stdClass Object

(

[agents_bottom_line] =>

Individual opinions make headlines. We believe this survey is a fairer depiction of future values.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => For Buyers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los compradores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

[1] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 9

[name] => Home Prices

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => home-prices

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Precios

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

[2] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 11

[name] => First-Time Buyers

[parent] =>

[parent_id] =>

[published_at] => 2024-04-10T15:59:33Z

[slug] => first-time-buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Compradores de vivienda por primera vez

)

)

[updated_at] => 2024-04-10T15:59:33Z

)

[3] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 38

[name] => Move-Up

[parent] =>

[parent_id] =>

[published_at] => 2024-04-10T16:00:35Z

[slug] => move-up

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Compradores de casa mas grande

)

)

[updated_at] => 2024-04-10T16:00:35Z

)

)

[content_type] => blog

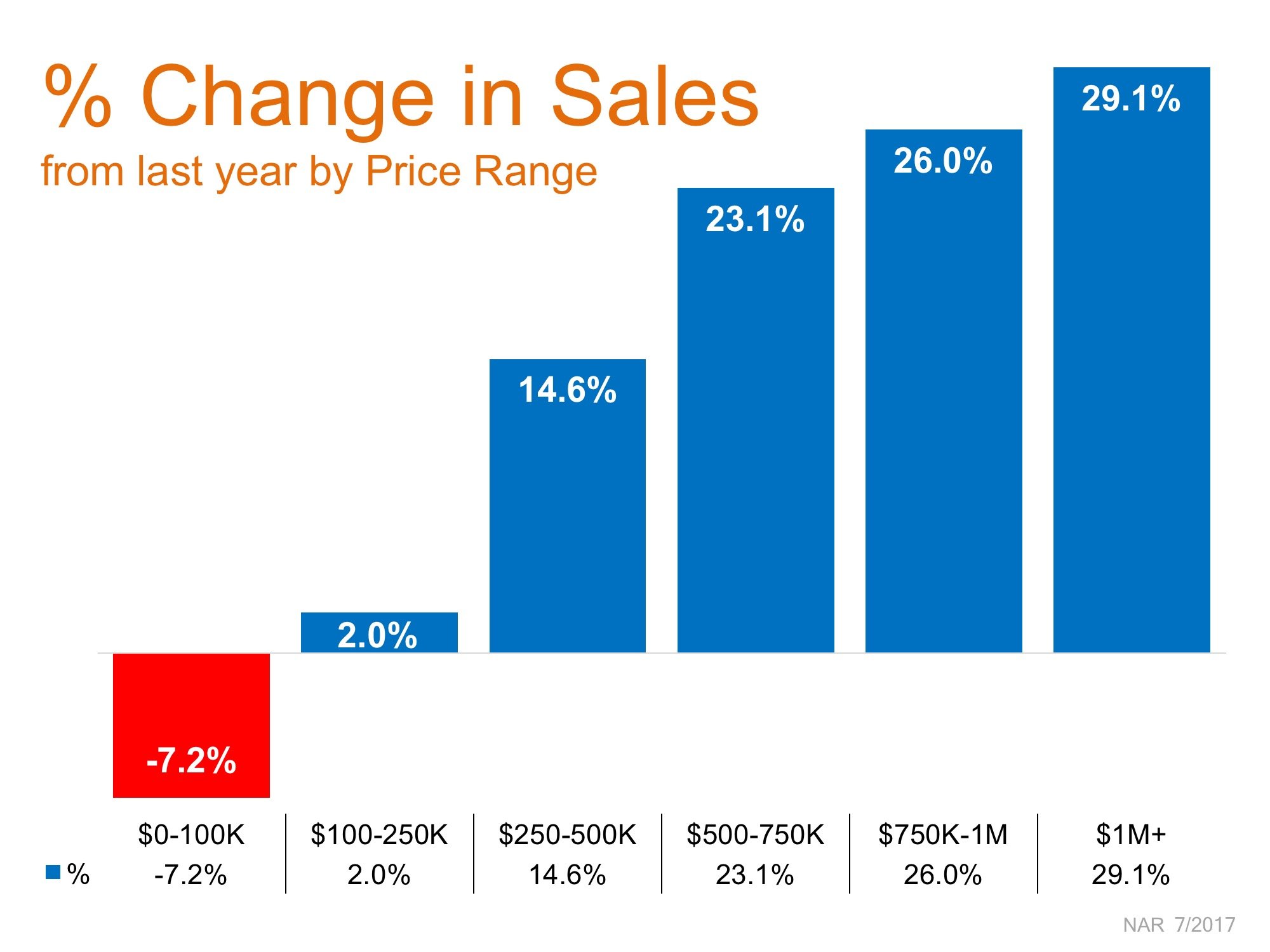

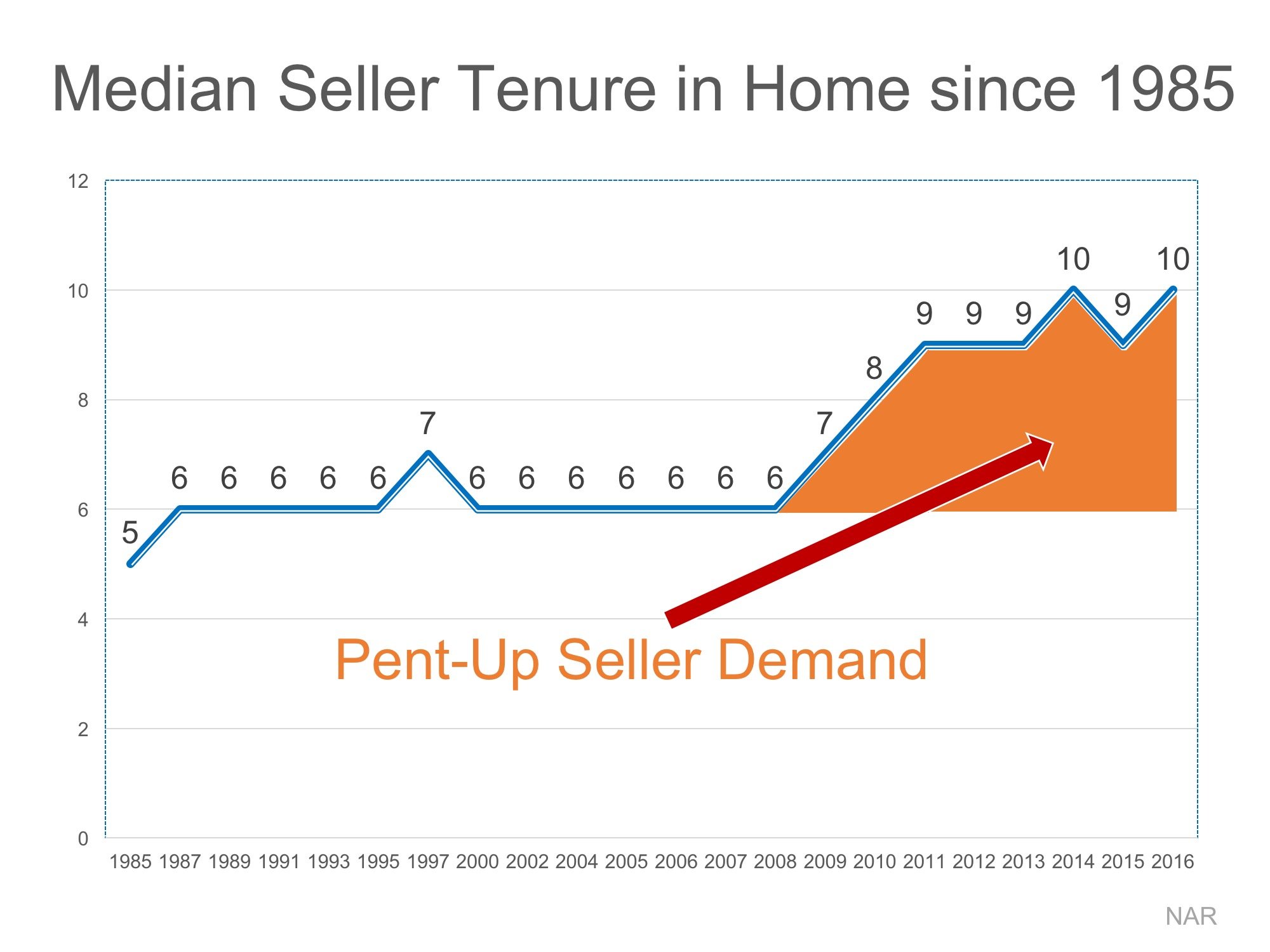

[contents] => Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey.

Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts, and investment & market strategists about where they believe prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

The results of their latest survey:

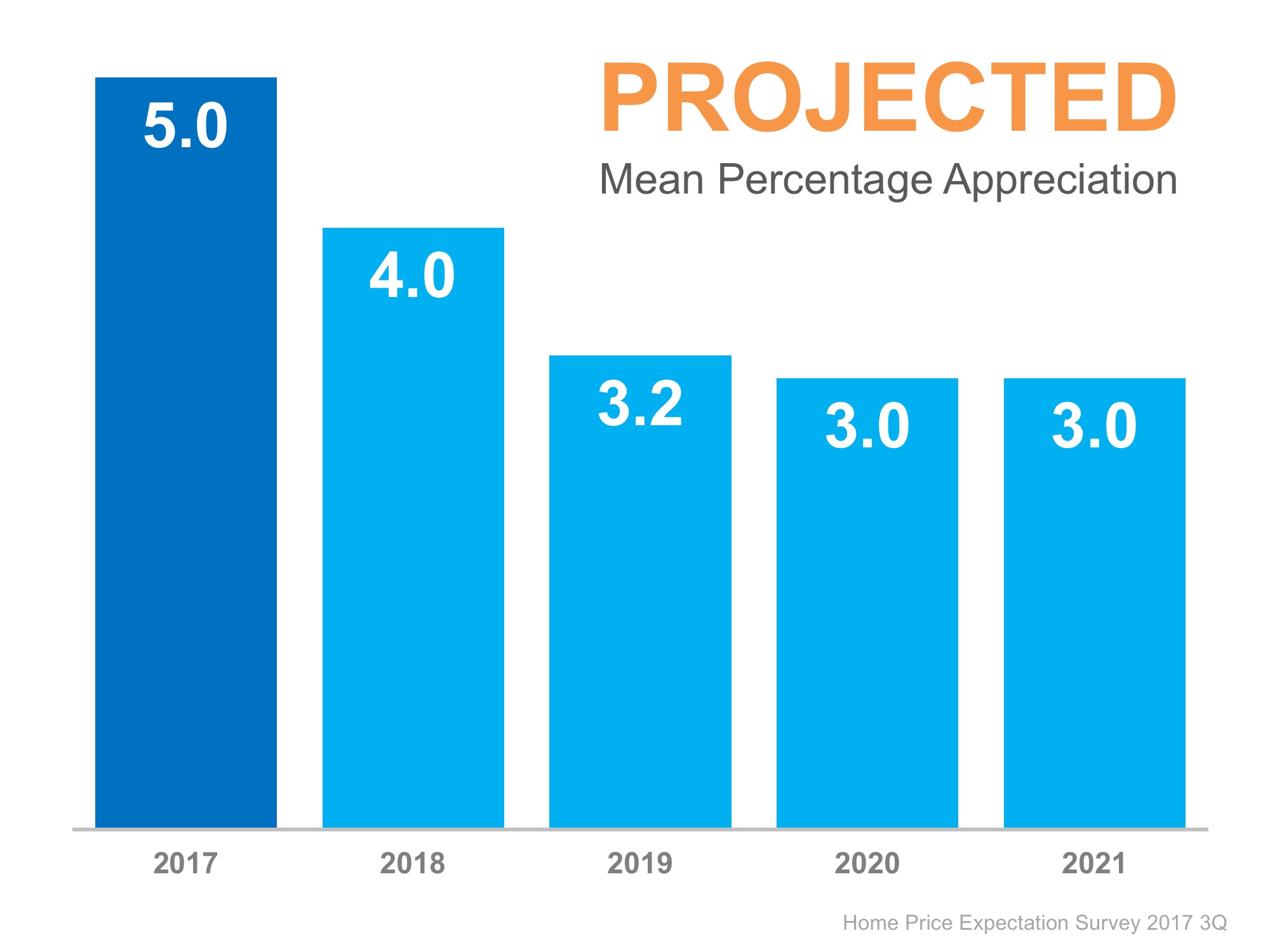

Home values will appreciate by 5.0% over the course of 2017, 4.0% in 2018, 3.2% in 2019, 3.0% in 2020, and 3.0% in 2021. That means the average annual appreciation will be 3.64% over the next 5 years.

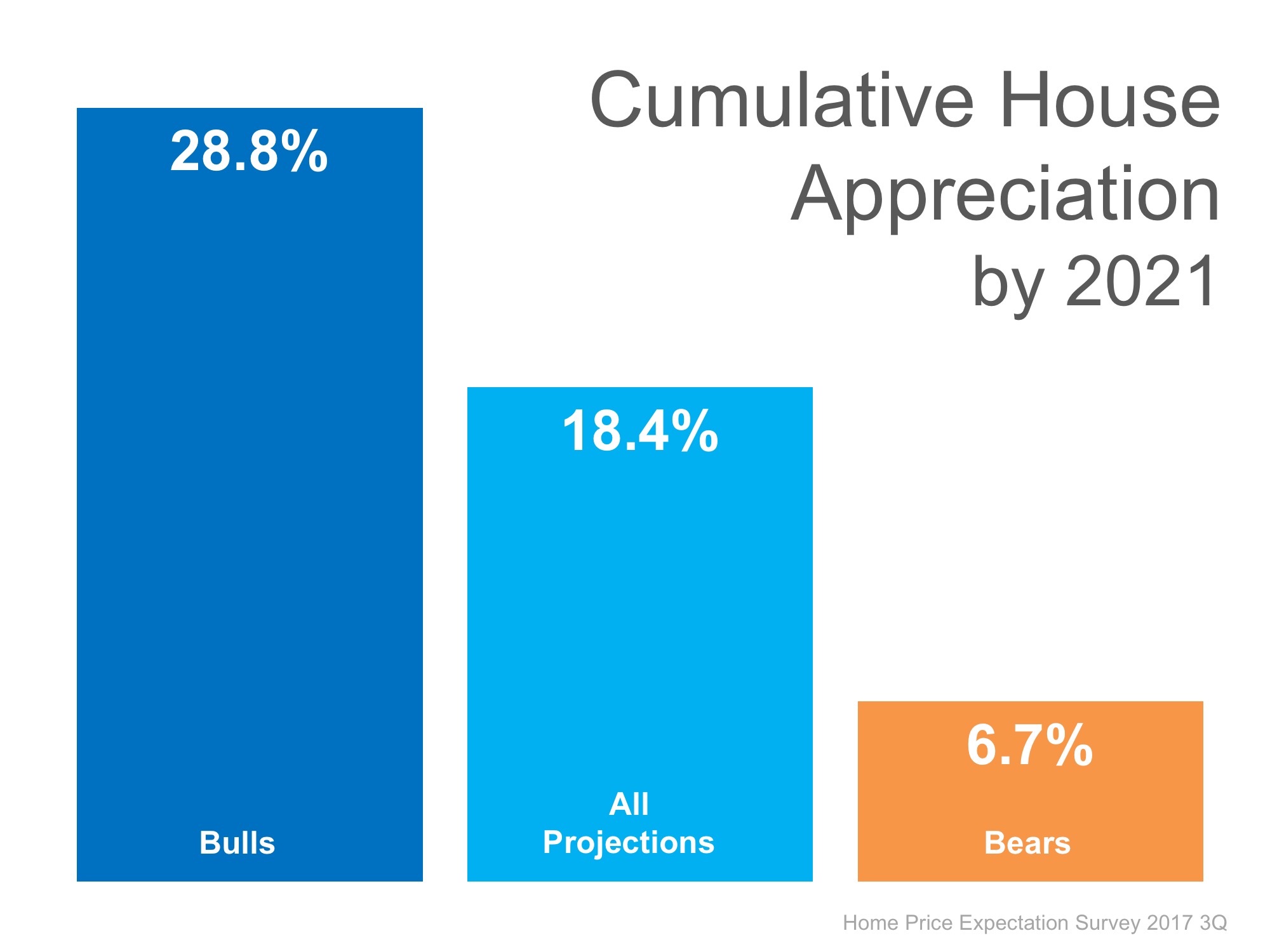

The prediction for cumulative appreciation increased from 17.8% to 18.4% by 2021. The experts making up the most bearish quartile of the survey are projecting a cumulative appreciation of 6.7%.

The prediction for cumulative appreciation increased from 17.8% to 18.4% by 2021. The experts making up the most bearish quartile of the survey are projecting a cumulative appreciation of 6.7%.

Bottom Line

Individual opinions make headlines. We believe this survey is a fairer depiction of future values.

[created_at] => 2017-08-29T06:00:38Z

[description] => Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey.

[expired_at] =>

[featured_image] => https://simplifyingmedia/wp-content/uploads/2017/08/21122012/20170829-Share-STM.jpg

[id] => 899

[published_at] => 2017-08-29T10:00:38Z

[related] => Array

(

)

[slug] => where-are-the-home-prices-heading-in-the-next-5-years-2

[status] => published

[tags] => Array

(

)

[title] => Where Are Home Prices Heading in The Next 5 Years?

[updated_at] => 2017-10-11T14:05:36Z

[url] => /2017/08/29/where-are-the-home-prices-heading-in-the-next-5-years-2/

)

Where Are Home Prices Heading in The Next 5 Years?

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey.

![Home Prices Up 6.64% Across the Country! [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2017/08/FHFA-Home-Prices-STM.jpg)

![Median Days on the Market Drops to 27! [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2017/06/20170707-Days-on-the-Market-STM.jpg)

![Existing Home Sales Surge into Summer [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2017/06/20170630-EHS-Report-STM.jpg)