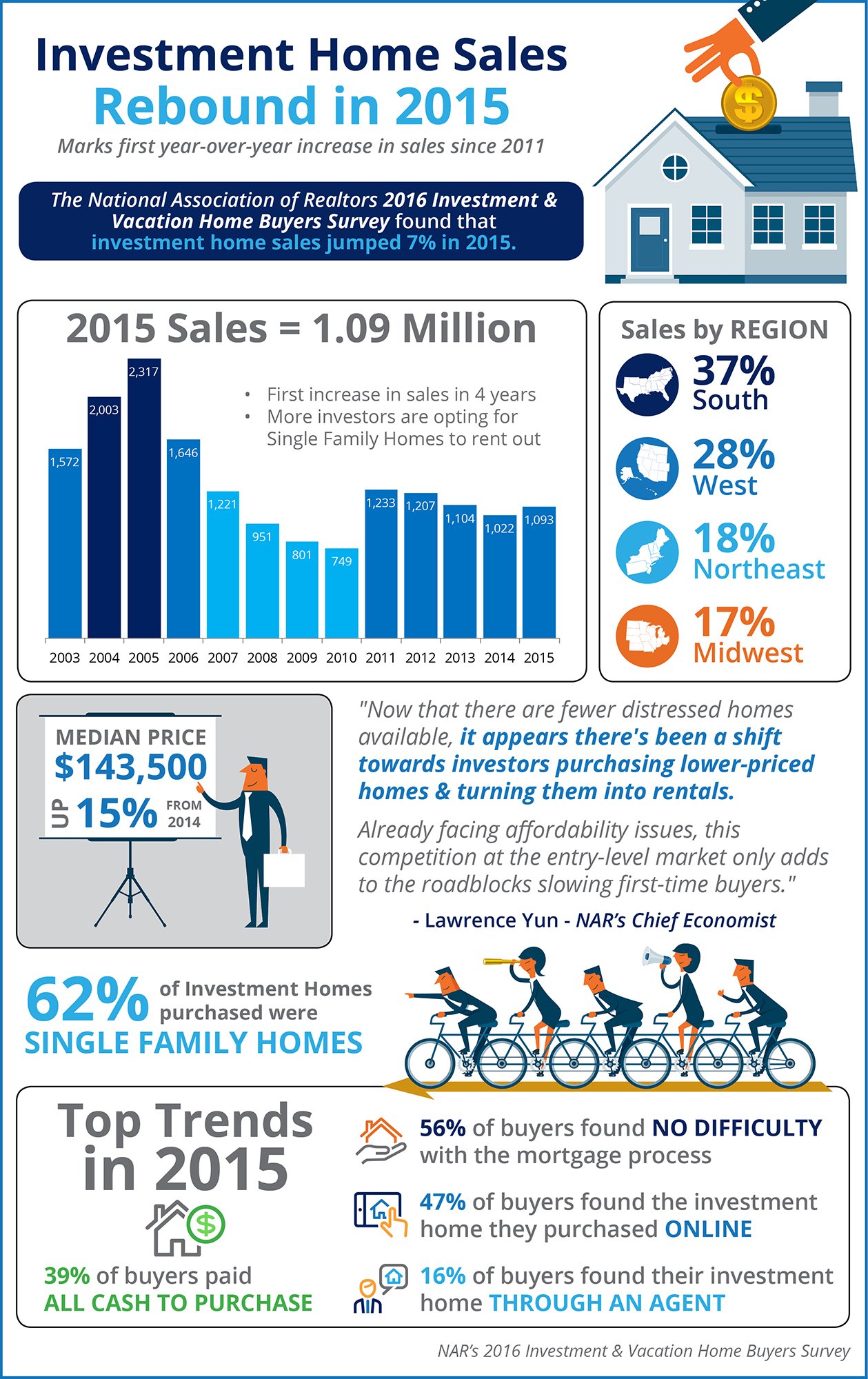

Investment Home Sales Rebound in 2015 [INFOGRAPHIC]

Some Highlights:

- 2015 marks the first year-over-year increase in investment home sales since 2011.

- 62% of all investment homes purchased were single family homes.

- The South saw the highest percentage of investment home sales (39%) with the West coming in second (28%).

![New Home Buyers Look For Green Options [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2016/04/Go-Green-Infographic-STM.jpg)

![Vacation Home Sales Reach 2nd Highest Mark Since 2006 [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2016/04/Vacation-Homes-STM.jpg)

![Don't Be Fooled... Homeownership Is A Great Investment! [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2016/03/Dont-Be-Fooled-STM.jpg)