida el próximo año. Sucede cada otoño, reflexionamos si deberíamos reubicarnos en una parte diferente del país para encontrar un clima mejor durante todo el año o tal vez mudarnos a través del estado para encontrar mejores oportunidades de trabajo. Los propietarios de casa en esta situación deben considerar si ellos deben vender su casa o esperar. Si usted es uno de estos vendedores potenciales, aquí hay cinco razones importantes para hacerlo ahora en lugar de en pleno invierno.

1.La demanda está fuerte

El tránsito peatonal se refiere al número de personas que están físicamente mirando casas ahora. Los últimos números del tránsito peatonal muestran que hay más compradores potenciales actualmente mirando casas que en cualquier otro momento en los últimos doce meses que incluyen el mercado de los compradores de la primavera. Estos compradores están listos, dispuestos y en capacidad de comprar… ¡y ahora están en el mercado!

A medida que entremos más hacia finales del año, muchas personas tienen otras cosas (el clima, los días festivos, etc.) que los distraen de buscar una casa. Aproveche la actividad actual de los compradores en el mercado.

2. Hay menos competencia ahora

El suministro de la vivienda está aún por debajo del número histórico del suministro de 6 meses. Esto significa que, en muchos mercados, no hay suficientes casas para la venta para satisfacer la cantidad de los compradores en ese mercado. Esta es una buena noticia para los precios de las casas. Sin embargo, el inventario adicional está a punto de llegar al mercado.

Hay un deseo reprimido de muchos propietarios de casas de mudarse, debido a que no podían vender durante los últimos años por el valor líquido negativo. Los propietarios están ahora viendo el regreso del valor líquido positivo a medida que los precios han aumentado durante los últimos dos años. Muchas de estas casas llegaran al mercado en el futuro cercano.

También, las nuevas construcciones de las viviendas unifamiliares esta nuevamente comenzando a aumentar. Un estudio reciente por Harris Poll revelo que 41% de los compradores prefieren comprar una casa nueva mientras que solo 21% prefieren una casa ya existente (38% no tiene preferencia).

Las opciones que tienen los compradores seguirán aumentando durante los próximos meses. No espere hasta que todo este otro inventario de casas llegue al mercado antes de que usted venda.

3. El proceso será más rápido

Uno de los mayores desafíos del mercado de la vivienda de 2014 ha sido la cantidad del tiempo que tarda desde el contrato al cierre. Los bancos exigen más y más papeleo antes de aprobar una hipoteca. Cualquier retraso en el proceso siempre se prolonga durante la temporada de los días festivos del invierno. Hacer que su casa sea vendida y que cierre antes de que empiecen estos retrasos, se presta para tener una transacción más suave.

4. Nunca habrá un mejor momento para mudarse a algo más grande

Si se está mudando a una casa más grande, más costosa, considere hacerlo ahora. Los precios están proyectados para apreciar en más del 19% desde ahora hasta el 2018. Si se está mudando a una casa con un precio más alto, Lo hará costándole más en dólares en bruto (ambos en la cuota inicial y el pago de la hipoteca) si usted espera. Usted puede también bloquear los gastos de vivienda a 30 años con las tasas de interés en los bajos 4 por ciento ahora. Las tasas están proyectadas para ser más del 5% en próximo año.

5. Es hora de continuar con su vida

Vea la razón por la que usted decidió vender en primer lugar y decida si vale la pena esperar. ¿Es el dinero más importante que estar con su familia? ¿Es el dinero más importante que su salud? ¿Es el dinero es más importante que tener la liberta de seguir con su vida de la forma que usted quiere?

Solo usted sabe la respuesta a estas preguntas. Usted tiene el poder de retomar el control de la situación de poner su casa en el mercado y el darle un precio que garantice su venta. Tal vez, ha llegado el momento para que usted y su familia sigan adelante y empiecen a vivir la vida que usted desea.

Eso es lo que es realmente importante.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 6

[name] => Para los vendedores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => sellers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] =>  La gente en todo el país está empezando a pensar en cómo será su vida el próximo año. Sucede cada otoño, reflexionamos si deberíamos reubicarnos en una parte diferente del país para encontrar un clima mejor durante todo el año o tal vez mudarnos a través del estado para encontrar mejores oportunidades de trabajo. Los propietarios de casa en esta situación deben considerar si ellos deben vender su casa o esperar. Si usted es uno de estos vendedores potenciales, aquí hay cinco razones importantes para hacerlo ahora en lugar de en pleno invierno.

La gente en todo el país está empezando a pensar en cómo será su vida el próximo año. Sucede cada otoño, reflexionamos si deberíamos reubicarnos en una parte diferente del país para encontrar un clima mejor durante todo el año o tal vez mudarnos a través del estado para encontrar mejores oportunidades de trabajo. Los propietarios de casa en esta situación deben considerar si ellos deben vender su casa o esperar. Si usted es uno de estos vendedores potenciales, aquí hay cinco razones importantes para hacerlo ahora en lugar de en pleno invierno.

1.La demanda está fuerte

El tránsito peatonal se refiere al número de personas que están físicamente mirando casas ahora. Los últimos números del tránsito peatonal muestran que hay más compradores potenciales actualmente mirando casas que en cualquier otro momento en los últimos doce meses que incluyen el mercado de los compradores de la primavera. Estos compradores están listos, dispuestos y en capacidad de comprar… ¡y ahora están en el mercado!

A medida que entremos más hacia finales del año, muchas personas tienen otras cosas (el clima, los días festivos, etc.) que los distraen de buscar una casa. Aproveche la actividad actual de los compradores en el mercado.

2. Hay menos competencia ahora

El suministro de la vivienda está aún por debajo del número histórico del suministro de 6 meses. Esto significa que, en muchos mercados, no hay suficientes casas para la venta para satisfacer la cantidad de los compradores en ese mercado. Esta es una buena noticia para los precios de las casas. Sin embargo, el inventario adicional está a punto de llegar al mercado.

Hay un deseo reprimido de muchos propietarios de casas de mudarse, debido a que no podían vender durante los últimos años por el valor líquido negativo. Los propietarios están ahora viendo el regreso del valor líquido positivo a medida que los precios han aumentado durante los últimos dos años. Muchas de estas casas llegaran al mercado en el futuro cercano.

También, las nuevas construcciones de las viviendas unifamiliares esta nuevamente comenzando a aumentar. Un estudio reciente por Harris Poll revelo que 41% de los compradores prefieren comprar una casa nueva mientras que solo 21% prefieren una casa ya existente (38% no tiene preferencia).

Las opciones que tienen los compradores seguirán aumentando durante los próximos meses. No espere hasta que todo este otro inventario de casas llegue al mercado antes de que usted venda.

3. El proceso será más rápido

Uno de los mayores desafíos del mercado de la vivienda de 2014 ha sido la cantidad del tiempo que tarda desde el contrato al cierre. Los bancos exigen más y más papeleo antes de aprobar una hipoteca. Cualquier retraso en el proceso siempre se prolonga durante la temporada de los días festivos del invierno. Hacer que su casa sea vendida y que cierre antes de que empiecen estos retrasos, se presta para tener una transacción más suave.

4. Nunca habrá un mejor momento para mudarse a algo más grande

Si se está mudando a una casa más grande, más costosa, considere hacerlo ahora. Los precios están proyectados para apreciar en más del 19% desde ahora hasta el 2018. Si se está mudando a una casa con un precio más alto, Lo hará costándole más en dólares en bruto (ambos en la cuota inicial y el pago de la hipoteca) si usted espera. Usted puede también bloquear los gastos de vivienda a 30 años con las tasas de interés en los bajos 4 por ciento ahora. Las tasas están proyectadas para ser más del 5% en próximo año.

5. Es hora de continuar con su vida

Vea la razón por la que usted decidió vender en primer lugar y decida si vale la pena esperar. ¿Es el dinero más importante que estar con su familia? ¿Es el dinero más importante que su salud? ¿Es el dinero es más importante que tener la liberta de seguir con su vida de la forma que usted quiere?

Solo usted sabe la respuesta a estas preguntas. Usted tiene el poder de retomar el control de la situación de poner su casa en el mercado y el darle un precio que garantice su venta. Tal vez, ha llegado el momento para que usted y su familia sigan adelante y empiecen a vivir la vida que usted desea.

Eso es lo que es realmente importante.

[created_at] => 2014-09-03T06:00:23Z

[description] =>

La gente en todo el país está empezando a pensar en cómo será su vida el próximo año. Sucede cada otoño, reflexionamos si deberíamos reubicarnos en una parte diferente del país para encontrar un clima mejor durante todo el año o tal vez mudarnos ...

[expired_at] =>

[featured_image] => https:///

[id] => 121

[published_at] => 2014-09-03T10:00:23Z

[related] => Array

(

)

[slug] => 5-reasons-to-sell-before-winter-hits

[status] => published

[tags] => Array

(

)

[title] => 5 Razones para vender ANTES de que llegue el invierno

[updated_at] => 2014-09-03T14:41:21Z

[url] => /es/2014/09/03/5-reasons-to-sell-before-winter-hits/

)

5 Razones para vender ANTES de que llegue el invierno

La gente en todo el país está empezando a pensar en cómo será su vida el próximo año. Sucede cada otoño, reflexionamos si deberíamos reubicarnos en una parte diferente del país para encontrar un clima mejor durante todo el año o tal vez mudarnos ...

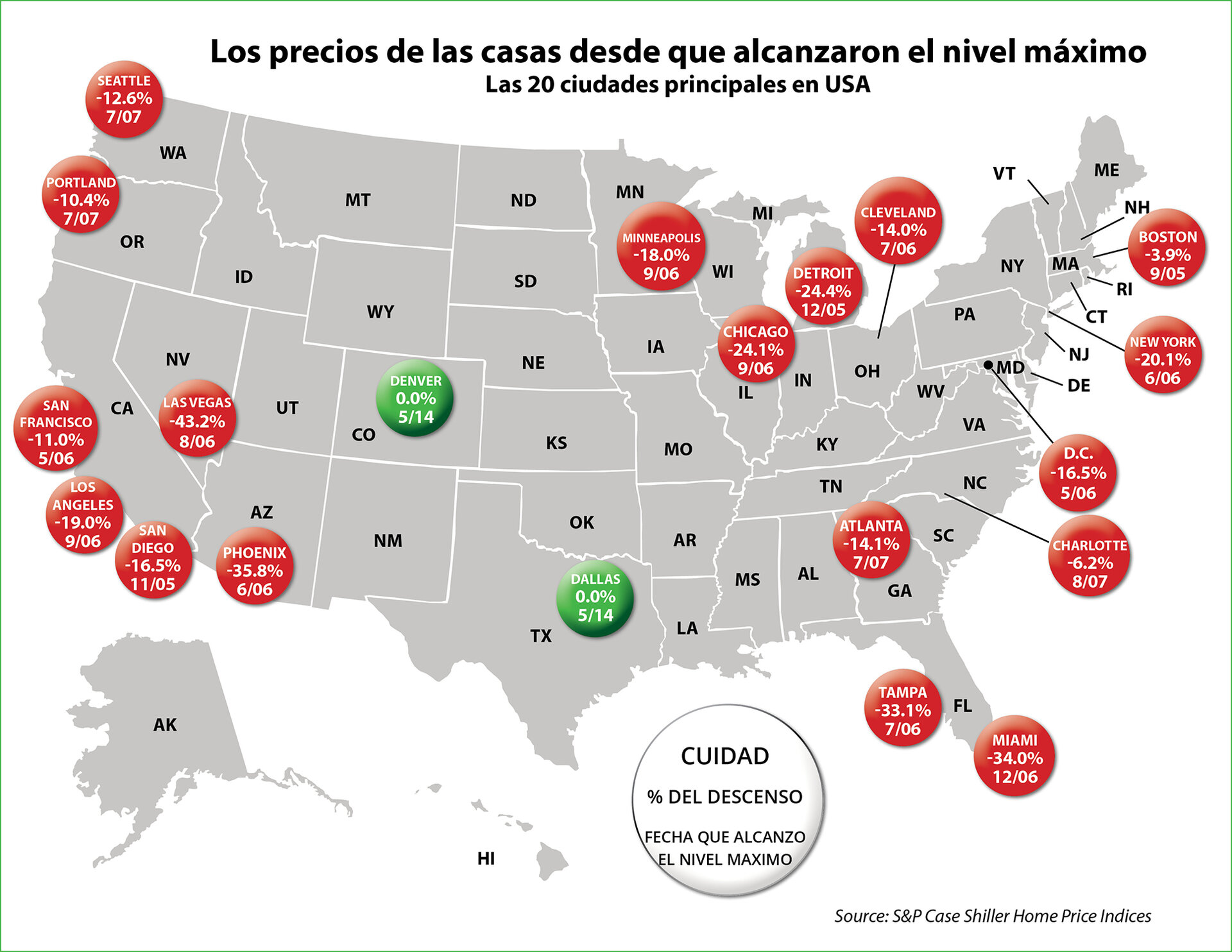

Hay algunas personas que no han comprado una casa porque están incomodos con tomar la obligación de una hipoteca. Todo el mundo debe darse cuenta que, a menos que usted esté viviendo con sus padres libres de alquiler, usted está pagando una hipoteca, sea su hipoteca o la de su arrendador. Como explico un

Hay algunas personas que no han comprado una casa porque están incomodos con tomar la obligación de una hipoteca. Todo el mundo debe darse cuenta que, a menos que usted esté viviendo con sus padres libres de alquiler, usted está pagando una hipoteca, sea su hipoteca o la de su arrendador. Como explico un  Mucha gente sufrió a través de la crisis de la vivienda. Nos dimos cuenta que la mayoría de los dolores de cabeza fueron el resultado de que la vivienda y el mercado de las hipotecases se volvieron locos. Muchos consumidores fueron arrastrados por las aguas de un mercado de la vivienda frenético, que dio lugar a una crisis que incluso los expertos no vieron venir.

Sin embargo, algunos de los sufrimientos fueron causados por las malas decisiones de compradores de casas y vendedores. ¡USTED NO! No compro esa casa que estiraba las finanzas de su familia más allá del punto de la sostenibilidad. Usted no obtuvo un préstamo sobre el capital en la propiedad y compro un esquí acuático nuevo. No hizo una refinanciación para sacar en efectivo la cantidad máxima posible.

En cambio, ¡usted compro una casa que su familia puede disfrutar- y pagar! Usted espero que las tasas de interés bajaran hasta el mínimo histórico y entonces refinancio su casa; no simple mente por sacar dinero pero para bajar sus pagos mensuales.

Usted tiene valor líquido en su casa y un buen, pago de hipoteca bajo. Usted ha jugado el mercado de la vivienda perfectamente.

Mucha gente sufrió a través de la crisis de la vivienda. Nos dimos cuenta que la mayoría de los dolores de cabeza fueron el resultado de que la vivienda y el mercado de las hipotecases se volvieron locos. Muchos consumidores fueron arrastrados por las aguas de un mercado de la vivienda frenético, que dio lugar a una crisis que incluso los expertos no vieron venir.

Sin embargo, algunos de los sufrimientos fueron causados por las malas decisiones de compradores de casas y vendedores. ¡USTED NO! No compro esa casa que estiraba las finanzas de su familia más allá del punto de la sostenibilidad. Usted no obtuvo un préstamo sobre el capital en la propiedad y compro un esquí acuático nuevo. No hizo una refinanciación para sacar en efectivo la cantidad máxima posible.

En cambio, ¡usted compro una casa que su familia puede disfrutar- y pagar! Usted espero que las tasas de interés bajaran hasta el mínimo histórico y entonces refinancio su casa; no simple mente por sacar dinero pero para bajar sus pagos mensuales.

Usted tiene valor líquido en su casa y un buen, pago de hipoteca bajo. Usted ha jugado el mercado de la vivienda perfectamente.

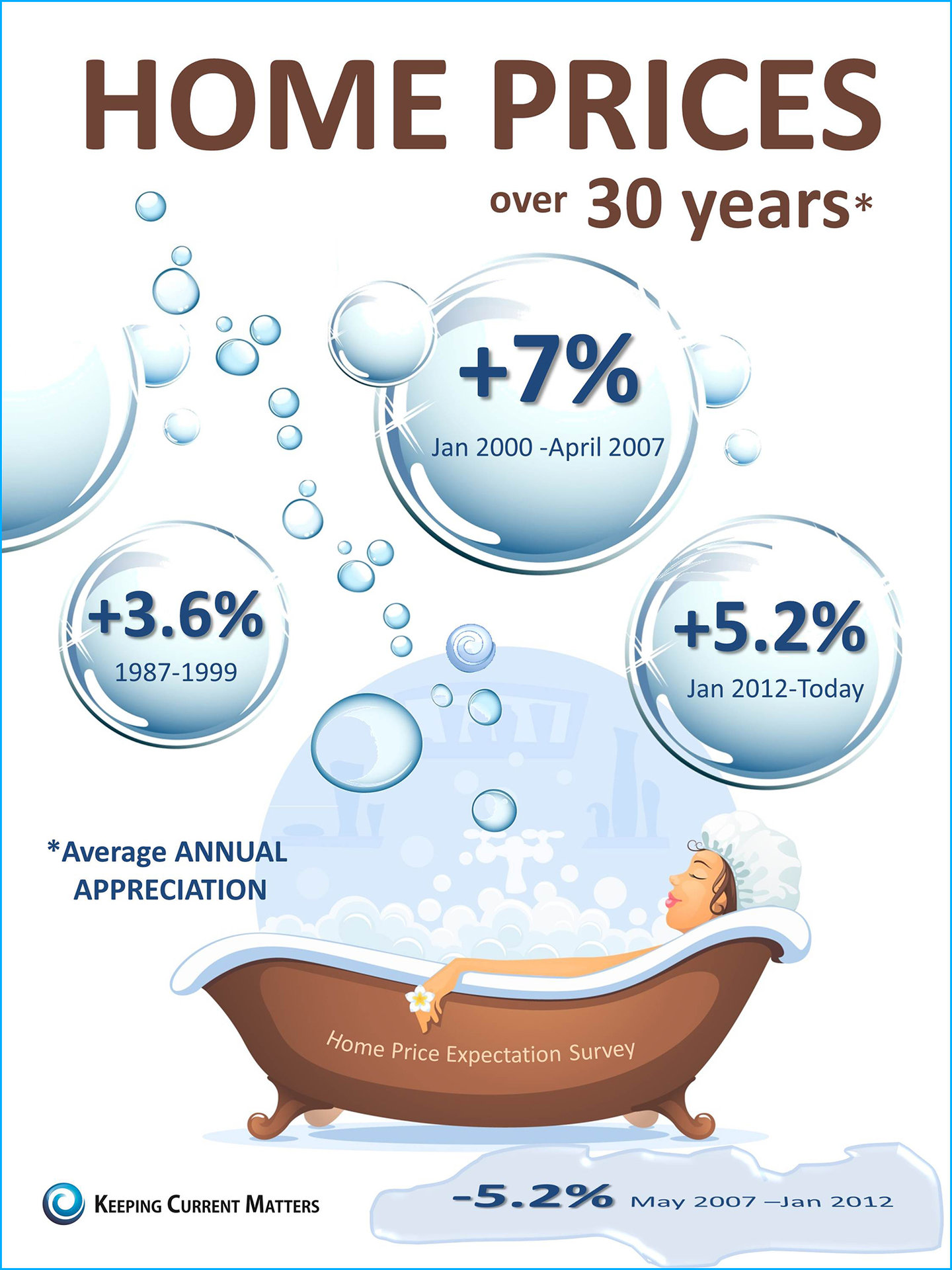

Hoy en día, muchas conversaciones de bienes raíces se centran en los precios de la vivienda y hacia donde se dirigen. Es por eso que nos gusta la encuesta Home Price Expectation. Cada trimestre, Pulsenomics encuesta a un panel nacional de más de cien economistas, expertos en bienes raíces e inversiones & estrategas del mercado; sobre hacia donde se dirigen los precios durante los próximos cinco años. Entonces ellos sacan un promedio de las proyecciones de los más de 100 expertos en un solo número.

Los resultados de su última encuesta:

Hoy en día, muchas conversaciones de bienes raíces se centran en los precios de la vivienda y hacia donde se dirigen. Es por eso que nos gusta la encuesta Home Price Expectation. Cada trimestre, Pulsenomics encuesta a un panel nacional de más de cien economistas, expertos en bienes raíces e inversiones & estrategas del mercado; sobre hacia donde se dirigen los precios durante los próximos cinco años. Entonces ellos sacan un promedio de las proyecciones de los más de 100 expertos en un solo número.

Los resultados de su última encuesta:

Aquí hay cuatro buenas razones que considerar al comprar una casa hoy en vez de esperar.

Aquí hay cuatro buenas razones que considerar al comprar una casa hoy en vez de esperar.

We are pleased to have KCM Founder and Chief Content Creator, Steve Harney, do a personal post today. Enjoy!

That is what a headline announced in a CNNMoney

We are pleased to have KCM Founder and Chief Content Creator, Steve Harney, do a personal post today. Enjoy!

That is what a headline announced in a CNNMoney  New reports are revealing that the number of months’ inventory of existing homes available for sale is increasing. Some of these sellers are moving up, some are downsizing and others are making a lateral move.

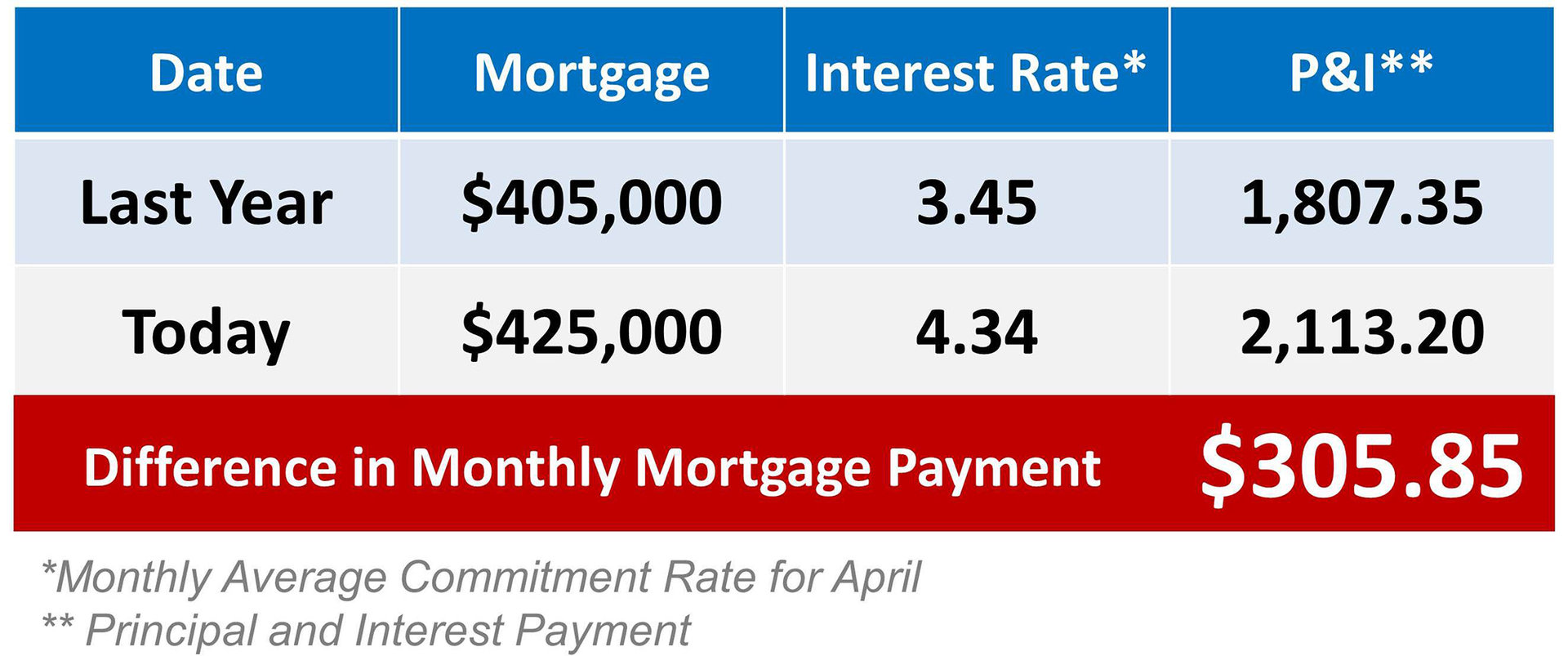

There is no way for us to predict the future but we can look at what happened over the last year. Let’s look at buyers that considered moving up last year but decided to wait instead.

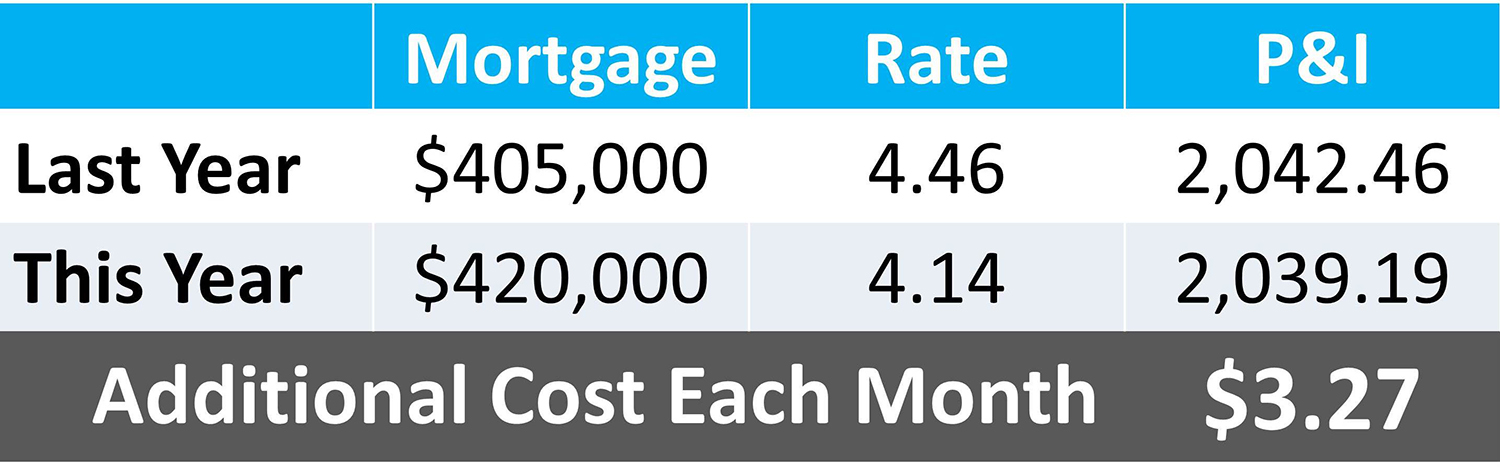

Assume, last year, they had a home worth $300,000 and were looking at a home for $450,000 (putting 10% down they would get a mortgage of $405,000). By waiting, their house appreciated by approximately 10% over the last year (national average based on the Case Shiller Pricing Index). Their home would now be worth $330,000. But, the $450,000 home would now be worth $495,000 (requiring a mortgage of $420,000 assuming the original $45,000 down plus the additional $30,000 from the sale of their home).

Here is a table showing what the difference in monthly cost (principal and interest) would be if a purchaser had waited:

New reports are revealing that the number of months’ inventory of existing homes available for sale is increasing. Some of these sellers are moving up, some are downsizing and others are making a lateral move.

There is no way for us to predict the future but we can look at what happened over the last year. Let’s look at buyers that considered moving up last year but decided to wait instead.

Assume, last year, they had a home worth $300,000 and were looking at a home for $450,000 (putting 10% down they would get a mortgage of $405,000). By waiting, their house appreciated by approximately 10% over the last year (national average based on the Case Shiller Pricing Index). Their home would now be worth $330,000. But, the $450,000 home would now be worth $495,000 (requiring a mortgage of $420,000 assuming the original $45,000 down plus the additional $30,000 from the sale of their home).

Here is a table showing what the difference in monthly cost (principal and interest) would be if a purchaser had waited:

We all realize that the best time to sell anything is when demand is high and the supply of that item is limited. The last two major reports issued by the National Association of Realtors (NAR) revealed information that suggests that now may be the best time to sell your house. Let’s look at the data covered by the latest

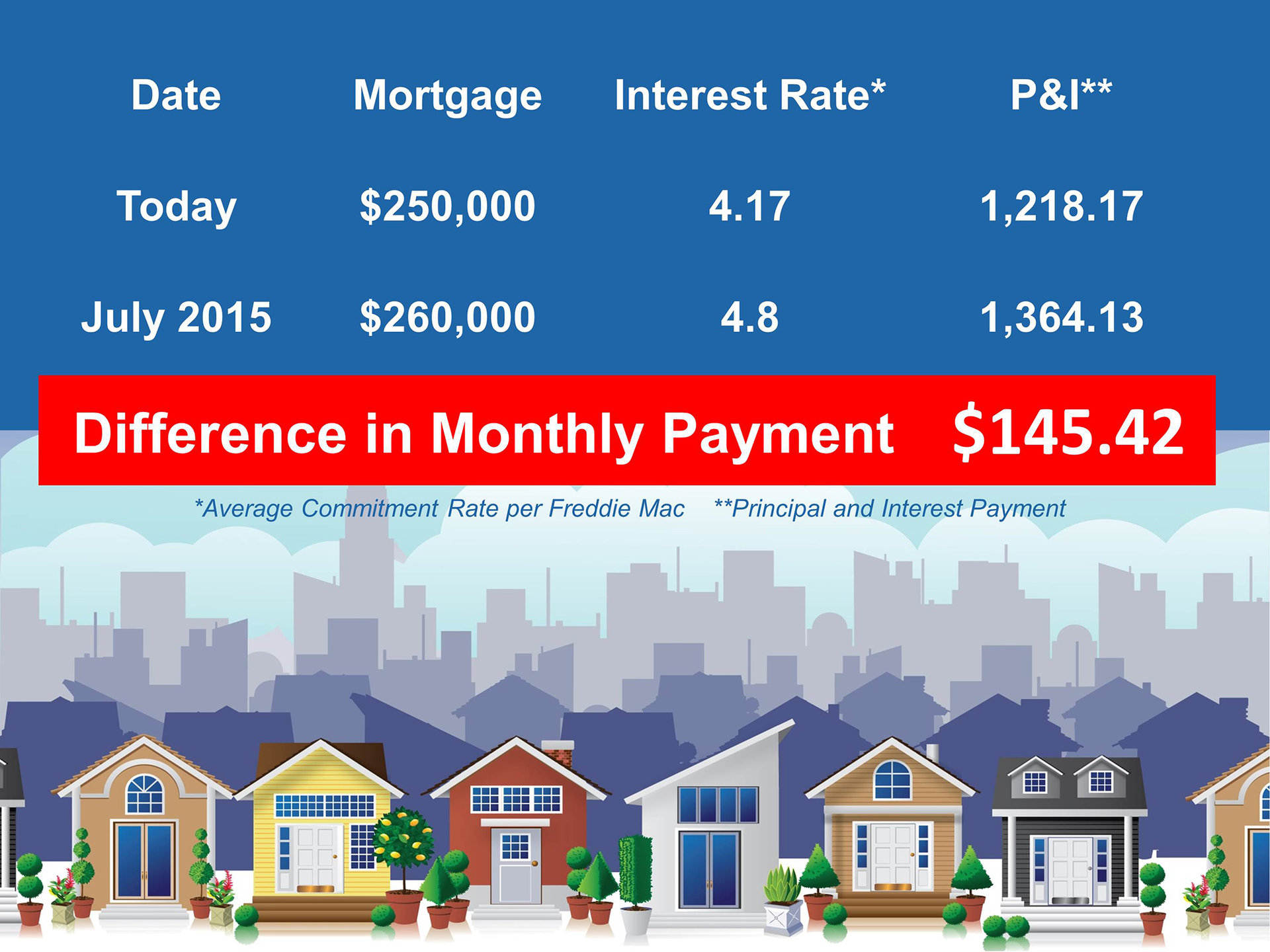

We all realize that the best time to sell anything is when demand is high and the supply of that item is limited. The last two major reports issued by the National Association of Realtors (NAR) revealed information that suggests that now may be the best time to sell your house. Let’s look at the data covered by the latest  Whether you are a first time buyer or a move-up buyer, you should look at the projections housing experts are making in two major areas: home prices and mortgage rates.

Whether you are a first time buyer or a move-up buyer, you should look at the projections housing experts are making in two major areas: home prices and mortgage rates.

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

There has been a lot written about how buying a home is less expensive than renting one in most parts of the country. Rents are skyrocketing and homes are still at great prices. These two situations are also causing some sellers to consider renting their home instead of selling it. After all, a homeowner can get great rental income now and perhaps wait until house values increase even further before selling.

This logic makes sense in some cases. There is a strong belief that residential real estate is a great investment right now. However, if you have no desire to actually become an educated investor in this sector, you may be headed for more trouble than you were looking for.

Before renting your home, you should answer the following questions to make sure this is the right course of action for you and your family.

There has been a lot written about how buying a home is less expensive than renting one in most parts of the country. Rents are skyrocketing and homes are still at great prices. These two situations are also causing some sellers to consider renting their home instead of selling it. After all, a homeowner can get great rental income now and perhaps wait until house values increase even further before selling.

This logic makes sense in some cases. There is a strong belief that residential real estate is a great investment right now. However, if you have no desire to actually become an educated investor in this sector, you may be headed for more trouble than you were looking for.

Before renting your home, you should answer the following questions to make sure this is the right course of action for you and your family.

Here are four great reasons to consider buying a home today, instead of waiting.

Here are four great reasons to consider buying a home today, instead of waiting.

American consumers’ perception of the residential real estate market was revealed in a recent

American consumers’ perception of the residential real estate market was revealed in a recent  Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

Many experts are currently discussing a variety of topics such as real estate as an investment, the movement on mortgage interest rates and reasons to buy now instead of waiting. It is important that we realize that this does not apply solely to the first time home buyer.

The opportunity that exists in real estate today is there for everyone.

However, the family that already owns a home might be thinking that, if they wait, their home could be worth more next year than it is now. And that may cause them to delay moving up to the home of their dreams thinking it makes good financial sense. Actually, the opposite is true. This is the best chance a family has to buy up into the home that makes sense for their family right now.

We must realize that whatever percentage of value we gain on our house will also be gained on our dream home.

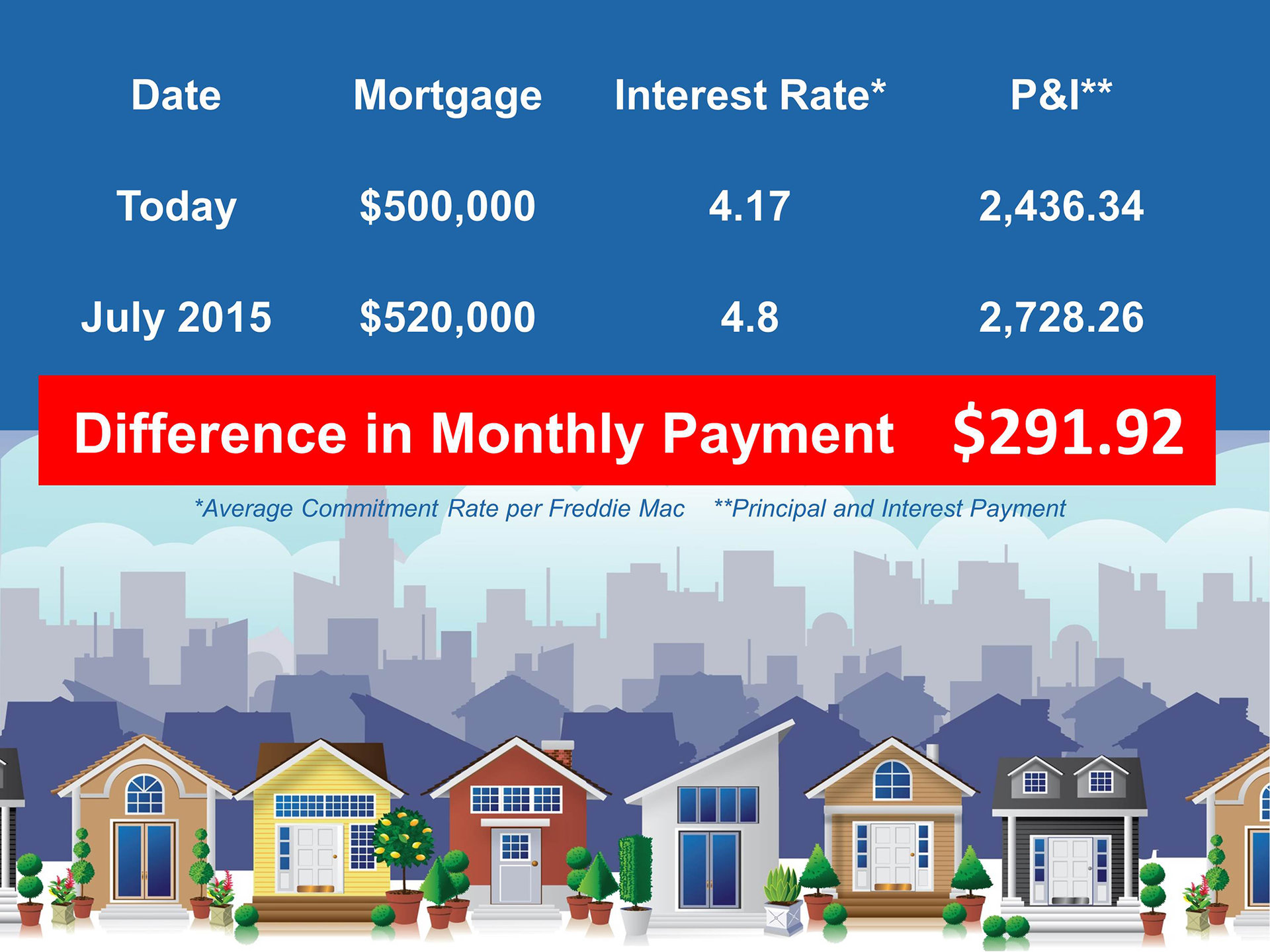

Let’s assume your current home is worth $500,000. Your house will be worth $520,000 next year if prices rise by 4% over that time (a number projected by the Home Price Expectation Survey).

However, the $750,000 home you are hoping to move into will also appreciate by about that same 4%. That means next year it will be valued at $780,000. You wouldn’t make $20,000 by waiting. You would actually be losing $10,000 ($30,000 - $20,000).

And, you will pay a lower interest rate on the mortgage than you probably will next year.

Plug in the numbers that apply to your house and the home you are longing to buy and see what the bottom line turns out to be for you.

That is how wealth is built in this country - by purchasing real estate at the right time, at the right price and at the right terms.

Go out and find your family's dream house and buy it! Ten years from now, you will be glad you did!

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => Para los compradores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)

Many experts are currently discussing a variety of topics such as real estate as an investment, the movement on mortgage interest rates and reasons to buy now instead of waiting. It is important that we realize that this does not apply solely to the first time home buyer.

The opportunity that exists in real estate today is there for everyone.

However, the family that already owns a home might be thinking that, if they wait, their home could be worth more next year than it is now. And that may cause them to delay moving up to the home of their dreams thinking it makes good financial sense. Actually, the opposite is true. This is the best chance a family has to buy up into the home that makes sense for their family right now.

We must realize that whatever percentage of value we gain on our house will also be gained on our dream home.

Let’s assume your current home is worth $500,000. Your house will be worth $520,000 next year if prices rise by 4% over that time (a number projected by the Home Price Expectation Survey).

However, the $750,000 home you are hoping to move into will also appreciate by about that same 4%. That means next year it will be valued at $780,000. You wouldn’t make $20,000 by waiting. You would actually be losing $10,000 ($30,000 - $20,000).

And, you will pay a lower interest rate on the mortgage than you probably will next year.

Plug in the numbers that apply to your house and the home you are longing to buy and see what the bottom line turns out to be for you.

That is how wealth is built in this country - by purchasing real estate at the right time, at the right price and at the right terms.

Go out and find your family's dream house and buy it! Ten years from now, you will be glad you did!

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => Para los compradores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)  A recent

A recent

Today, many real estate conversations center on housing prices and where they may be headed. That is why the Home Price Expectation Survey is a great barometer. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

The results of their latest survey

Today, many real estate conversations center on housing prices and where they may be headed. That is why the Home Price Expectation Survey is a great barometer. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

The results of their latest survey

Whether you are buying or selling a home, you need an experienced Real Estate Professional to lead you toward your ultimate goal. In this world of instant gratification and Internet searches, many sellers think that they can For Sale by Owner or FSBO.

The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but rather have been strengthened in recent months due to

Whether you are buying or selling a home, you need an experienced Real Estate Professional to lead you toward your ultimate goal. In this world of instant gratification and Internet searches, many sellers think that they can For Sale by Owner or FSBO.

The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but rather have been strengthened in recent months due to  I have been a subscriber to the Wall Street Journal (WSJ) for as long as I can remember. In my opinion, it is the single greatest source of financial information and insights available. I don’t always agree with their analysis but I always respect their position.

However, in an article this past weekend,

I have been a subscriber to the Wall Street Journal (WSJ) for as long as I can remember. In my opinion, it is the single greatest source of financial information and insights available. I don’t always agree with their analysis but I always respect their position.

However, in an article this past weekend,