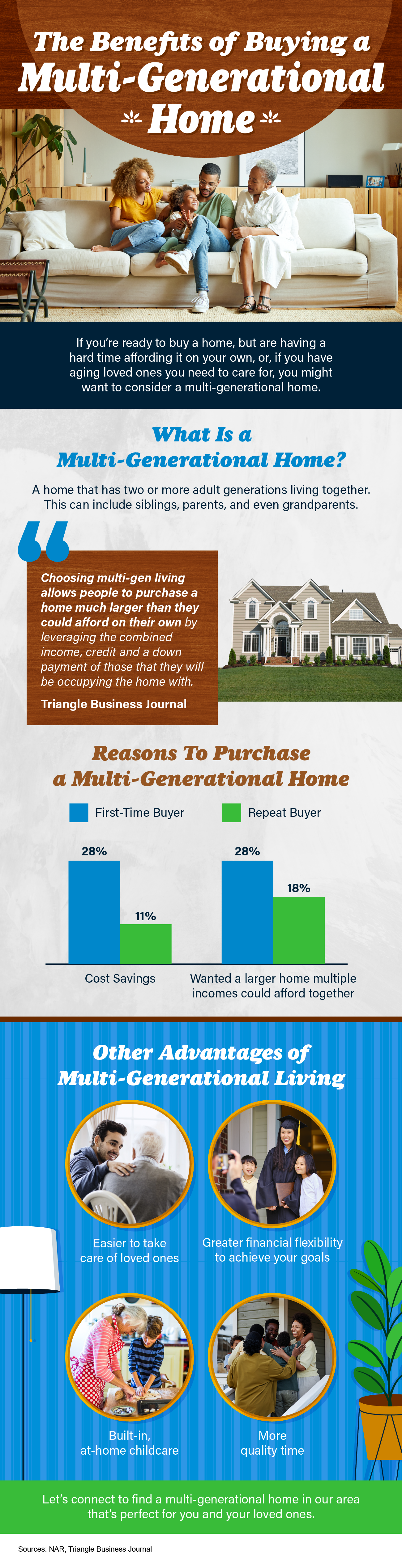

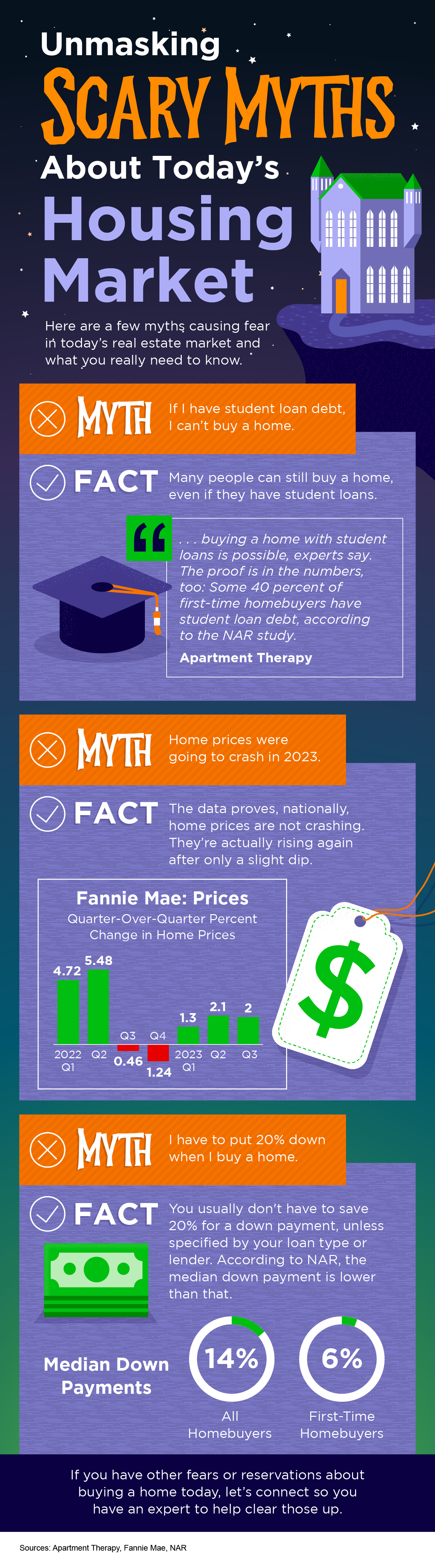

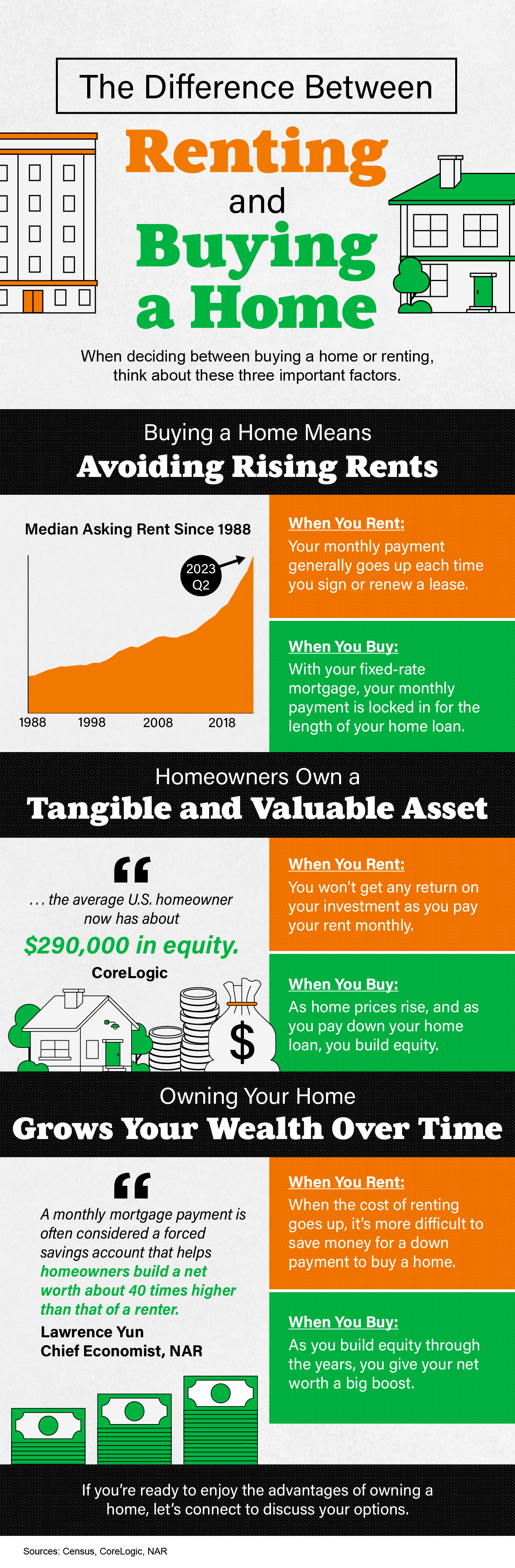

- VA home loans can help people who served our country become homeowners.

- These loans can help qualified individuals purchase a VA-approved home or condo, build a new home, or enhance their current one.

- Owning a home is the American Dream, and one way to show our appreciation to veterans is by providing them with important information about the advantages of VA home loans.

VA home loans can help people who served our country become homeowners.

[expired_at] => [featured_image] => https://files.keepingcurrentmatters.com/content/images/20231107/VA-Loans-Help-Heroes-Achieve-Homeownership-KCM-Share.png [id] => 16562 [kcm_ig_caption] => VA home loans can help people who served our country become homeowners. These loans can help qualified individuals purchase a VA-approved home or condo, build a new home, or enhance their current one. Owning a home is the American Dream, and one way to show our appreciation to veterans is by providing them with important information about the advantages of VA home loans. [kcm_ig_hashtags] => realestate,homeownership,homebuying,realestategoals,realestatetips,realestatelife,realestatenews,realestateagent,realestateexpert,realestateagency,realestateadvice,realestateblog,realestatemarket,realestateexperts,realestateagents,instarealestate,instarealtor,realestatetipsoftheday,realestatetipsandadvice,keepingcurrentmatters [kcm_ig_quote] => VA Loans help heroes achieve homeownership. [public_bottom_line] =>- VA home loans can help people who served our country become homeowners.

- These loans can help qualified individuals purchase a VA-approved home or condo, build a new home, or enhance their current one.

- Owning a home is the American Dream, and one way to show our appreciation to veterans is by providing them with important information about the advantages of VA home loans.

VA Loans Help Heroes Achieve Homeownership [INFOGRAPHIC]

VA home loans can help people who served our country become homeowners.