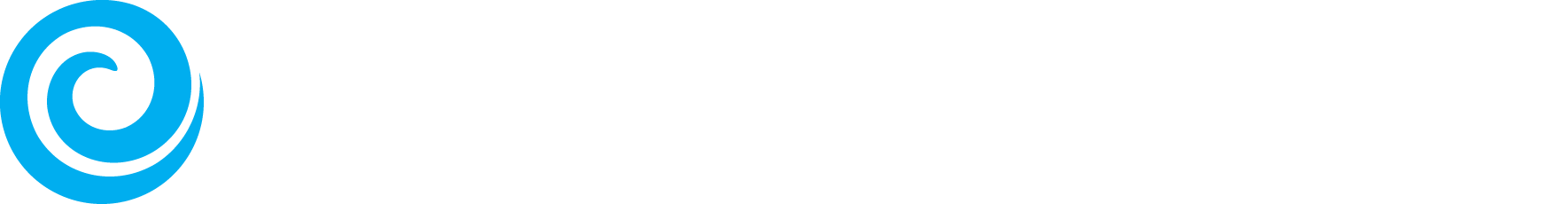

- While remote work peaked during the pandemic, many people still work from home today.

- If you’re one of them, it could have an unexpected benefit when you’re looking to buy a home.

- If you can work from home, you might have more choices for where to live. Let’s connect to talk about your options and what's most important to you.

While remote work peaked during the pandemic, many people still work from home today.

[expired_at] => [featured_image] => https://files.keepingcurrentmatters.com/content/images/20230920/How-Remote-Work-Helps-with-Your-House-Hunt-KCM-Share.png [id] => 15543 [kcm_ig_caption] => While remote work peaked during the pandemic, many people still work from home today. If you’re one of them, it could have an unexpected benefit when you’re looking to buy a home. If you can work from home, you might have more choices for where to live. DM me to talk about your options and what's most important to you. [kcm_ig_hashtags] => firsttimehomebuyer,opportunity,housingmarket,househunting,makememove,homegoals,houseshopping,housegoals,investmentproperty,emptynest,downsizing,locationlocationlocation,newlisting,homeforsale,renovated,starterhome,dreamhome,curbappeal,keepingcurrentmatters [kcm_ig_quote] => How remote work helps with your house hunt. [public_bottom_line] =>- While remote work peaked during the pandemic, many people still work from home today.

- If you’re one of them, it could have an unexpected benefit when you’re looking to buy a home.

- If you can work from home, you might have more choices for where to live. Connect with a real estate agent to talk about your options and what's most important to you.

How Remote Work Helps with Your House Hunt [INFOGRAPHIC]

While remote work peaked during the pandemic, many people still work from home today.