stdClass Object

(

[agents_bottom_line] =>  Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

1. Demand is Strong

There is currently a pent-up demand of purchasers as many home buyers pushed off their search this past winter & early spring because of extreme weather. According to the National Association of Realtors (NAR), the number of buyers in the market, which feel off dramatically in December, January and February, has begun to increase again over the last few months. These buyers are ready, willing and able to buy…and are in the market right now!

2. There Is Less Competition Now

Housing supply is still under the historical number of 6 months’ supply. This means that, in many markets, there are not enough homes for sale to satisfy the number of buyers in that market. This is good news for home prices. However, additional inventory is about to come to market. There is a pent-up desire for many homeowners to move as they were unable to sell over the last few years because of a negative equity situation. Homeowners are now seeing a return to positive equity as prices increased over the last eighteen months. Many of these homes will be coming to the market in the near future. Also, new construction of single-family homes is again beginning to increase. A recent study by Harris Poll revealed that 41% of buyers would prefer to buy a new home while only 21% prefer an existing home (38% had no preference). The choices buyers have will continue to increase over the next few months. Don’t wait until all this other inventory of homes comes to market before you sell.

3. The Process Will Be Quicker

One of the biggest challenges of the 2014 housing market has been the length of time it takes from contract to closing. Banks are requiring more and more paperwork before approving a mortgage. As the market heats up, banks will be inundated with loan inquiries causing closing timelines to lengthen. Selling now will make the process quicker and simpler.

4. There Will Never Be a Better Time to Move-Up

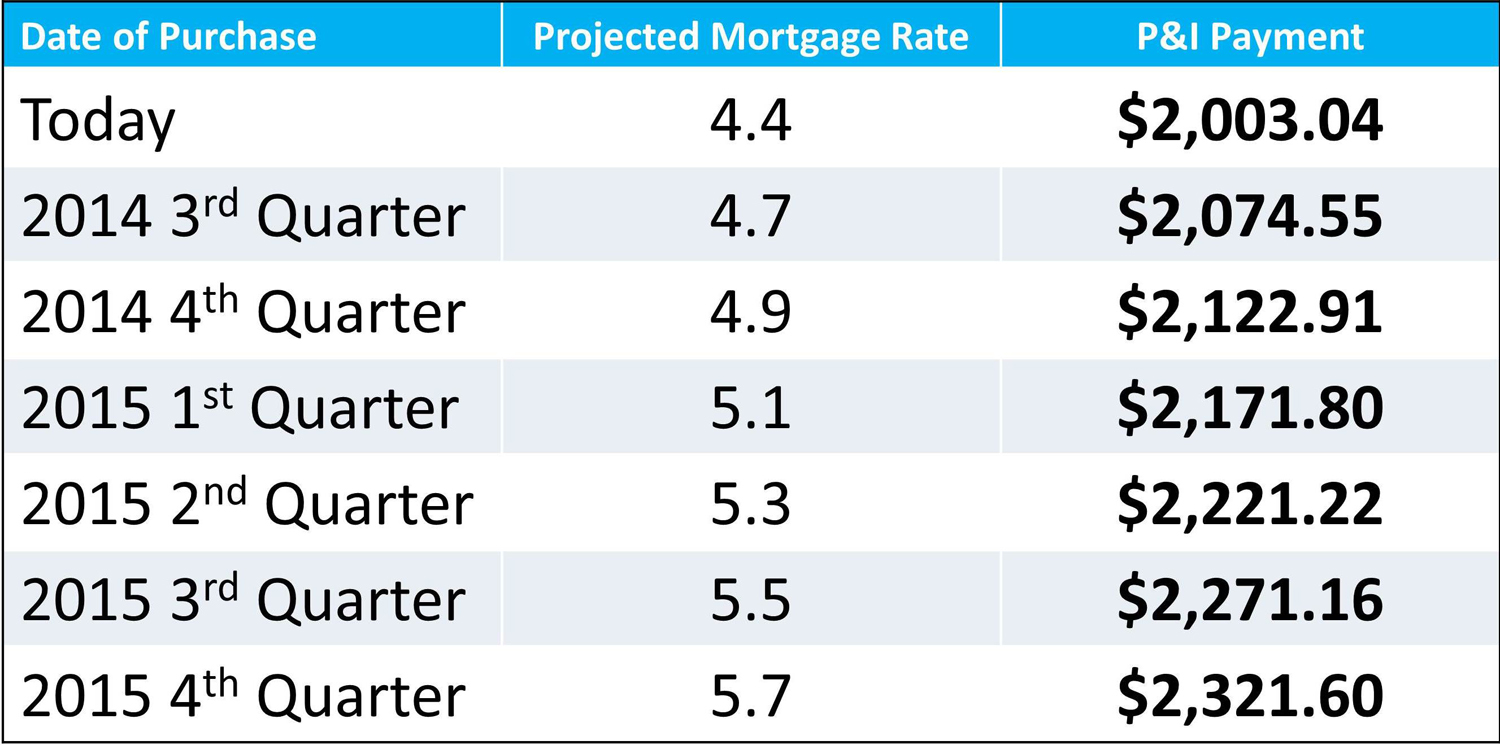

If you are moving up to a larger, more expensive home, consider doing it now. Prices are projected to appreciate by over 19% from now to 2018. If you are moving to a higher priced home, it will wind-up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. You can also lock-in your 30 year housing expense with an interest rate in the low 4’s right now. Rates are projected to be over 5% by the end of next year.

5. It’s Time to Move On with Your Life

Look at the reason you decided to sell in the first place and determine whether it is worth waiting. Is money more important than being with family? Is money more important than your health? Is money more important than having the freedom to go on with your life the way you think you should? Only you know the answers to the questions above. You have the power to take back control of the situation by putting your home on the market and pricing it so it sells. Perhaps, the time has come for you and your family to move on and start living the life you desire. That is what is truly important.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 6

[name] => For Sellers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => sellers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los vendedores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] =>  Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

1. Demand is Strong

There is currently a pent-up demand of purchasers as many home buyers pushed off their search this past winter & early spring because of extreme weather. According to the National Association of Realtors (NAR), the number of buyers in the market, which feel off dramatically in December, January and February, has begun to increase again over the last few months. These buyers are ready, willing and able to buy…and are in the market right now!

2. There Is Less Competition Now

Housing supply is still under the historical number of 6 months’ supply. This means that, in many markets, there are not enough homes for sale to satisfy the number of buyers in that market. This is good news for home prices. However, additional inventory is about to come to market. There is a pent-up desire for many homeowners to move as they were unable to sell over the last few years because of a negative equity situation. Homeowners are now seeing a return to positive equity as prices increased over the last eighteen months. Many of these homes will be coming to the market in the near future. Also, new construction of single-family homes is again beginning to increase. A recent study by Harris Poll revealed that 41% of buyers would prefer to buy a new home while only 21% prefer an existing home (38% had no preference). The choices buyers have will continue to increase over the next few months. Don’t wait until all this other inventory of homes comes to market before you sell.

3. The Process Will Be Quicker

One of the biggest challenges of the 2014 housing market has been the length of time it takes from contract to closing. Banks are requiring more and more paperwork before approving a mortgage. As the market heats up, banks will be inundated with loan inquiries causing closing timelines to lengthen. Selling now will make the process quicker and simpler.

4. There Will Never Be a Better Time to Move-Up

If you are moving up to a larger, more expensive home, consider doing it now. Prices are projected to appreciate by over 19% from now to 2018. If you are moving to a higher priced home, it will wind-up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. You can also lock-in your 30 year housing expense with an interest rate in the low 4’s right now. Rates are projected to be over 5% by the end of next year.

5. It’s Time to Move On with Your Life

Look at the reason you decided to sell in the first place and determine whether it is worth waiting. Is money more important than being with family? Is money more important than your health? Is money more important than having the freedom to go on with your life the way you think you should? Only you know the answers to the questions above. You have the power to take back control of the situation by putting your home on the market and pricing it so it sells. Perhaps, the time has come for you and your family to move on and start living the life you desire. That is what is truly important.

[created_at] => 2014-07-21T06:00:38Z

[description] =>

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your ho...

[expired_at] =>

[featured_image] => https:///

[id] => 89

[published_at] => 2014-07-21T10:00:38Z

[related] => Array

(

)

[slug] => selling-your-house-5-reasons-to-do-it-now-2

[status] => published

[tags] => Array

(

)

[title] => Selling Your House? 5 Reasons to Do It Now!

[updated_at] => 2015-05-09T00:55:56Z

[url] => /2014/07/21/selling-your-house-5-reasons-to-do-it-now-2/

)

Selling Your House? 5 Reasons to Do It Now!

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your ho...

We are pleased to have KCM Founder and Chief Content Creator, Steve Harney, do a personal post today. Enjoy!

That is what a headline announced in a CNNMoney

We are pleased to have KCM Founder and Chief Content Creator, Steve Harney, do a personal post today. Enjoy!

That is what a headline announced in a CNNMoney  New reports are revealing that the number of months’ inventory of existing homes available for sale is increasing. Some of these sellers are moving up, some are downsizing and others are making a lateral move.

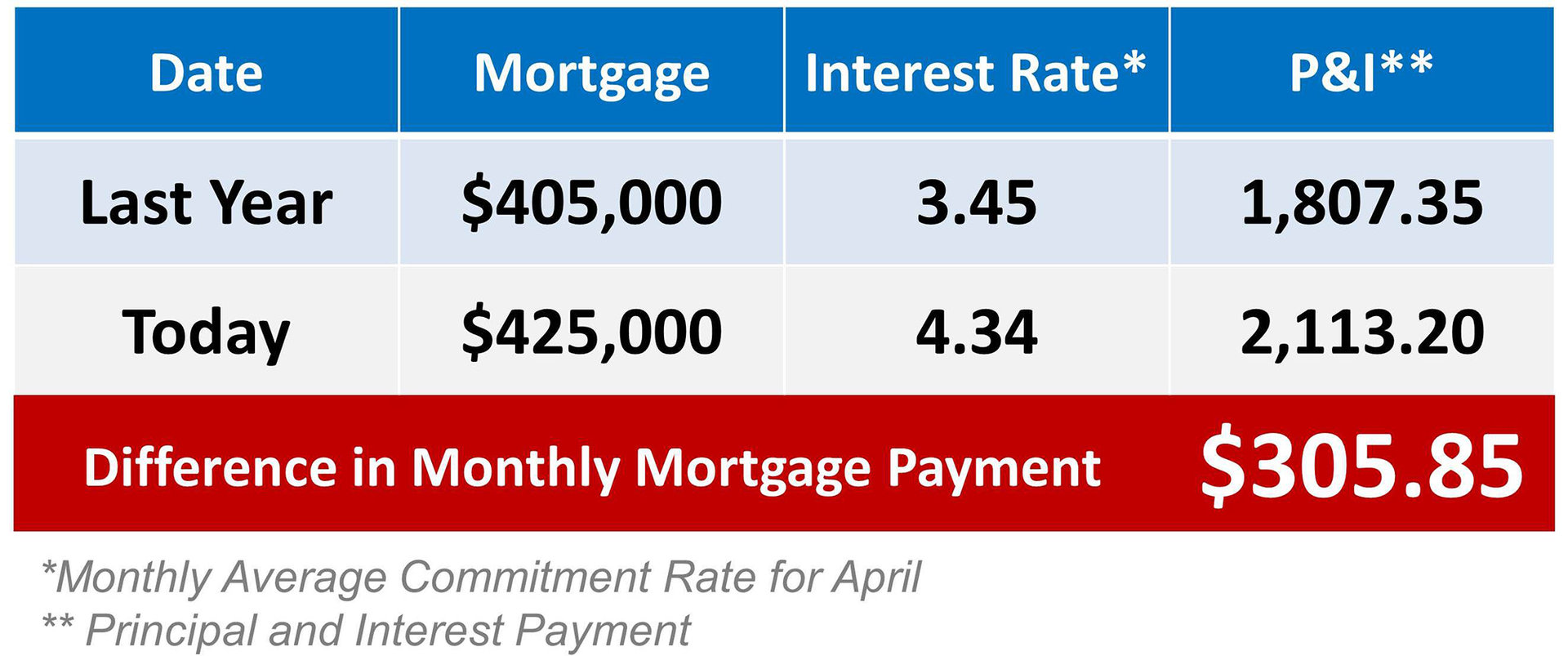

There is no way for us to predict the future but we can look at what happened over the last year. Let’s look at buyers that considered moving up last year but decided to wait instead.

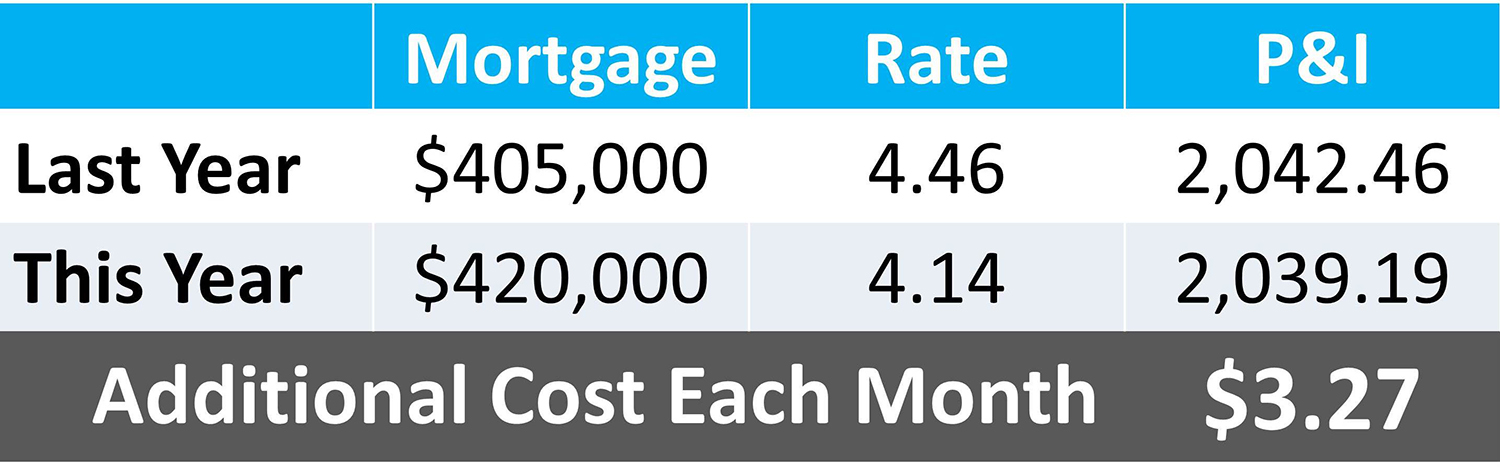

Assume, last year, they had a home worth $300,000 and were looking at a home for $450,000 (putting 10% down they would get a mortgage of $405,000). By waiting, their house appreciated by approximately 10% over the last year (national average based on the Case Shiller Pricing Index). Their home would now be worth $330,000. But, the $450,000 home would now be worth $495,000 (requiring a mortgage of $420,000 assuming the original $45,000 down plus the additional $30,000 from the sale of their home).

Here is a table showing what the difference in monthly cost (principal and interest) would be if a purchaser had waited:

New reports are revealing that the number of months’ inventory of existing homes available for sale is increasing. Some of these sellers are moving up, some are downsizing and others are making a lateral move.

There is no way for us to predict the future but we can look at what happened over the last year. Let’s look at buyers that considered moving up last year but decided to wait instead.

Assume, last year, they had a home worth $300,000 and were looking at a home for $450,000 (putting 10% down they would get a mortgage of $405,000). By waiting, their house appreciated by approximately 10% over the last year (national average based on the Case Shiller Pricing Index). Their home would now be worth $330,000. But, the $450,000 home would now be worth $495,000 (requiring a mortgage of $420,000 assuming the original $45,000 down plus the additional $30,000 from the sale of their home).

Here is a table showing what the difference in monthly cost (principal and interest) would be if a purchaser had waited:

We all realize that the best time to sell anything is when demand is high and the supply of that item is limited. The last two major reports issued by the National Association of Realtors (NAR) revealed information that suggests that now may be the best time to sell your house. Let’s look at the data covered by the latest

We all realize that the best time to sell anything is when demand is high and the supply of that item is limited. The last two major reports issued by the National Association of Realtors (NAR) revealed information that suggests that now may be the best time to sell your house. Let’s look at the data covered by the latest  Whether you are a first time buyer or a move-up buyer, you should look at the projections housing experts are making in two major areas: home prices and mortgage rates.

Whether you are a first time buyer or a move-up buyer, you should look at the projections housing experts are making in two major areas: home prices and mortgage rates.

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

There has been a lot written about how buying a home is less expensive than renting one in most parts of the country. Rents are skyrocketing and homes are still at great prices. These two situations are also causing some sellers to consider renting their home instead of selling it. After all, a homeowner can get great rental income now and perhaps wait until house values increase even further before selling.

This logic makes sense in some cases. There is a strong belief that residential real estate is a great investment right now. However, if you have no desire to actually become an educated investor in this sector, you may be headed for more trouble than you were looking for.

Before renting your home, you should answer the following questions to make sure this is the right course of action for you and your family.

There has been a lot written about how buying a home is less expensive than renting one in most parts of the country. Rents are skyrocketing and homes are still at great prices. These two situations are also causing some sellers to consider renting their home instead of selling it. After all, a homeowner can get great rental income now and perhaps wait until house values increase even further before selling.

This logic makes sense in some cases. There is a strong belief that residential real estate is a great investment right now. However, if you have no desire to actually become an educated investor in this sector, you may be headed for more trouble than you were looking for.

Before renting your home, you should answer the following questions to make sure this is the right course of action for you and your family.

Here are four great reasons to consider buying a home today, instead of waiting.

Here are four great reasons to consider buying a home today, instead of waiting.

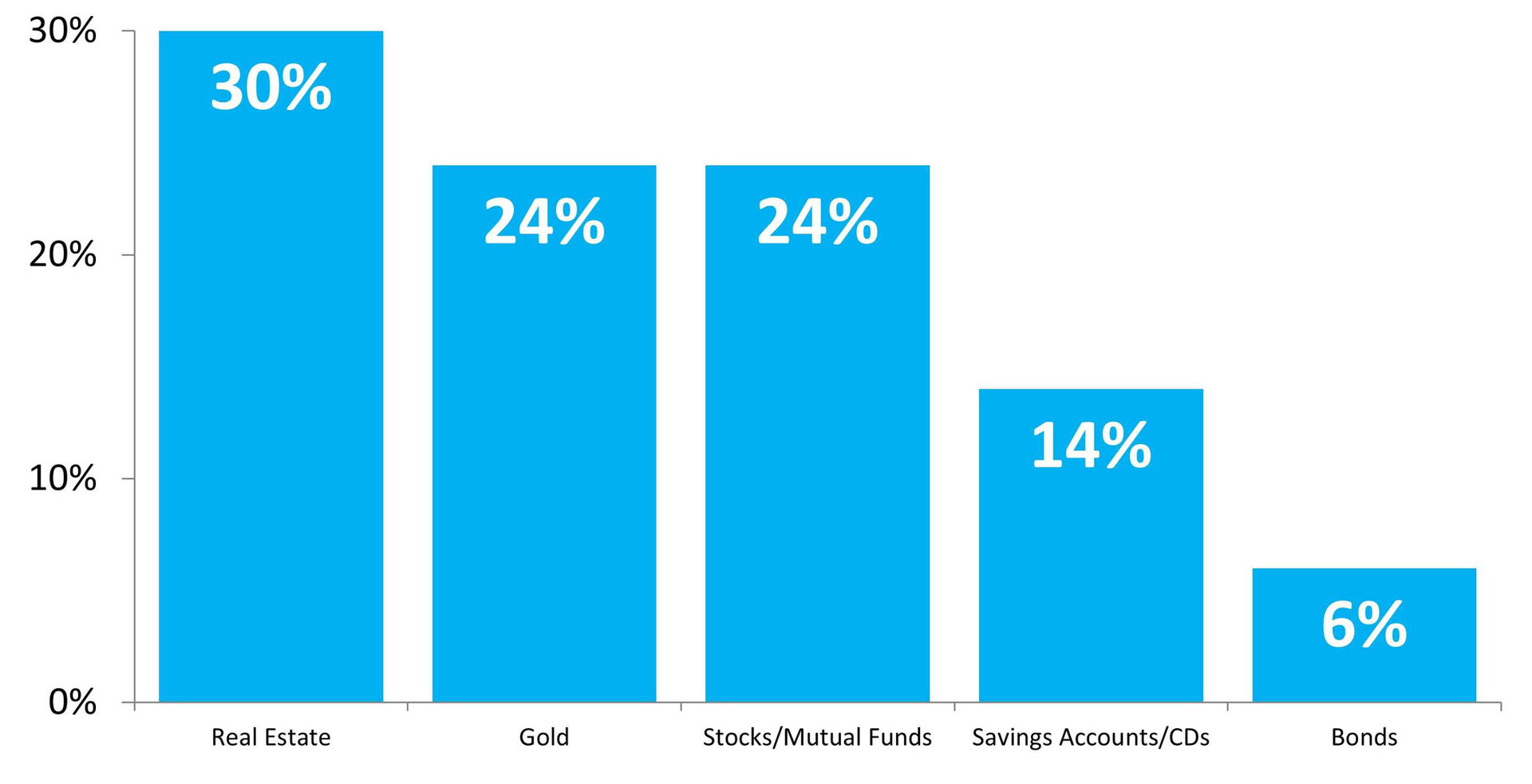

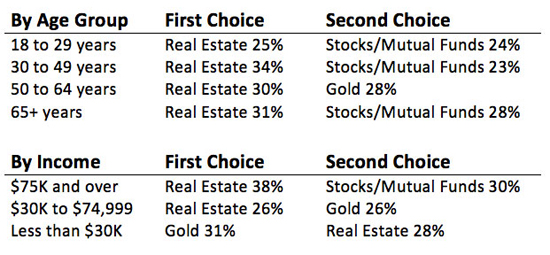

American consumers’ perception of the residential real estate market was revealed in a recent

American consumers’ perception of the residential real estate market was revealed in a recent  Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

Many experts are currently discussing a variety of topics such as real estate as an investment, the movement on mortgage interest rates and reasons to buy now instead of waiting. It is important that we realize that this does not apply solely to the first time home buyer.

The opportunity that exists in real estate today is there for everyone.

However, the family that already owns a home might be thinking that, if they wait, their home could be worth more next year than it is now. And that may cause them to delay moving up to the home of their dreams thinking it makes good financial sense. Actually, the opposite is true. This is the best chance a family has to buy up into the home that makes sense for their family right now.

We must realize that whatever percentage of value we gain on our house will also be gained on our dream home.

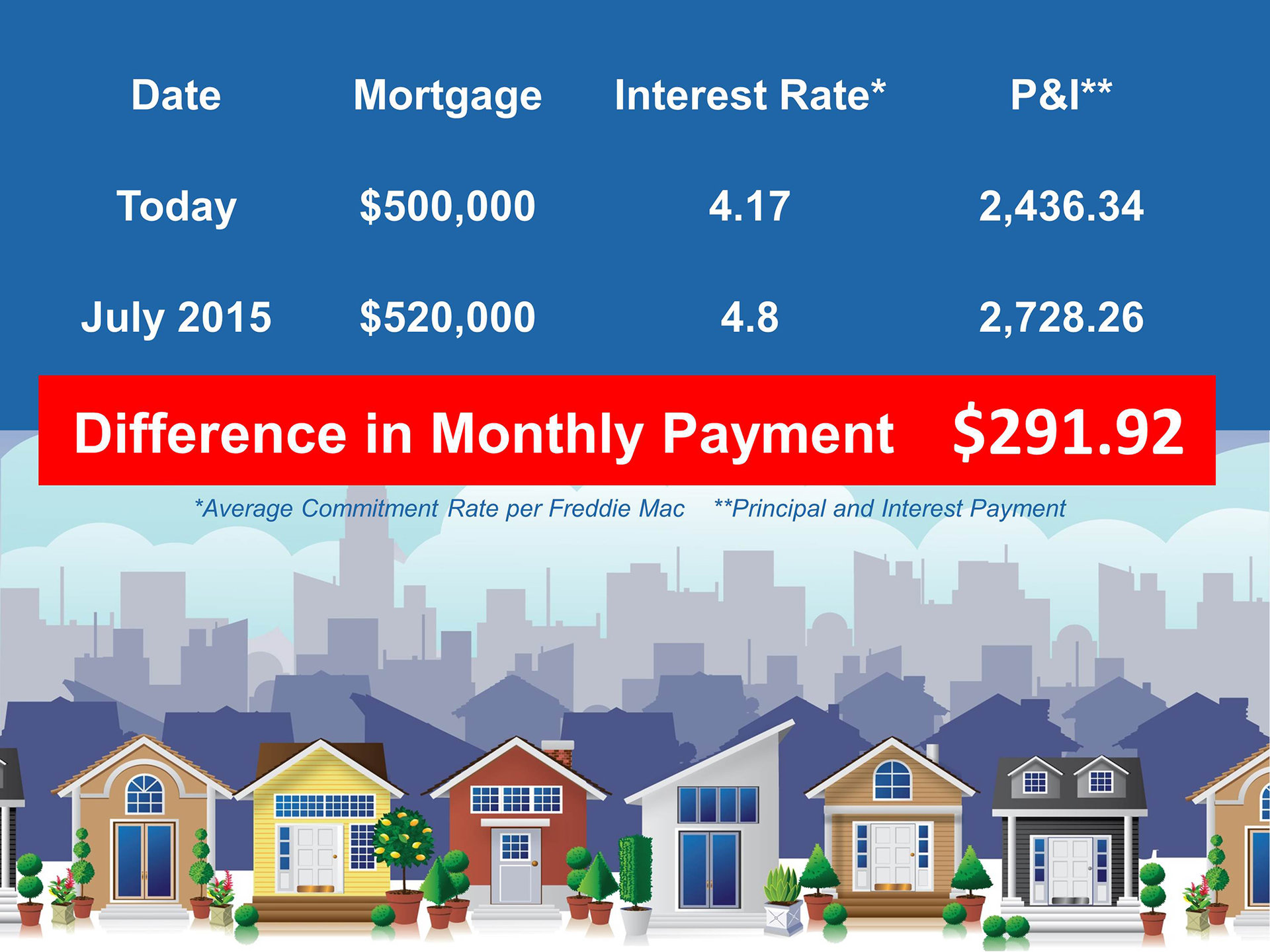

Let’s assume your current home is worth $500,000. Your house will be worth $520,000 next year if prices rise by 4% over that time (a number projected by the Home Price Expectation Survey).

However, the $750,000 home you are hoping to move into will also appreciate by about that same 4%. That means next year it will be valued at $780,000. You wouldn’t make $20,000 by waiting. You would actually be losing $10,000 ($30,000 - $20,000).

And, you will pay a lower interest rate on the mortgage than you probably will next year.

Plug in the numbers that apply to your house and the home you are longing to buy and see what the bottom line turns out to be for you.

That is how wealth is built in this country - by purchasing real estate at the right time, at the right price and at the right terms.

Go out and find your family's dream house and buy it! Ten years from now, you will be glad you did!

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => For Buyers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los compradores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] =>

Many experts are currently discussing a variety of topics such as real estate as an investment, the movement on mortgage interest rates and reasons to buy now instead of waiting. It is important that we realize that this does not apply solely to the first time home buyer.

The opportunity that exists in real estate today is there for everyone.

However, the family that already owns a home might be thinking that, if they wait, their home could be worth more next year than it is now. And that may cause them to delay moving up to the home of their dreams thinking it makes good financial sense. Actually, the opposite is true. This is the best chance a family has to buy up into the home that makes sense for their family right now.

We must realize that whatever percentage of value we gain on our house will also be gained on our dream home.

Let’s assume your current home is worth $500,000. Your house will be worth $520,000 next year if prices rise by 4% over that time (a number projected by the Home Price Expectation Survey).

However, the $750,000 home you are hoping to move into will also appreciate by about that same 4%. That means next year it will be valued at $780,000. You wouldn’t make $20,000 by waiting. You would actually be losing $10,000 ($30,000 - $20,000).

And, you will pay a lower interest rate on the mortgage than you probably will next year.

Plug in the numbers that apply to your house and the home you are longing to buy and see what the bottom line turns out to be for you.

That is how wealth is built in this country - by purchasing real estate at the right time, at the right price and at the right terms.

Go out and find your family's dream house and buy it! Ten years from now, you will be glad you did!

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => For Buyers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los compradores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] =>  A recent

A recent

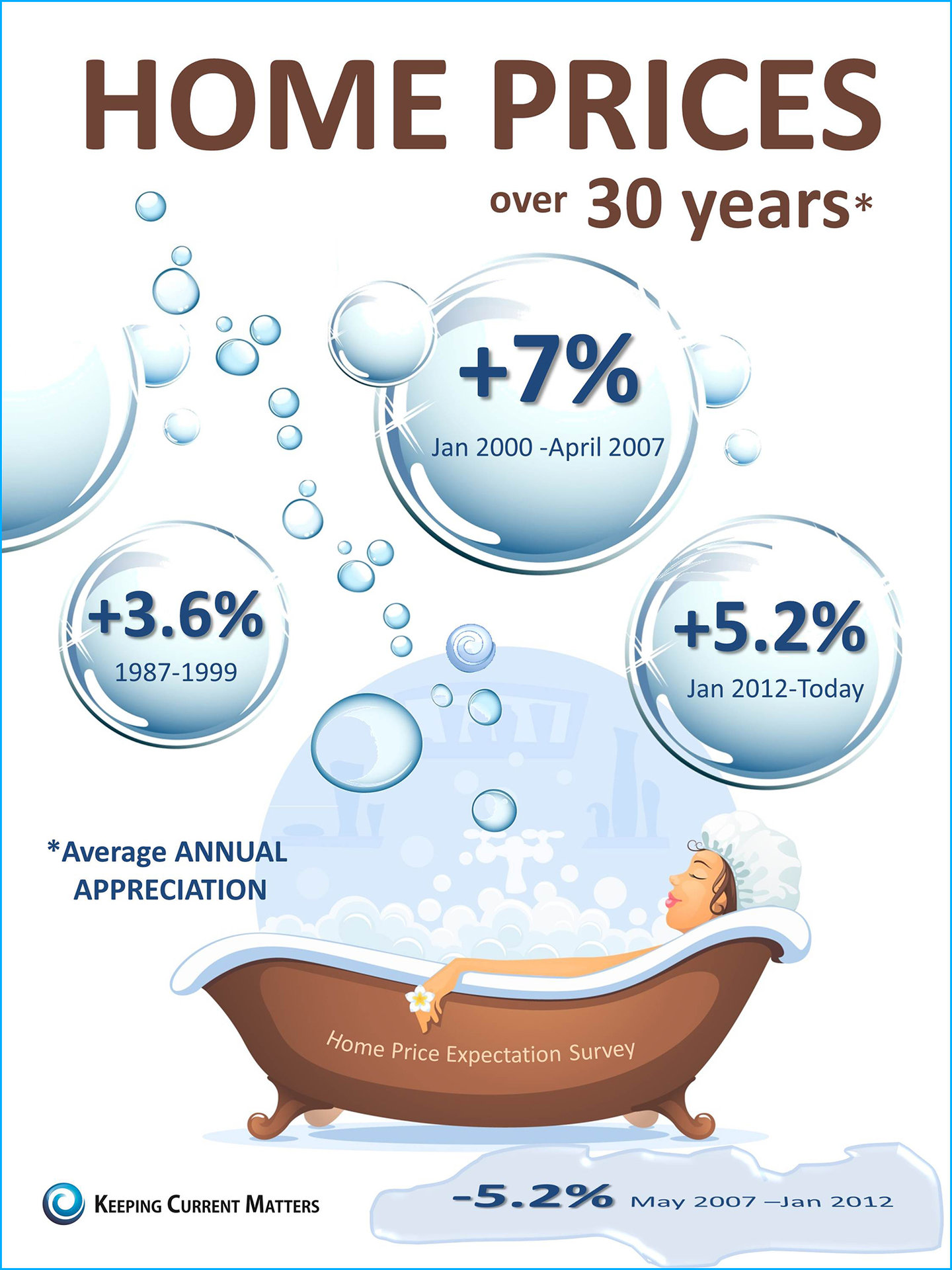

Today, many real estate conversations center on housing prices and where they may be headed. That is why the Home Price Expectation Survey is a great barometer. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

The results of their latest survey

Today, many real estate conversations center on housing prices and where they may be headed. That is why the Home Price Expectation Survey is a great barometer. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

The results of their latest survey

Whether you are buying or selling a home, you need an experienced Real Estate Professional to lead you toward your ultimate goal. In this world of instant gratification and Internet searches, many sellers think that they can For Sale by Owner or FSBO.

The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but rather have been strengthened in recent months due to

Whether you are buying or selling a home, you need an experienced Real Estate Professional to lead you toward your ultimate goal. In this world of instant gratification and Internet searches, many sellers think that they can For Sale by Owner or FSBO.

The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but rather have been strengthened in recent months due to  I have been a subscriber to the Wall Street Journal (WSJ) for as long as I can remember. In my opinion, it is the single greatest source of financial information and insights available. I don’t always agree with their analysis but I always respect their position.

However, in an article this past weekend,

I have been a subscriber to the Wall Street Journal (WSJ) for as long as I can remember. In my opinion, it is the single greatest source of financial information and insights available. I don’t always agree with their analysis but I always respect their position.

However, in an article this past weekend,  Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are three of those reasons.

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are three of those reasons. In a

In a  In a recent

In a recent  The Gallup organization just released their

The Gallup organization just released their

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => For Buyers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los compradores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] =>

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => For Buyers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los compradores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

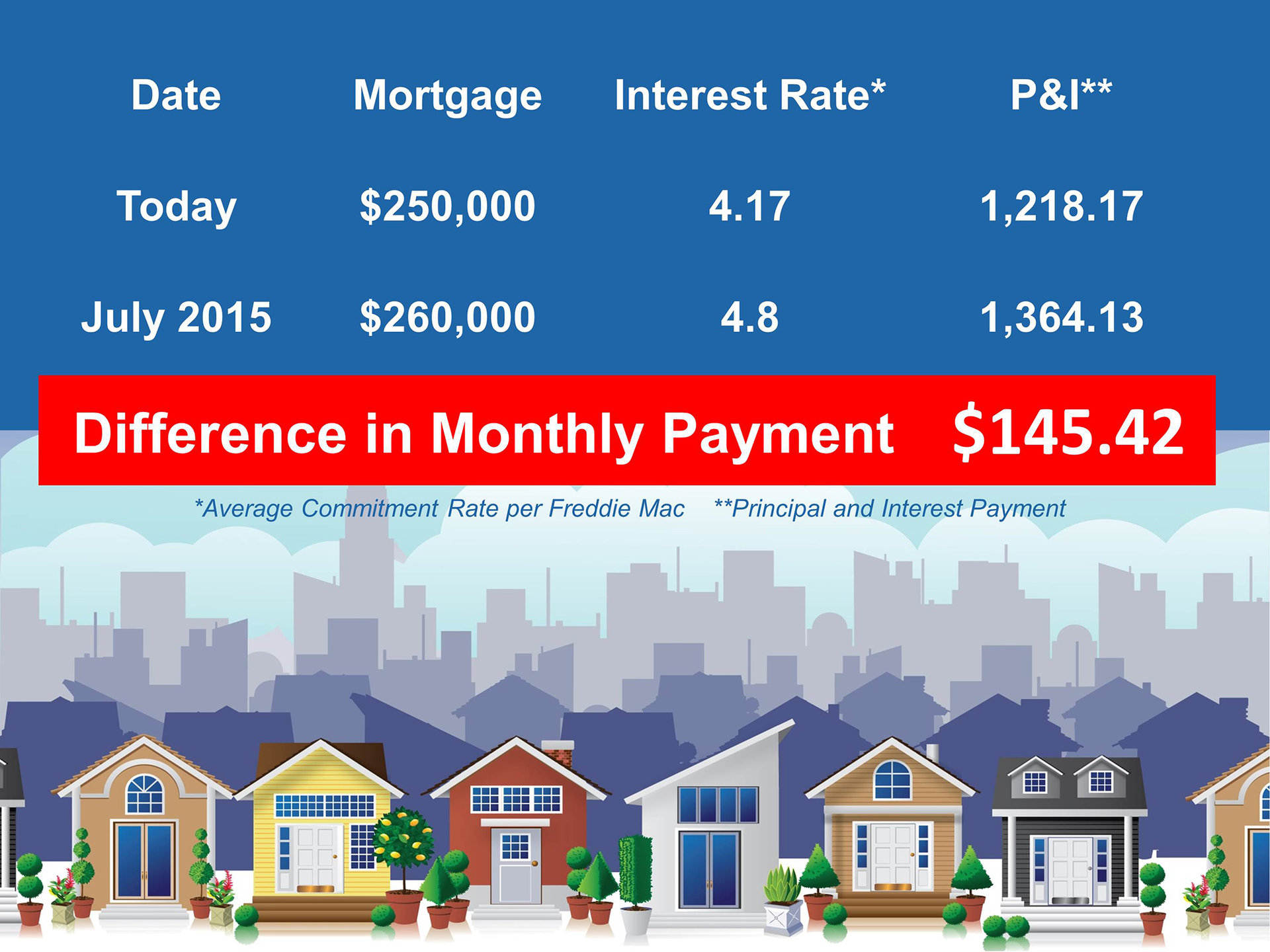

[contents] =>  There is a great opportunity that exists now for Millennials who are willing and able to purchase a home NOW... Here are a couple other ways to look at the cost of waiting.

Let’s say you're 30 and your dream house costs $250,000 today, at 4.41% your monthly Mortgage Payment with Interest would be $1,253.38.

But you’re busy, you like your apartment, moving is such a hassle...You decide to wait till the end of next year to buy and all of a sudden, you’re 31, that same house is $270,000, at 5.7%. Your new payment per month is $1,567.08.

There is a great opportunity that exists now for Millennials who are willing and able to purchase a home NOW... Here are a couple other ways to look at the cost of waiting.

Let’s say you're 30 and your dream house costs $250,000 today, at 4.41% your monthly Mortgage Payment with Interest would be $1,253.38.

But you’re busy, you like your apartment, moving is such a hassle...You decide to wait till the end of next year to buy and all of a sudden, you’re 31, that same house is $270,000, at 5.7%. Your new payment per month is $1,567.08.

There are some people that have not purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with our parents rent free, you are paying a mortgage - either your mortgage or your landlord’s.

As a

There are some people that have not purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with our parents rent free, you are paying a mortgage - either your mortgage or your landlord’s.

As a  Just like May flowers, every spring the housing market blossoms as buyers come out ready to purchase their dream house. This spring, we believe we are going to see the strongest purchasing market we have seen in a decade.

Why are we so bullish on the housing market this spring?

Here are a few reasons:

Just like May flowers, every spring the housing market blossoms as buyers come out ready to purchase their dream house. This spring, we believe we are going to see the strongest purchasing market we have seen in a decade.

Why are we so bullish on the housing market this spring?

Here are a few reasons:

The sales of vacation homes

The sales of vacation homes